Looking ahead to the monetary policy prospects of developed economies in 2025, the US dollar index is expected to continue to rise

The door to 2024 is about to close, and although it feels like a blink of an eye, many things have actually happened. If we had to summarize all of this in four words, it would be: 'A year full of surprises'.

The story that will dominate the market in 2024 includes global central bank policy easing, inflation, employment, growth, US presidential elections, rapid adoption of artificial intelligence (AI), and escalating geopolitical tensions in Europe and the Middle East. The impact of the above variables may continue to affect the global economy to varying degrees in the coming years.

Due to the chaos in the real estate market (homebuyers losing confidence in the over built economy), global trade tensions, deflationary pressures, and cautious consumers, expectations for a strong rebound in major Asian countries in 2024 have also not been realized.

Most major stock indices around the world have achieved double-digit returns, setting historic highs along the way. Patient investors will receive returns in 2024- not what many analysts/investors anticipated in early 2024. Artificial intelligence is undoubtedly still in a thriving state and is an important driving force for excellent performance, and forecasters expect this situation to continue until 2025.

In terms of the dollar index, the dollar also outperformed the market in 2024, rising for three consecutive months at the end of the year, and the yield of US treasury bond bonds also rose significantly. This' Outlook 'article will explore the economies of the United States, Europe, and the United Kingdom, and attempt to provide some ways to cope with the exciting but uncertain year ahead.

Global interest rate cuts

As the title implies, 2024 is the year of 'global interest rate cuts'. Except for the Reserve Bank of Australia maintaining its cash rate at 4.35% and the Bank of Japan raising its policy rate to 0.25% and ultimately exiting negative rates, most developed central banks have started policy easing in 2024. It is expected that further easing policies will continue as central banks shift from restrictive areas to more 'neutral' areas.

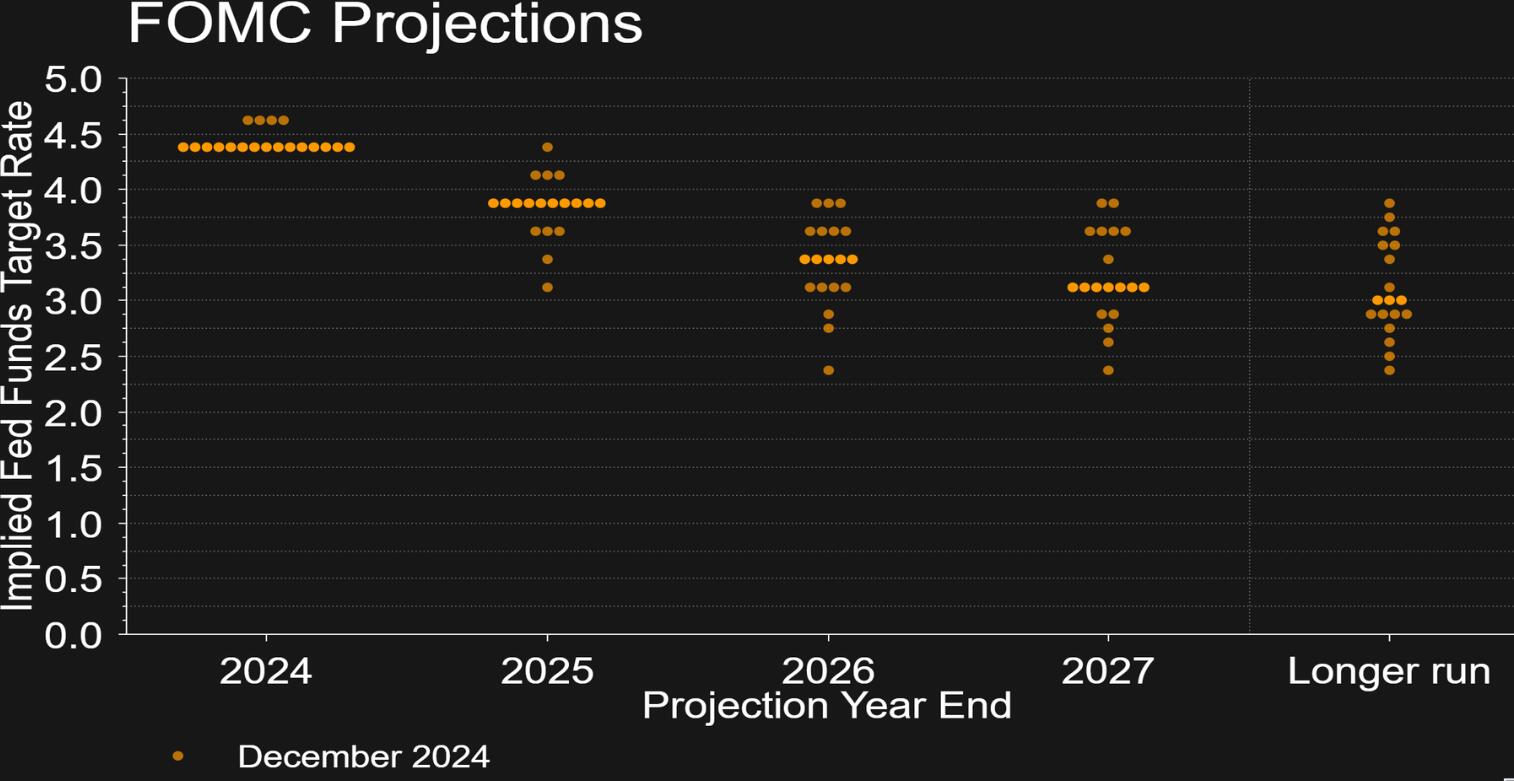

The Federal Reserve (Fed) lowered its target interest rate by 25 basis points (bps) to 4.25% -4.50% at its last meeting in 2024, adopting a "hawkish rate cut" approach. This is the third consecutive interest rate cut, with a rate cut of 100 basis points within the year. The Federal Reserve's dot matrix forecast (derived from the Economic Forecast Digest) is undoubtedly hawkish, indicating that the pace of interest rate cuts will slow down in 2025 and 2026. FOMC participants have actually lowered the 2025 fund target interest rate from 100 basis points to 50 basis points!

The economic forecast also shows that the Federal Reserve expects inflation to accelerate in 2025- currently, the PCE inflation rate is expected to be 2.5% in 2025, compared to the previous forecast of 2.1%, and 2.1% in 2026 (compared to the previous forecast of 2.0%). Overall, the Federal Reserve expects to not see PCE data reach its inflation target of 2.0% until 2027. In addition, there is uncertainty before President elect Trump proposes policies in early 2025, as well as the only opponent of Cleveland Fed Chairman Beth Hammack. The call for the Federal Reserve to maintain the target interest rate at its current level is likely to be a foregone conclusion at the next meeting in January (the market currently believes that there is a 92% chance of keeping the target interest rate unchanged). The market expects that the Federal Reserve will not push for a 25 basis point rate cut before its June meeting.

The European Central Bank (ECB) will lower deposit rates by 100 basis points to 3.0% in 2024, the lowest rate since early 2023. Unless there are any unforeseeable circumstances, the European Central Bank will further cut interest rates in early 2025, although it may be a gradual 25 basis point cut. Currently, the market expects another 125 basis points cut by the end of 2025, which will bring the deposit rate down to 1.75%. The market predicts that the central bank will continue to hold its ground thereafter. However, some sectors believe that the focus has shifted to whether the central bank has taken sufficient measures to support the eurozone economy, which lags behind the United States and the United Kingdom, and they believe that the European Central Bank needs to accelerate the pace of interest rate cuts. Therefore, market participants are expected to closely monitor potential indicators of economic challenges, especially those exacerbated by Germany's policy inaction and France's political deadlock. These indicators may mean that there may be even greater interest rate cuts in the coming year

As for the latest forecast from the staff of the European Central Bank, "in terms of GDP growth, it is currently expected that the eurozone economy will grow at a slower pace, with a growth rate of 0.7% in 2024 (lower than the previous forecast of 0.8%), 1.1% in 2025 (originally 1.3%), and 1.4% in 2026 (originally 1.5%). Inflation is expected to average 2.4% in 2024 (lower than the previous forecast of 2.5%). It is expected to further slow down to 2.1% in 2025 (from 2.2%), and then drop to 1.9% in 2026 (the same as the previous forecast). For core inflation, the forecasts for 2024 and 2025 remain unchanged at 2.9% and 2.3%, respectively, but revised to 1.9% in 2026 (lower than the previous forecast of 2.0%).

Vanguard analysts said, 'We expect the European Central Bank to lower its policy rate below neutral by 2025, with a year-end rate of 1.75%. This outlook faces downside risks. The intensification of trade tensions and a significant slowdown in global economic growth could lead to a more moderate monetary policy stance.'.

The Bank of England (BoE) will cut interest rates twice in 2024, lowering bank rates by 50 basis points to 4.75%. The last meeting in December resulted in a split MPC (Monetary Policy Committee), with three out of nine members (Vice President Dave Ramsden and external members Swati Dingra and Alan Taylor) voting in favor of a rate cut. Although the latest MPC vote is seen as a dovish shift and an unexpected move (economists predict an 8-1 vote in favor of keeping it unchanged), the language of the interest rate statement is cautious.

Bank of England Governor Andrew Bailey also pointed out that given the "increasing economic uncertainty," the central bank cannot commit to "when or how much" policies will be relaxed by 2025. Bailey also commented that the "gradual approach" of reducing policies is still correct. After the interest rate decision, market pricing remains unchanged, and investors expect a 50 basis point rate cut in 2025. The first 25 basis point rate cut will not be reflected until May.

The latest monetary policy report from the Bank of England (released in November) predicts that GDP (Gross Domestic Product) will rise to 1.7% in the fourth quarter of 25 years (0.9% in August), and GDP is expected to grow by 1.1% in the fourth quarter of 26 years (lower than the August forecast of 1.5%).

In terms of inflation, Bank of England economists predict that the inflation rate will rise to 2.7% in the fourth quarter of 2025 (2.2% in August), and then fall back to 2.2% in 2026 (2.2% in August).

As for the bank interest rate forecast, the forecast for the fourth quarter of 2024 shows that the interest rates for 2025 (lower than the August forecast of 4.1%) and 2026 (the same as the previous forecast) will both be 3.7%.

Economic outlook, inflation

In 2024, inflation has always been a top priority for policy makers and investors, with developed economies reaching or about to reach their central bank inflation targets (typically 2.0%). However, due to the possibility of facing price pressure again, progress in 2025 may be slow - of course, the specific situation varies by country.

The upward risk of inflation in the United States is evident, partly due to the impact of policies proposed by President Trump, particularly tariffs and immigration policies. Therefore, due to the impact of trade policies on the prices of imported goods such as clothing, cars, and steel, consumer spending, which has driven economic growth in the United States since the pandemic, may face pressure. Although tariffs obviously will never "lower" commodity prices, their impact on pricing may vary due to several factors. For example, the availability of local substitutes for imported goods plays an important role. Therefore, the extent to which tariffs affect prices will depend on which products are subject to these taxes and how high the tax rates are. In addition, the impact of deportation will certainly affect labor supply and subsequently trigger inflation, as companies raise wages to attract employees, thereby increasing the cost of producing goods and services, which are then passed on to consumers.

In the Eurozone, inflation has basically softened since breaking through around 10.6% in 2022 and has been hovering around the European Central Bank's inflation target of 2.0% since early 2024. Vanguard economists point out that 'in the context of weak growth, we expect the overall and core inflation rates to be below 2% by 2025'.

After reaching a peak of 11.1% at the end of 2022, deflation (slowing down the rate of price increases) in the UK has been progressing smoothly. However, in November, price pressure rose to 2.6% for the second consecutive month. This is the budget proposal put forward by Chancellor of the Exchequer Rachel Reeves against the backdrop of economic stagnation, which involves plans for significant reforms to public spending.

The Office for Budget Responsibility (OBR) predicts in its "Economic and Fiscal Outlook" (released in October 2024) that inflation will rise in 2025, partly due to the "direct and indirect effects of budget measures". The OBR added, "As the effects of these measures fade and the output gap narrows, inflation will slowly return to the 2% target within the forecast range.

Other departments believe that inflation in the UK will also rise by 2025; Deutsche Bank analysts predict that due to rising energy prices, the inflation rate will increase, and Pantheon Macroeconomics predicts that the inflation rate will reach 3.0% in April 2025.

GDP growth

In terms of growth, it is no secret that the US GDP is leading among developed economies, which contradicts people's expectations of a significant economic slowdown. Despite soaring inflation and the central bank's most aggressive interest rate hike cycle in a generation, the situation remains the same.

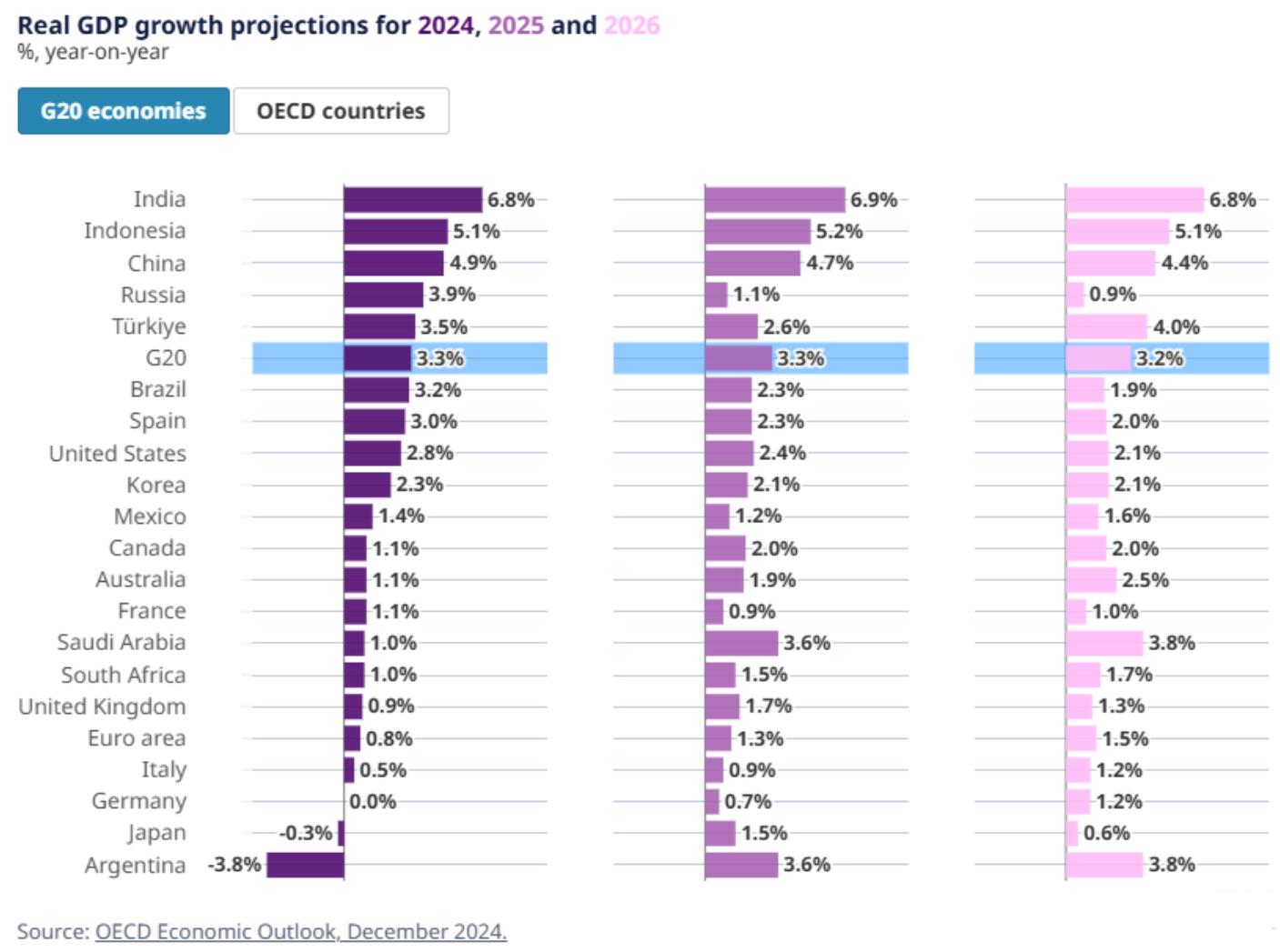

The Organization for Economic Cooperation and Development (OECD) predicts that by the end of 2024, US GDP is expected to continue growing at an annualized rate of 2.8%, and then decline to 2.4% and 2.1% in 2025 and 2026, respectively. Consumer spending and productivity growth. The concern of economic recession has temporarily disappeared, and the narrative of a soft landing is undoubtedly something that many people are closely monitoring.

The OECD predicts that the annualized growth rate of the eurozone is expected to be 0.8% in 2024, 1.3% in 2025, and 1.5% in 2026. Nevertheless, 2025 may be another challenging year for economic activity in the eurozone, with poor growth prospects, especially for the top two economies, Germany and France. The expectation of the United States imposing tariffs will exacerbate this situation.

According to the OECD's forecast, UK GDP is expected to grow by 0.9% by the end of 2024, 1.7% in 2025, and 1.3% in 2026. After a continuous contraction of 0.1% in GDP in October, the UK economy has only grown for one month out of five (as of October), which may indicate a contraction in the fourth quarter.

Job opportunities

The latest employment report in the United States shows that due to weather and strikes, the economy rebounded in November, with 227000 new jobs added, compared to 12000 in October (revised upwards to 36000 in November). On average, the US economy will add approximately 180000 new jobs per month in 2024. The unemployment rate rose to 4.2% in November, higher than expected and higher than the 4.1% in October.

However, according to historical standards, the long-term unemployment rate remains at a relatively low level. In terms of salary growth, the MM (month on month) and YY (year on year) figures are consistent with the October data, at 0.4% and 4.0% respectively, and both are slightly higher than expected.

Overall, there are clear signs of cooling in the US labor market. Analysts from Silvercrest Asset Management Group pointed out that "as the number of job opportunities provided continues to increase, we expect employment opportunities to continue to grow. The job vacancy and labor mobility survey measures this number. The latest report shows that as of October, there were 7.74 million job vacancies in the United States. Although this number has decreased significantly from the 12 million interrupted by the pandemic, it is still higher than the typical level of 6-7 million in the late 2010s.

The October employment report of the Eurozone shows that the unemployment rate has reached a historic low of 6.3%. This indicates that the expected economic slowdown and signs of reduced recruitment have not yet affected the stability of the job market. Considering the current wage levels in the eurozone, which recently reached a historic high of 5.5% in 2024, this may also help support inflationary pressures.

According to economists from Vanguard, "With a significant slowdown in the German economy and broader growth pressures, we expect the unemployment rate to rise to a high of 6% by 2025

Goldman Sachs analysts also hold this view, commenting: "Given our bleak growth prospects, we expect the unemployment rate to rise by 2025 and reach 6.7% by early 2026. We expect wage growth to slow down to 3.2% by the fourth quarter of 2025, as wage catch-up is completed and the labor market weakens.

In the UK, the biggest takeaway from the latest employment report is that wages grew faster than expected in the three months ending October 2024. Both regular wages and salaries (including bonuses) increased by 5.2% and 4.4% respectively from 4.9%. This will help support the reason for the Bank of England to maintain higher interest rates for a longer period of time in 2025. The credibility of data from the UK Office for National Statistics remains questionable, particularly with the unemployment rate remaining unchanged at 4.3%. Although the data clearly indicates that the UK job market continues to cool down, it remains resilient despite facing economic challenges. Given the latest data, everyone's attention is focused on wages, and the Bank of England will look for signs of weakness in these data before cutting interest rates again. As mentioned earlier, the market expects the Bank of England to not cut interest rates again before the second quarter of 2025.

The Trump Era

On November 5, 2024, Donald Trump won a landslide victory in the election, and investors will be prepared in early 2025 to reset the proposed policies. After the election results were announced, major stock indexes in the United States rose, with the S&P 500 index achieving its largest daily increase in about two years. The yield of the US dollar and US treasury bond bonds also rose on the same day.

Analysts' expectation for Trump in early 2025 is to immediately increase tariffs on imports from major Asian countries and develop policies to reduce immigration. The tax reduction policy for 2017 is expected to be fully extended instead of expiring, and there are also expected to be moderate additional tax reductions. Trump may not have taken office yet, but he ensures his voice is heard. In late November, a few days before the Thanksgiving holiday, Trump announced the possibility of imposing a 25% tariff on Mexico and Canada, as well as an additional 10% tariff on imported goods from major Asian countries, which are the three main trading partners of the United States.

At the beginning of this month, Trump increased his bet by threatening to impose 100% tariffs on BRICS countries if they attempt to establish a competitive currency.

Analysts believe that if Trump fulfills these threats and implements 100% tariffs - highly unlikely - it will increase the cost of goods for these countries and potentially exacerbate inflation in the United States. However, it is worth noting that Trump has previously used the threat of tariffs as a negotiating strategy and is likely to reach a compromise.

There is no doubt that these latest tariff threats are numerous, supporting the buying of the US dollar and suppressing the currencies of BRICS countries. When we enter January, the timing of Trump's policies may play an important role. If he had prioritized tariffs and immigration measures in the early stages of his administration, the resulting increase in seller costs could have led to higher consumer prices.

Conversely, this may exacerbate inflationary pressures and have a negative impact on consumer spending. In addition, new tariffs and stricter immigration laws may hinder economic growth in the United States. The overall effectiveness of these expected policies will largely depend on their implementation methods and timing. The overall effectiveness of these expected policies will largely depend on their implementation methods and timing. The overall effectiveness of these expected policies will largely depend on their implementation methods and timing.

Outlook for the US Dollar Index in 2025

FXBlue believes that there is still room for the US dollar to rise and will closely monitor the strong trend of the US dollar in the first quarter of 2025. Trump's election and his administration's pro growth policies are expected to push up inflation. In addition, investors (including the Federal Reserve) expect the pace of interest rate cuts to slow down in 2025, which is bullish for the US dollar.

The US dollar index - the geometric average weighted value of the US dollar against six major currencies - provides a clear picture of the US dollar. Since 2023, buyers and sellers have been struggling between the monthly support level of 100.51 and the resistance level of 106.11. Importantly, the recent breakthrough above the resistance level is expected to set the highest monthly closing price since the end of 2022, thus raising the possibility of a subsequent upward movement to the resistance level of 109.33.

From the daily chart, after rebounding from trend line resistance to support, the US dollar has recently pierced the upper limit of the triangular flag pattern (drawn from the high of 108.07 and the low of 106.13 so far this year), extending from the high of 107.35. Given this and the potential for the monthly level to reach 109.33, the US dollar is currently technically bullish, at least until it falls below 106.11.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights