The US index is fluctuating at a high level, and the EUR/USD is facing critical support

The US dollar index performed strongly in 2024, with an annual increase of about 7%, as the Federal Reserve maintained high interest rates. Citibank believes that its strong performance will be affected by expectations of interest rate cuts from the Federal Reserve. At the same time, safe haven gold has also shown strong performance, reaching a historic high on October 31, 2024. It is expected that support factors will continue until 2025, but Trump's policies and the Federal Reserve's interest rate cuts may slow down or become resistance. The inflation rate is higher than the target, and traders expect the Federal Reserve to slowly and cautiously cut interest rates next year. Trump's policies may increase inflation and slow down the pace of interest rate cuts. The yield of US 10-year treasury bond bonds will rise by more than 60 basis points in 2024, and the steep yield curve reflects concerns about fiscal sustainability. Geopolitical tensions, the conflict between the Middle East and Russia-Ukraine conflict increased the demand for dollars and promoted risk aversion. The US Department of Labor will release the number of initial jobless claims, which will affect the trend of gold prices. In addition, the final value of January manufacturing PMI in European and American countries and the changes in the number of unemployment claims in the United States on this trading day are worth paying attention to, and investors should also pay attention to the geopolitical situation news.

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Tuesday. The highest price of the day rose to 108.561, the lowest was 107.839, and closed at 108.458. Looking back at the performance of the US dollar index on Tuesday, after the morning opening, the price initially fell under pressure in the short term, and then rose again to the four hour resistance level after the European session, while the US continued to rise. Today is the first trading day of 2025. From the monthly chart, it appears that the month is ending with a strong yang. Currently, the watershed of the monthly chart is in the 104.50 area, and prices tend to be bullish in the long term above this position. From a weekly perspective, it is currently important to pay attention to the 105.60 area as a watershed. At the same time, the daily support is in the 107.80 area, and the price is above the multi cycle support, so the overall trend is still bullish. At the same time, the price has been fluctuating in the range of 107.55-108.50 recently, and we will focus on breaking through after the fluctuation. Before breaking through in the short term, we will treat it as if it is more volatile.

The US index focuses on the fluctuation range of 107.55-108.50, and will only open up space after breaking the level

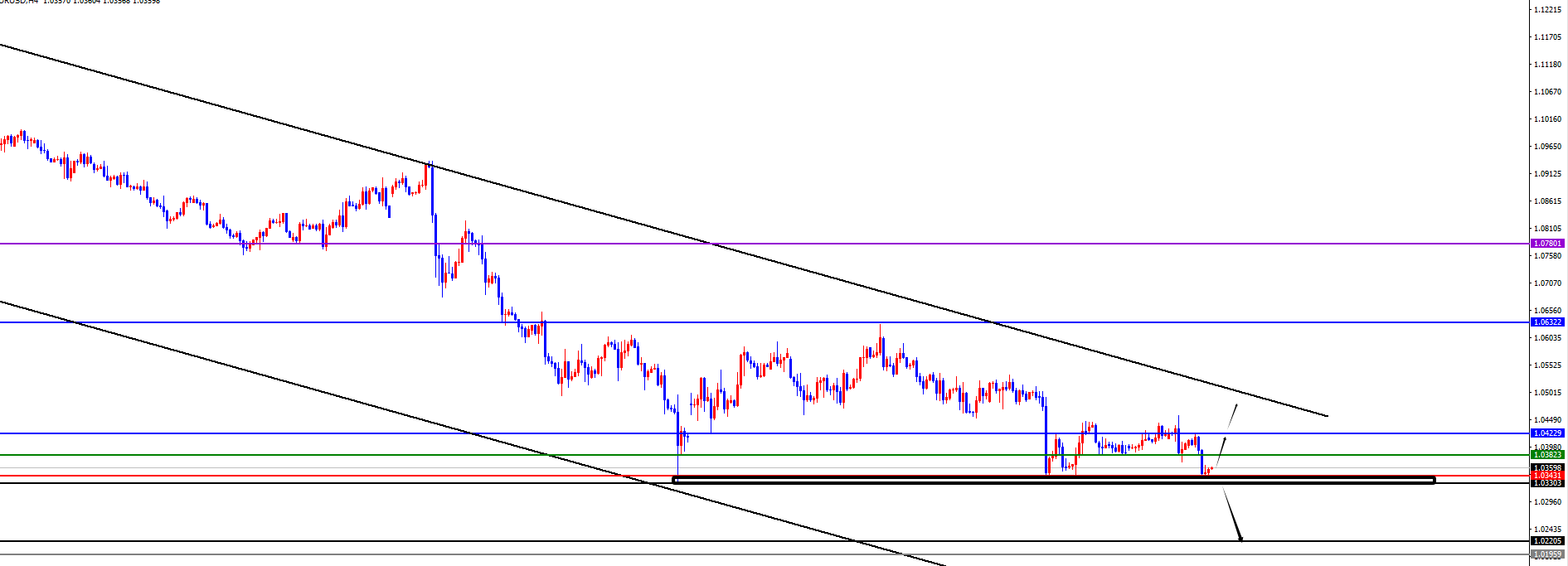

In terms of EUR/USD, the overall price of EURUSD showed a downward trend on Tuesday. The lowest price of the day fell to 1.0343, the highest rose to 1.0424, and closed at 1.0352. Looking back at the performance of the EURUSD market on Tuesday, during the morning session, the price first rebounded upwards and corrected in the short term. Then, the price hit the four hour resistance zone and fell again under pressure. The time point was during the European session, and if the European session broke through the low point of the morning session, it means that there is still pressure in the future. Therefore, the US market continued to decline and eventually ended in a bearish trend. At present, the monthly resistance is in the 1.0780 area, below which the long line is still bearish. At the same time, the weekly resistance is in the 1.0630 area, and the price is bearish below this position. At the same time, the daily resistance level is in the 1.0420 area, and attention should be paid to the support of the November low point in the 1.0330 area below. Prices need to be treated with caution before breaking through.

EURUSD pays attention to the gains and losses of the long short watershed of 1.0330-40

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights