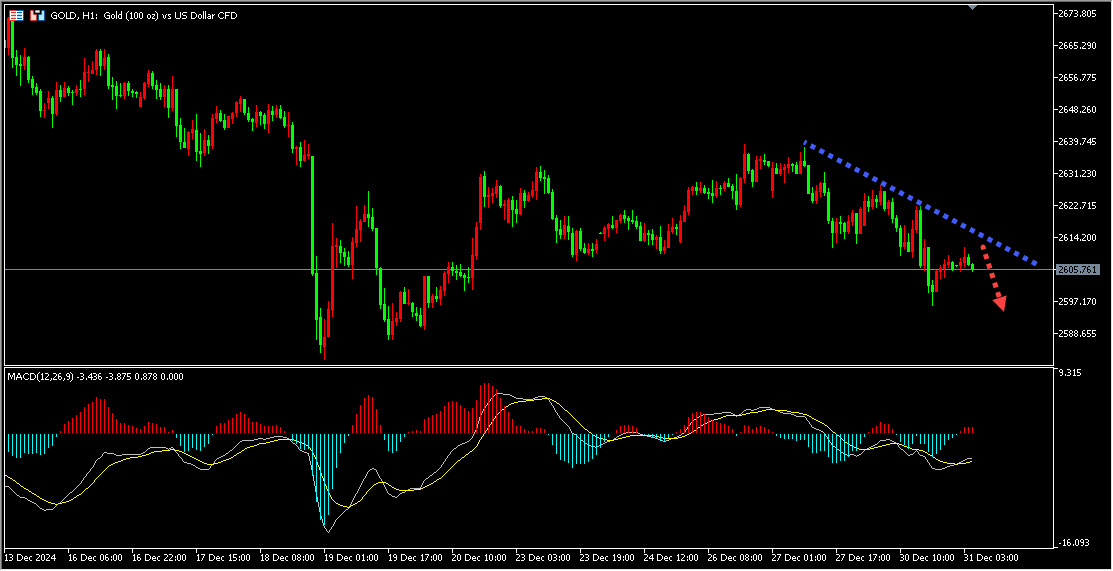

12.31 Analysis of the Trend of Gold Crude Oil

Gold is currently starting to weaken in the short term. Today, investors are paying attention to the pressure area of the 1-hour downward trend line above. After the gold adjustment is under pressure, they are short selling gold in the short term.

① The policies of the Trump administration may stimulate economic growth, which will put pressure on the rise of gold.

② The Federal Reserve has lowered its forecast for a rate cut in 2025 from 100 basis points to 50 basis points this month, which will reduce the investment appeal of gold.

③ Currently, gold is starting to weaken in the short term.

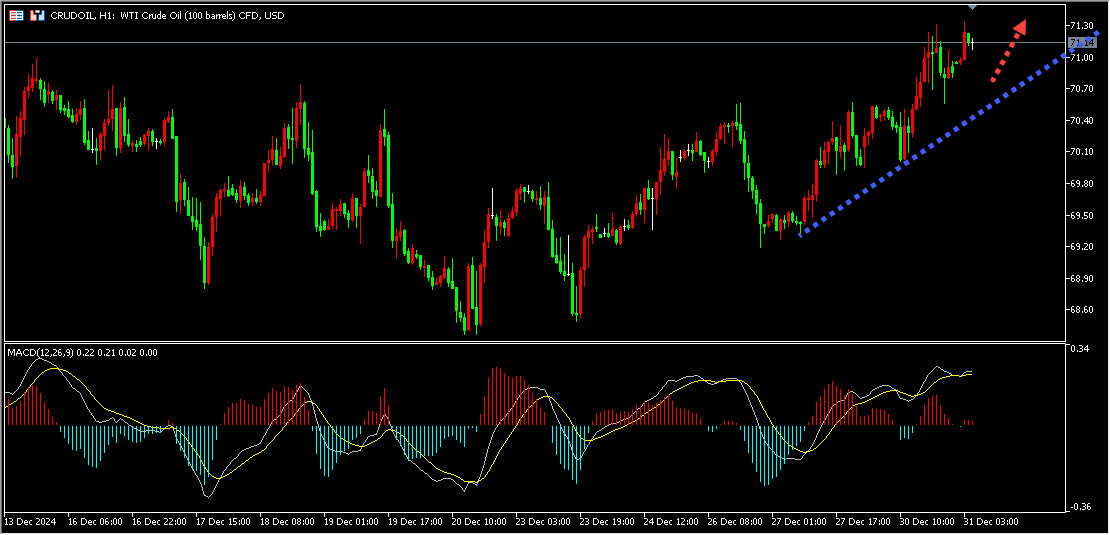

The current trend of crude oil is relatively strong. Today, investors are paying attention to the support area of the 1-hour uptrend line below, and will continue to buy long after the crude oil price stabilizes after a pullback.

① Last week's EIA inventory data fell beyond expectations, providing strong support for oil prices.

② The expectation of a rebound in demand from major Asian countries has increased, providing potential support for crude oil.

③ The expected temperature drop in the United States and Europe in the coming weeks will boost diesel demand.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights