This week marks the New Year holiday, and the market awaits Trump's return

Last Friday, due to the uncertainty of the upcoming Trump administration's policies, the US dollar index remained volatile and ultimately closed down 0.06% at 108.03. US Treasury yields rose across the board, with two-year yields closing at 4.3340% and 10-year yields closing at 4.6300%. The US stock market opened low and fell, with the three major indexes collectively closing lower. The Dow Jones Industrial Average fell 0.77%, the Nasdaq fell 1.49%, and the S&P 500 index fell 1.11%.

Monday risk warning

☆ 22:45. The United States released the Chicago PMI for December, with a market expectation of 42.5. The previous value was 40.2;

☆ 23:30. The United States released the Dallas Fed Business Activity Index for December, with market expectations of 0. The previous value was -2.7

The rise in US treasury bond bond yields was the main reason for the fall in gold prices last week. The higher treasury bond yield increases the opportunity cost of holding US dollar bonds, thus reducing the attractiveness of gold as a non yield asset. This is particularly evident in the context of sluggish trading during holidays, where market liquidity has decreased and is more susceptible to the influence of a single factor.

The US dollar index has risen for the fourth consecutive week, putting pressure on gold prices. The strengthening of the US dollar has reduced the attractiveness of gold to holders of other currencies, thereby suppressing demand for gold. The US dollar index reached a two-year high of 108.54 on December 20th, and is expected to rise by 6.6% for the whole year. A strong US dollar is often seen as a bearish factor for gold prices, as gold is typically priced in US dollars, and an appreciation of the US dollar would make gold prices relatively more expensive.

The market's expectations of President elect Trump's return and its potential policy impact have also created uncertainty for the gold market. Trump's inflation stimulus policies may lead to an increase in inflation expectations, which is favorable for gold. In addition, Trump's trade protectionism policies may trigger a trade war, increasing geopolitical uncertainty, which will further enhance the attractiveness of gold as a safe haven asset. The coexistence of positive and negative factors has led to divergent opinions in the market regarding the impact of Trump's return.

① The rising global geopolitical risks will continue to enhance the attractiveness of gold as a safe haven asset, thereby supporting gold prices.

② The sustained purchases of gold by global central banks will continue to support gold prices.

③ The change in inflation expectations will directly affect the price of gold. Rising inflation expectations usually benefit gold.

④ The uncertainty of Trump's return policy provides support for gold.

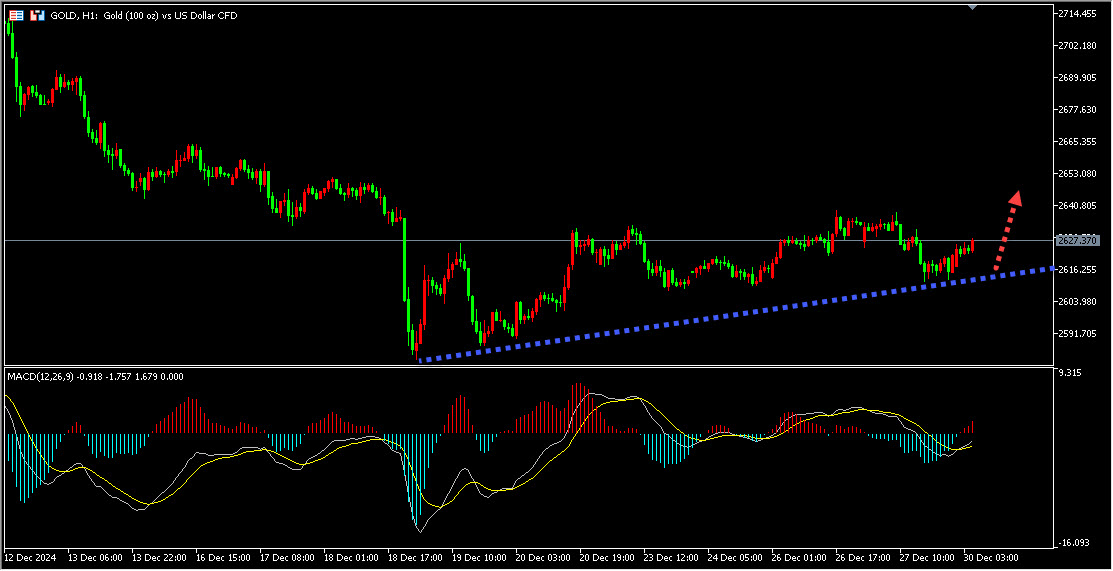

In summary, the current 1-hour bullish trend of gold is good. Today, investors are paying attention to the 1-hour support area below, and buying long is the main focus after the gold price stabilizes after a pullback.

In terms of crude oil:

① The data released by the US Energy Information Administration (EIA) provides strong support for oil prices, driving them up.

② The escalation of geopolitical risks has once again made the issue of crude oil supply security a focus of market attention, providing support for oil prices.

③ The economic stimulus measures of major Asian countries are another key factor supporting the sentiment of the crude oil market

In summary, the current bullish trend of crude oil is clear. Today, investors are paying attention to the support area of the 1-hour trend line below. After the stabilization of the crude oil correction, they will continue to buy long in crude oil.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights