Gold: Strong Embarking on a New Journey

In the first trading day of 2025, the gold market welcomed a good start, continuing the rebound momentum at the end of 2024. The price surged above 2650, and the daily chart continued to rise and close. The bullish rebound trend gradually strengthened, and the bottoming signal of 2602 in the early stage became more significant, which is likely to become a key turning point for this round of bullish recovery.

In terms of geopolitical risks, Trump is preparing to strengthen his strikes against the Houthi armed forces in Yemen after taking office. The Houthi armed forces have also shot down US drones and carried out attacks on US ships, escalating regional tensions. At the same time, Trump's tariff policy has raised concerns among other countries, and South Korea's political risks have not dissipated, and its exports to the United States may face pressure to increase taxes.

Particularly important is the debt problem of the United States. The debt ceiling came into force again on January 2. Although the debt ceiling was not reached on that day due to a technical coincidence, it is expected that it will be touched from January 14 to 23, and the shadow of the debt crisis will be shrouded again. Each debt crisis will provide support for the gold price.

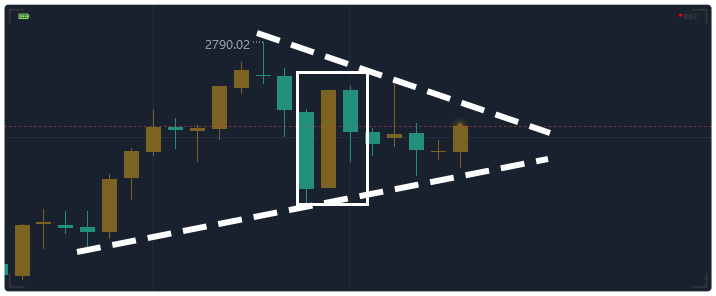

Since reaching a high of 2790 on October 31st, the overall market has shown a volatile correction trend, but this has not changed the upward rhythm of the bulls, but rather accumulated strength for subsequent upward movements.

From the perspective of the market structure, the daily chart has been continuously rising and closing at a high level, showing a strong continuation pattern. The eight hour line is also a bullish upward attack, showing a bullish momentum!

According to the bullish rhythm, after a continuous rise in the previous trading day, the Asian market is often a correction market. The current Asian market is in a volatile state, which can be seen as a sideways correction and can be directly involved in long orders. That is, the 2660 line support can be directly bullish, and the 2656 low below serves as the dividing point. According to the view of strengthening without breaking through the low, if the Asian market smoothly rises, then after the correction before and after the European market, the US market is expected to further expand its gains. Overall, there is a clear bullish trend in gold, and it is expected to continue to rise in the short term, so it is important to grasp the bullish trend.

The above views are for reference only. Investment carries risks, and caution is required when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights