On Wednesday (January 1st Beijing time), during the New Year holiday, the market was mostly closed and trading was light. Gold prices surged by over 27% throughout 2024, marking the largest annual increase since 2010, driven by safe haven demand and interest rate cuts by central banks around the world; However, market sentiment may become more cautious as the market focuses on policy changes during Trump's second presidential term, with oil prices falling by about 3% in 2024, marking the second consecutive year of decline. This is due to stagnant demand recovery after the pandemic, as well as the United States and other non OPEC oil producing countries injecting more crude oil into the well supplied global market.

The Dow Jones Industrial Average closed down 0.07% on Tuesday at 42544.22 points; The S&P 500 index fell 0.43% to 5881.63 points; The Nasdaq index fell 0.90% to 19310.79 points.

equity market

The US stock market fell on Tuesday, ending a significant year for the stock market. Driven by the prosperity of artificial intelligence and the first interest rate cut by the Federal Reserve in three and a half years, the US stock market has repeatedly hit new highs in 2024.

The three major stock indexes in the United States all closed lower in quiet trading on Tuesday, but their trends have been volatile over the past year. 2024 includes intensified geopolitical disputes, the US presidential election, and a shift in speculation about the direction of Federal Reserve policy in the coming year.

AXS Investments CEO Greg Bassuk stated that there was no significant Santa Claus rally this week, but investors received a gift of 2024 returns. Driven by the triple blow of artificial intelligence explosion, consecutive interest rate cuts by the Federal Reserve, and strong US economy, 2024 is a year of stock market rally. This lays the foundation for sustained strength in 2025.

In 2024, the Nasdaq index surged 28.6%. The S&P 500 index surged 23.3%, marking its best two-year performance since 1997-1998. The blue chip Dow Jones Industrial Average rose 12.9% for the year.

Among the 11 major sectors of the S&P 500 index, communication services, technology, and non essential consumer goods led the way in growth in 2024, with annual increases ranging from 29.1% to 38.9%. Healthcare, real estate, and energy only recorded single digit increases. Materials is the only sector to experience a decline in 2024, with a drop of nearly 1.8%.

In the fourth quarter, the Nasdaq index rose 6.2% and the S&P 500 index rose 2.1%. The Dow Jones Industrial Average struggled to rise by 0.5%.

Looking ahead to 2025, the financial market currently believes that the Federal Reserve will cut interest rates by about 50 basis points, and investors are concerned about the overvaluation of the market and the uncertainty of the tax and tariff policies of President elect Trump's administration.

Bassuk said that investors should be cautious about the impact of the upcoming Trump administration and its effects on certain industries. Geopolitics, particularly the instability caused by the Russia/Ukraine conflict and ongoing conflicts in the Middle East, may trigger panic among companies and industries associated with the affected regions. Bassuk believes that there is still room for growth in the artificial intelligence craze.

He added: In the upward trend, valuations have become very high, but we believe that the growth of artificial intelligence will continue and shift from hardware to software on a large scale in most industries.

gold market

Gold prices surged by over 27% throughout 2024, marking the largest annual increase since 2010, driven by safe haven demand and interest rate cuts by central banks around the world; However, market sentiment may become more cautious, depending on policy changes during Trump's second term as president.

Spot gold rose 0.7% to $2624.24 per ounce; US futures closed up 0.9% at $2641.00. The strong purchases by the central bank, geopolitical uncertainty, and loose monetary policy have driven safe haven gold to record highs in 2024, reaching a historic high of $2790.15 on October 31st.

Analysts predict that the factors supporting gold prices in 2024 will continue into 2025, but they also mentioned potential resistance that Trump's policies may bring, which could stimulate inflation and slow down the pace of the Federal Reserve's interest rate cuts.

Nicky Shiels, head of metal strategy at MKS PAMP SA, said, "Gold is in a long-term bull market, but the trend in 2025 will not be as one-way as in 2024

In other aspects, spot silver fell 0.3% to $28.87 per ounce; Palladium rose 0.9% to $908.67; Platinum fell 0.1% to $903.15.

Silver is expected to have its best year since 2020, rising nearly 22% so far. Platinum and palladium are expected to experience annual declines, with declines exceeding 8% and 17% respectively.

Citibank analyst Mulqueen believes that silver prices will rise to $36 per ounce in 2025 in response to a huge market shortage and the Federal Reserve's interest rate cuts. Due to unfavorable factors in industrial demand growth in 2025, it is expected that silver's performance will not surpass gold.

Crude oil market

Oil prices will fall by about 3% in 2024, marking the second consecutive year of decline, due to stagnant demand recovery after the pandemic, as well as the United States and other non OPEC oil producing countries injecting more crude oil into the well supplied global market.

On Tuesday, the last trading day of the year, the settlement price of Brent crude oil futures rose 0.88% to $74.64 per barrel. The settlement price of US crude oil rose 1.03% to $71.72 per barrel. The settlement price of Brent crude oil has fallen by about 3% compared to the final closing price of $77.04 in 2023, while the final settlement price of US crude oil is basically the same as last year.

In September, the closing price of Brent futures fell below $70 per barrel for the first time since December 2021. This year, Brent futures basically traded below the high in the past few years, because the demand rebound after the epidemic and the impact of the Russia-Ukraine conflict on prices in 2022 began to weaken.

According to a monthly survey by Reuters on Tuesday, weak demand and increased global supply will offset OPEC+'s efforts to support the market, and oil prices may be around $70 per barrel in 2025.

Data released by the US Energy Information Administration (EIA) on Tuesday showed that US oil production increased by 259000 barrels per day in October, reaching a historic high of 13.46 million barrels per day, due to a surge in demand, reaching its strongest level since the pandemic. EIA states that next year's production will reach a new record of 13.52 million barrels per day.

Investors will be paying attention to the prospect of the Federal Reserve's interest rate cuts in 2025. Previously, Federal Reserve decision-makers predicted this month that the pace of interest rate cuts in 2025 would slow down due to high inflation rates.

Some analysts believe that supply may tighten next year, depending on President elect Trump's policies, including sanctions. He called for an immediate ceasefire in the Russia Ukraine conflict and may reintroduce the so-called maximum pressure policy on Iran, which could have a significant impact on the oil market.

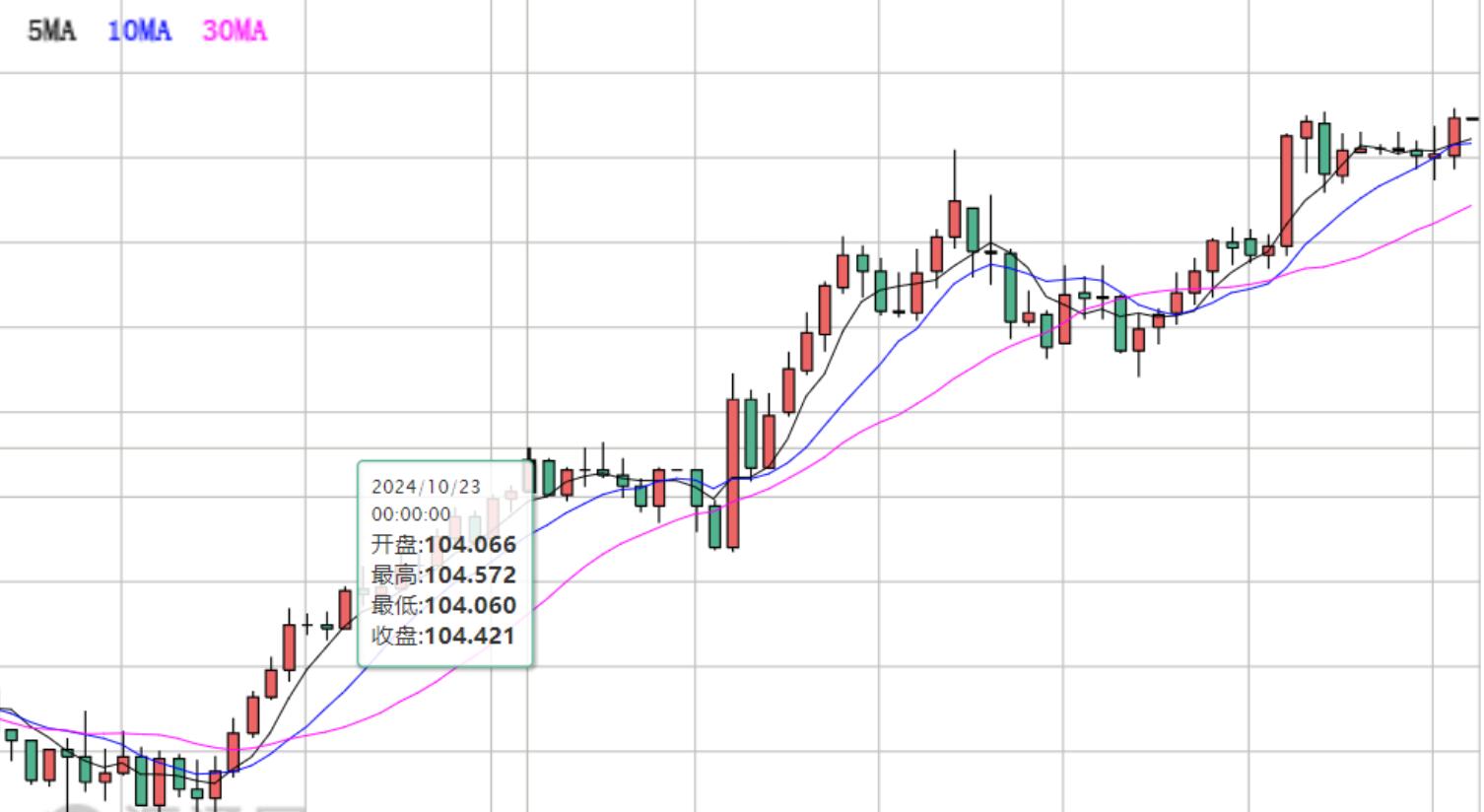

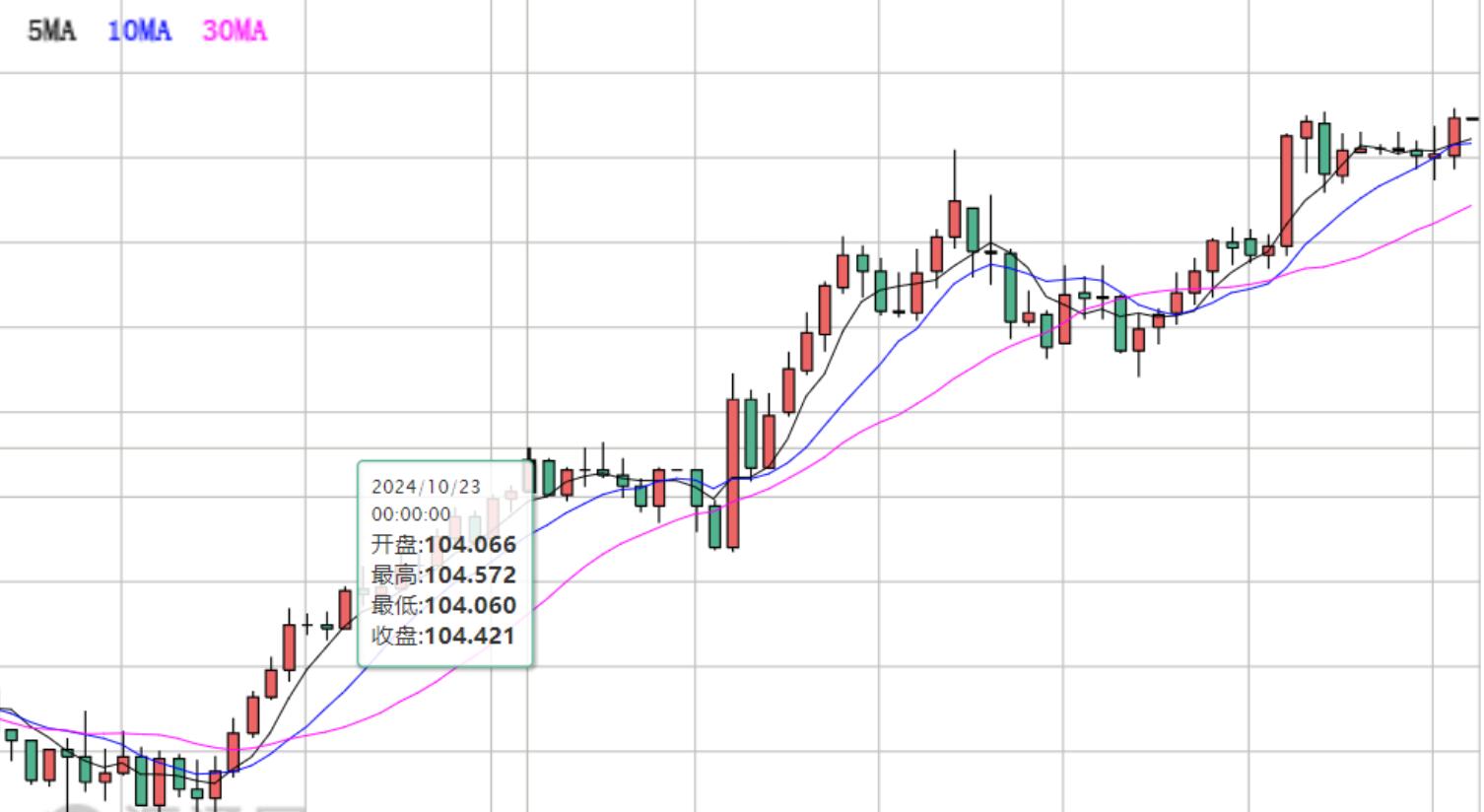

foreign exchange market

The US dollar index rose 0.41% to 108.49 on Tuesday, hitting 108.58 in early trading, the highest level since November 2022. The US dollar index achieved an annual increase of 7.0%. Almost all major currencies have achieved annual gains against the US dollar, as the Federal Reserve will maintain interest rates higher than other central banks, leading to the dollar leading other currencies.

Due to the inflation rate still exceeding the Fed's annual target of 2%, traders have adjusted their expectations, believing that the Fed will take a slow and cautious approach to further rate cuts next year.

Analysts also expect that President elect Trump will introduce policies including relaxing corporate regulations, reducing taxes, imposing tariffs, and cracking down on illegal immigration to promote economic growth and increase price pressure next year. This has led to higher yields on US Treasury bonds and increased demand for the US dollar.

Lee Hardman, Senior Monetary Analyst at Mitsubishi UFJ Financial Group, said, "US Treasury yields have been adjusted to higher levels to reflect the inflationary impact that the incoming Trump administration's policy agenda may bring, including raising tariffs, tightening immigration policies, and maintaining loose fiscal policies

The weak growth prospects outside the United States, escalating geopolitical tensions in the Middle East, and the ongoing Russia Ukraine conflict have increased demand for the US dollar this year.

Action Economics analysts stated in a report that the US dollar has been boosted by "increased concerns about growth in other regions amid geopolitical risks. Trading was light on Tuesday before the New Year holiday on Wednesday.

The Japanese yen is one of the biggest losers this year, as it is expected to record its fourth consecutive annual decline against the US dollar due to the significant difference in interest rates between Japan and the United States.

Analysts predict that further easing of monetary policy by the Federal Reserve and interest rate hikes by the Bank of Japan will ultimately provide support for the yen. Prior to this, traders were paying attention to the intervention of the Japanese authorities, who have repeatedly supported the yen this year.

The latest increase in USD/JPY is 0.29%, reaching 157.28, achieving an annual increase of 11.5%. The euro fell 0.52% to $1.0353, recording an annual decline of 6.2%, and traders expect the European Central Bank's interest rate cuts to be greater than those of the Federal Reserve.

The pound fell 0.34% to $1.2508, and by 1.6% in 2024, it has performed the best against the US dollar among all major currencies this year.

The Australian dollar and New Zealand dollar both fell to two-year lows on Tuesday. The Australian dollar has fallen by about 9.2% this year, marking its worst performance since 2018, while the New Zealand dollar has fallen by 11.4% against the US dollar, marking its worst performance since 2015.

international news

The probability of the Federal Reserve keeping interest rates unchanged in January next year is 88.8%

According to CME's "Federal Reserve Watch", the probability of the Federal Reserve keeping interest rates unchanged in January next year is 88.8%, and the probability of cutting interest rates by 25 basis points is 11.2%. The probability of maintaining the current interest rate unchanged until March next year is 47.1%, the probability of reducing interest rates by 25 basis points cumulatively is 47.7%, and the probability of reducing interest rates by 50 basis points cumulatively is 5.3%.

Venezuelan bandits attempt to invade the United States before Trump takes office

According to foreign media reports, members of the Venezuelan criminal organization "Aragua Train" attempted to attack the US Mexico border crossing in order to enter the United States before Trump's inauguration ceremony. According to Texas law enforcement officials' documents, the bandits attacked with knives at a border crossing in El Paso, claiming to attack the border guards who were blocking them. Last week, 20 Venezuelan armed bandits attempted to enter the country, and the next attack by the "Aragua Train" gang is expected to take place on January 1st. El Paso is considered the headquarters of the gang, and many members enter the United States through it. Retired Homeland Security Investigation Agency agent stated that the increase in cross-border attempts is closely related to Trump's upcoming inauguration, and it is expected that border violence will intensify as the criminals know the situation will change in 27 days. Trump has stated plans to deport illegal immigrants on a large scale and has made it a key issue in his campaign.

On the first day of the new year, the flow of Russian natural gas through Ukraine is expected to be zero

On December 31, 2024 local time, according to the "Ukrainian Natural Gas Transport System Operator" data, the application flow for transporting Russian natural gas through Ukraine on January 1, 2025 is zero. TASS reported that this indicates that the possibility of reaching a solution for the continued transit of Russian natural gas through Ukraine before the new year local time is decreasing.

Zelensky claims that Ukraine has found a solution to deal with Russian missiles

On December 31st local time, Ukrainian President Zelensky announced on his official social media platform that the highest meeting of the technical department was held that day, and relevant government departments, military command centers, and defense enterprises attended the meeting. He stated that Ukraine has currently found some system solutions to defend against Russian missiles and bombs. (CCTV)

US Central Command launches new round of strikes against Houthi militants

According to a statement released by the US Central Command, on December 30th and 31st local time, US Central Command forces carried out multiple precision strikes on Houthi targets in the Yemeni capital Sana'a, as well as coastal locations within Houthi controlled territory. According to the statement, on December 30th and 31st, US Navy vessels and aircraft targeted the command and control facilities of the Houthis, as well as advanced conventional weapons production and storage facilities, including missiles and unmanned aerial vehicles. In addition, the US military also destroyed the Houthi armed coastal radar station, seven cruise missiles, and one-way attack unmanned aerial vehicles over the Red Sea. (CCTV)

Cold warning stimulates surge in US natural gas futures prices

On December 31st, US media reported that due to the meteorological department's prediction of unusually cold weather in some areas of the United States in January 2025, the market expects a significant increase in demand for heating and power generation fuels, leading to a sharp rise in US natural gas futures prices. Bloomberg reported that natural gas futures for delivery in February 2025 rose 16% on the 30th, closing at $3.94 per million British thermal units, marking the largest daily increase since trading began in 2012. On that day, the most active contract price soared to its highest level in two years during trading. According to the latest weather forecast released by the National Weather Service, the likelihood of unusually cold weather in the eastern and central western regions of the United States significantly increases in the next 8 to 14 days. The US natural gas weather website predicts that severe cold weather will lead to a surge in energy demand, driving up bullish sentiment in prices. Due to sufficient shale gas production in the United States, natural gas futures contract prices have mostly remained below $3 in recent months over the past year. But a US analysis and trading company has stated that the upcoming cold wave may freeze some wellheads, thereby suppressing natural gas production.

Cocoa to close 2024 with significant gains amid supply concerns and sluggish trading

Cocoa is ending the year as the top performing major commodity in 2024, with its significant annual increase driven by supply concerns and market volatility. In the past 12 months, cocoa is expected to record a 175% increase, driven by a series of crop failures in Ivory Coast and Ghana, which grow the majority of cocoa crops. The continuous reduction of global inventory has put pressure on both buyers and chocolate manufacturers. With the increase in margin requirements and the continuous rise in holding costs, record breaking prices have led to liquidity dropping to its lowest level in over a decade. The low liquidity in the futures market exacerbates the drastic fluctuations in prices, with price changes exceeding $1000 during the most volatile days of trading.

Russian Locomotive Equipment Factory: All tanks are equipped with anti drone devices

The Ural Locomotive Equipment Factory in Russia confirmed to Russian media that since the special military operation in Ukraine, the factory has made hundreds of changes to tank design, and all tanks are equipped with anti drone devices. On December 31st, the Russian news agency quoted Ural Locomotive Equipment Factory as saying that all tanks produced by the factory are equipped with anti drone networks, and the rear, engine, and engine drive shaft compartments of the tanks have been strengthened with protection. At the same time, they are also equipped with enhanced camouflage systems and electronic countermeasure drone systems. Alexander Potapov, CEO of Ural Locomotive Equipment Factory, said that the tank's protection system faced many challenges in the days leading up to the special military operation, and corresponding improvement measures were immediately adopted. The tanks produced by the factory in early 2022 and those produced by the end of 2024 can be considered as two different types of tanks.

Domestic news

Yiwu: Record high import and export value in the first 11 months of 2024, vigorously promoting brand overseas plans

In the first 11 months of this year, China's total import and export value of goods trade was 39.79 trillion yuan, a year-on-year increase of 4.9%. In recent years, cross-border e-commerce has gradually become a "dark horse" for Yiwu merchants to expand their foreign trade orders. In the first 11 months of this year, the total import and export value of Yiwu City reached 613.99 billion yuan, setting a new historical high. Yiwu Small Commodity Market links more than 20 industrial clusters, 2.1 million small and medium-sized enterprises, and 32 million industrial workers across the country. In order to sustain market prosperity and promote industrial upgrading, Yiwu market is vigorously promoting the plan of brand going global. (CCTV)

The industrialization of humanoid robots will accelerate by 2025, and the cost of humanoid robots is expected to be reduced to less than 200000 yuan

Recently, the domestic industry announced the official mass production of humanoid robots. The reporter visited the super factory of humanoid robots and found that many of the upstream precision machining processes of key components of the robots intersect with the domestic new energy vehicle industry. Industry insiders suggest that the industrialization of humanoid robots will accelerate by 2025, with costs expected to drop to within 200000 yuan. (CCTV)