Key resistance of spot gold weekly line, EURUSD hits major key position

Recently, the ongoing tensions between Russia, Ukraine, and Israel have brought about a lot of destruction and turmoil. On the Russian Ukrainian side, Russia launched a drone attack on Kiev, which hit Ukraine's energy system and made repairs difficult. In addition, military facilities were attacked and civilian facilities were damaged in many places on both sides. In the Israeli Palestinian conflict, the Israeli Defense Forces carried out airstrikes on refugee camps in Gaza, causing casualties, and also bombed facilities of Hezbollah. Although ceasefire negotiations have reached a stalemate, Israel has sent a delegation to Doha to participate in relevant negotiations. The economic situation is complex, and the US job market is stable. Last week, the number of unemployment benefit applications fell to an eight month low, pushing the US dollar index to a two-year high. However, the rise of the US dollar did not stop the rise of gold prices, and factors such as the return of the "Trump trade" increased the demand for safe haven gold buying, resulting in a price increase of over 27% in 2024. Next, the market will focus on many important data such as the December ISM Manufacturing PMI in the United States to determine the interest rate outlook for 2025, with the US dollar and gold trends receiving much attention.

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Thursday. The highest price of the day rose to 109.534, the lowest was 108.24, and closed at 109.252. Looking back at the performance of the US dollar index on Thursday, after the morning opening, the price fluctuated and corrected in the short term before rising again above the four hour support level. From the time point of view, it happened to be at the European trading point. Subsequently, the price also strengthened again during the US trading period, and the daily bullish trend finally came to an end. At the same time, the price broke through the upper edge of recent fluctuations yesterday. At present, the daily support is in the 108 area, and the 4-hour support is in the 108.50-60 range. We will see an upward trend after the price rebounds again.

Buy long in the 108.50-60 range of the US index, defend for $5, target 109-109.50-110.30

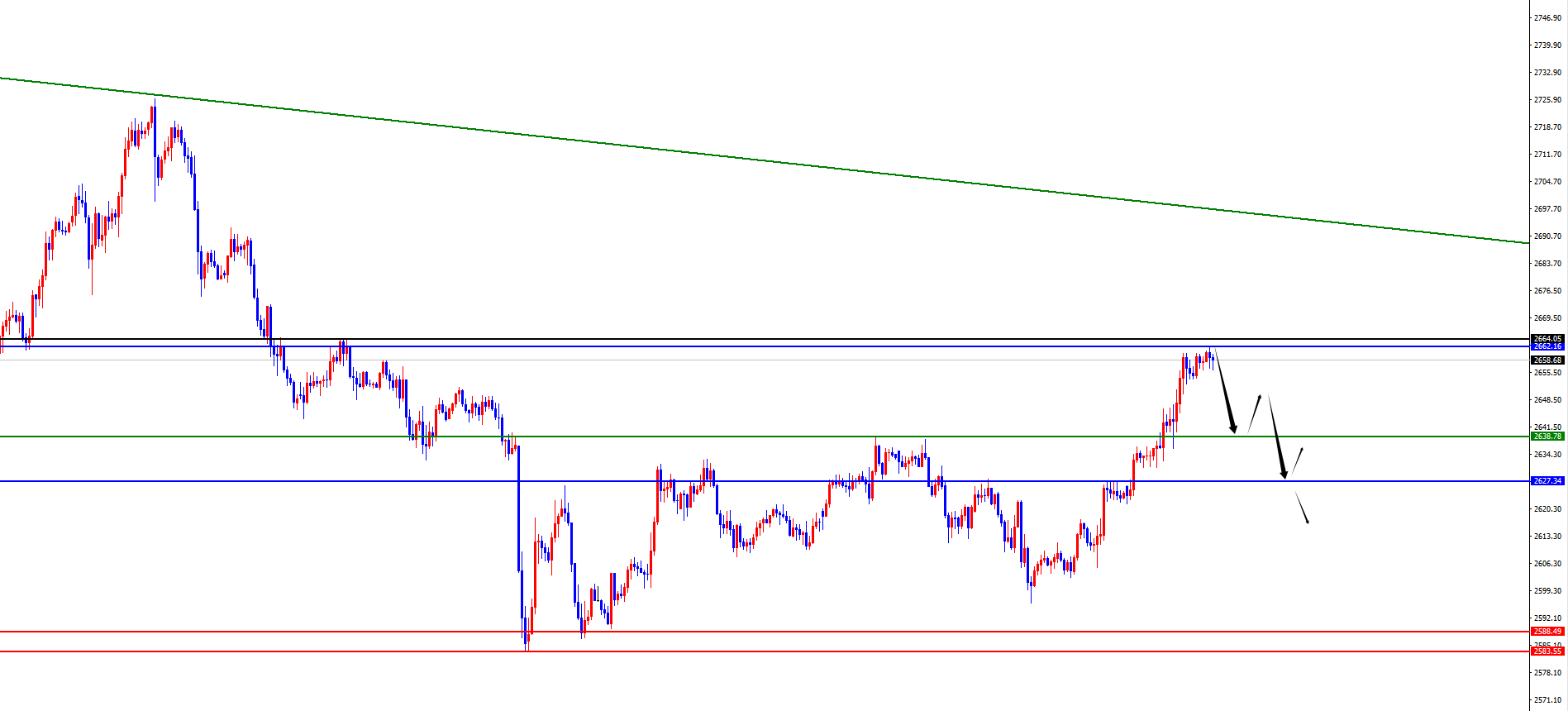

In terms of gold, the overall price of gold showed an upward trend on Thursday, with the highest price rising to 2660.36 and the lowest falling to 2621.55, closing at 2657.87. Looking back at the details of the gold market performance on Thursday, the price directly rose during the morning session and broke through the 2639 level we emphasized yesterday during the European session. Therefore, the market still needs to further test the weekly line in the 2662 area. Yesterday's strong yang ended, and today's morning session saw the price test in this area as scheduled. This region cannot blindly see a significant increase for the time being. Prices will only further rise if they break through this region, otherwise the market needs to be cautious of being under pressure again. The price on the weekly chart remains fluctuating within the range of 2537-2721, with the range of 2662-2664 serving as the watershed for weekly fluctuations and a key resistance point for the chart. So before we make a real breakthrough, we will rely on this area to see the pressure, and then pay attention to the 2639-2627 area below.

Short selling in the gold range of 2662-63, defending against $10, targeting 2639-2627

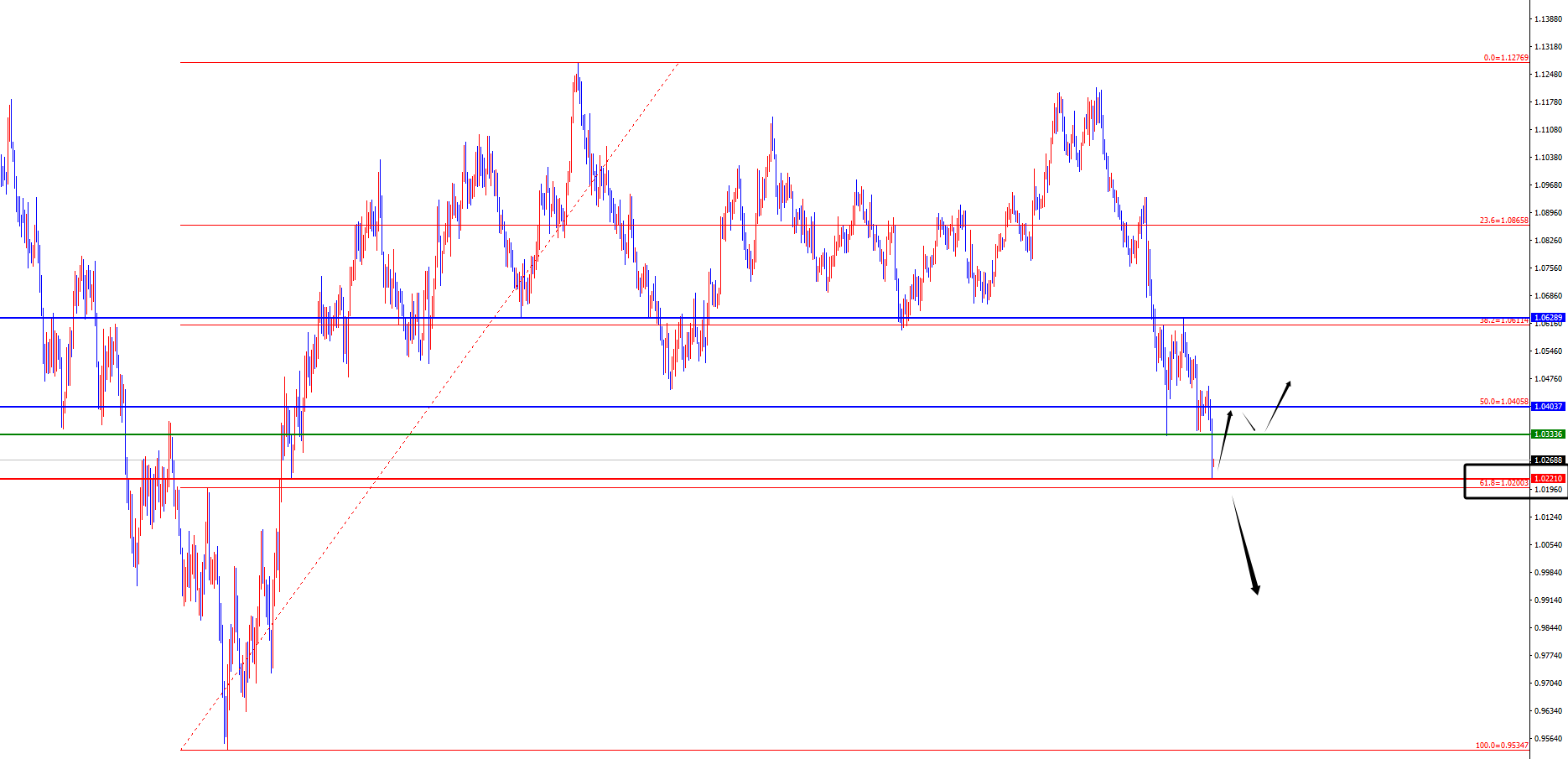

In terms of EURUSD, the overall price of EURUSD showed a downward trend on Thursday. The lowest price of the day fell to 1.0224, the highest rose to 1.0375, and closed at 1.0257. Looking back at the performance of the EURUSD market on Thursday, the price continued to be under pressure after short-term fluctuations in the morning session. Subsequently, the European and US markets continued to operate weakly. Yesterday, we emphasized our focus on gains and losses in the 1.0330-40 range. If the price directly breaks through during the European session, we will test the 1.0220 area in the future. As expected, the price will test this area as scheduled, and the daily price will end in a bearish trend. From a macro perspective, the area around 1.0200 is the 618 position where the previous bottom order rose from 0.95349 to 1.2748 and then retreated. We will focus on the gains and losses of this region in the future. Today, we will temporarily observe more and move less, and the key is to pay attention to whether this position can stop. Radicals can rely on the area around 1.0200-1.0220 to try more, and the price will only increase significantly if it stabilizes at daily resistance.

Attempt to buy long around EURUSD 1.0200-1.0220

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights