Gold oscillates, retraces, rebounds today, continues to short sell

The daily bearish candlestick of gold has fallen and closed lower, oscillating and retreating around the previous day's high of 2638. Although the pace is slow, the overall trend remains weak and consolidating downwards. The weekly candlestick also shows signs of weak correction, but the short-term pace is slow, oscillating first and then unilaterally. The oscillation is a process of accumulating momentum for one side. The daily chart is approaching the low point of 2580, testing the support of the low point.

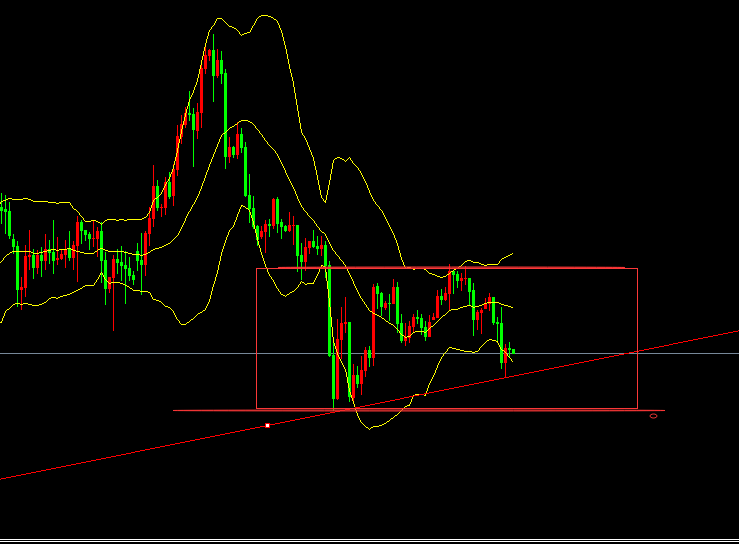

The 4-hour chart oscillated downwards, and after being under pressure at 2638, it was under pressure again at the 2628 level yesterday. The second highest point overlapped with the resistance of the Bollinger Bands to form a suppressed pullback. Continue to pay attention to the support of the 2580 low point below. The gains and losses of the low point determine the expansion of the future market space, breaking through the low point and weakening, and continuing to fluctuate without breaking. The oscillation of small period structures tends to be weaker, with 2620 as the dividing line.

Below this level, I am bearish, with resistance around 2610-2612. In the Asian session, I touched 2610-2612 and took the lead in short-term short selling to defend against the 2620 target of 2590-2580

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights