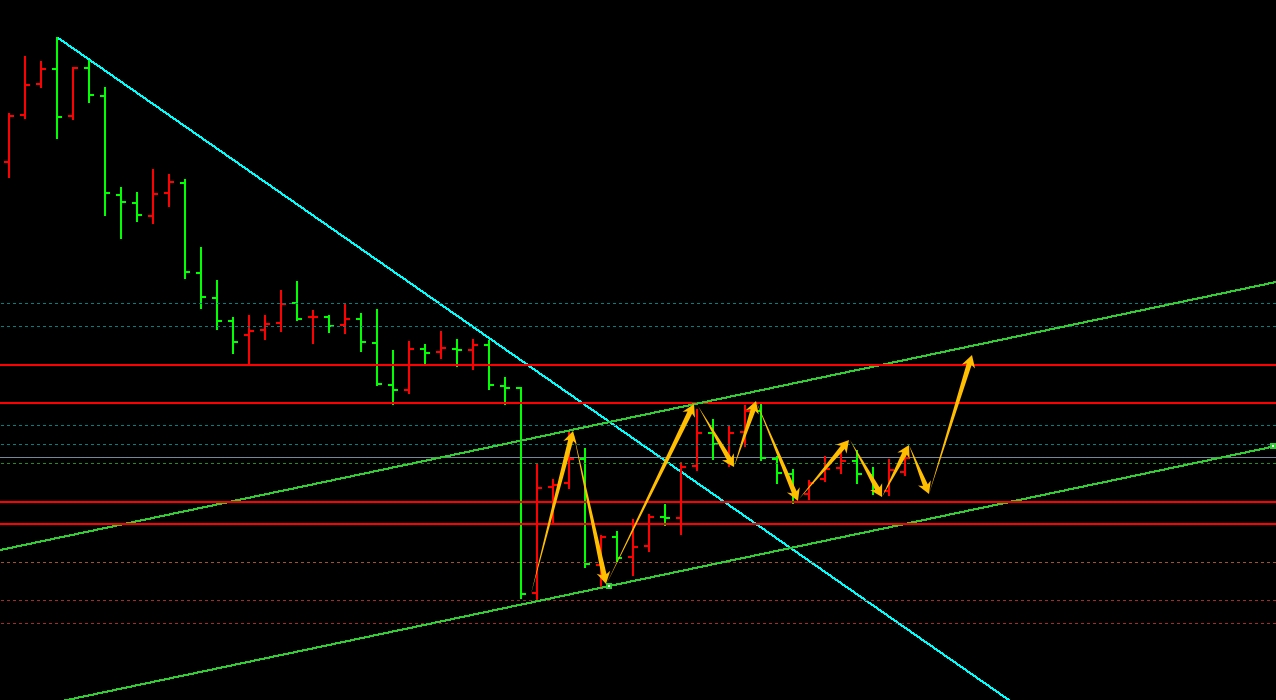

12.27 Gold low-frequency oscillation rises, Asian session 2623 buy

Yesterday morning, after a slight fluctuation, gold formed an upward trend. In the US market, it hit the upper limit of 31 for four hours and suppressed the downward trend to the 22nd line. In the end, it broke through the upward trend again and closed with a medium bullish line with an upper shadow. Looking at today, from the above chart, the price formed a low-frequency slow rhythm oscillation to accelerate after breaking through the downward trend line. The daily chart single K closed positive and continued, and the overall trend is still oscillating upwards. However, in order to fully turn around, it is necessary to break through the 50th level. Yesterday, it was an upward trend of 200 for the antenna to suppress the decline. However, in the short term, the key support today is still the lower limit of the hourly chart. It is best to continue buying at low prices in conjunction with the channel chart and multi cycle. Short selling can only be treated as short-term short selling. Therefore

Operationally: Fall 2624-23 to enter, defend 18. Look up 2635-45 to break through 55-63. Short sell once in the 63-68 area for the first time of the day.

GBP/JPY: Keep holding at 197 and continue to buy long. Further adjustments will be made when the market breaks down, with strong pressure from 198.7-200

Crude oil: After a double needle bottoming out, it formed a continued bullish trend on Friday, with short-term near four hour upper limit suppression. However, from the daily chart, there is a sign of further rebound in the future market. Yesterday, it also rebounded upwards, but eventually rose first and then fell, returning to the planned level at the end of the day. From this, it can be seen that it is still difficult to get out of a one-sided situation, and the expectation is still to fluctuate upwards. Therefore, today's Asian market is focused on buying support at 68.7, breaking 68.3 and exiting.

The above ideas are for reference only. There are risks in the market, and investment needs to be cautious.

Trading is for profit, not for gambling or trading, so traders must understand what actions to take when the price is at a certain stage! Traders are not always long or short, they always change with the market! Traders must have their own defense system to control risks! Risk control and fund management are essential in your trading!

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights