Spot gold daily bullish breakthrough is effective, there is still room for upward movement above

Today's spot gold market analysis:

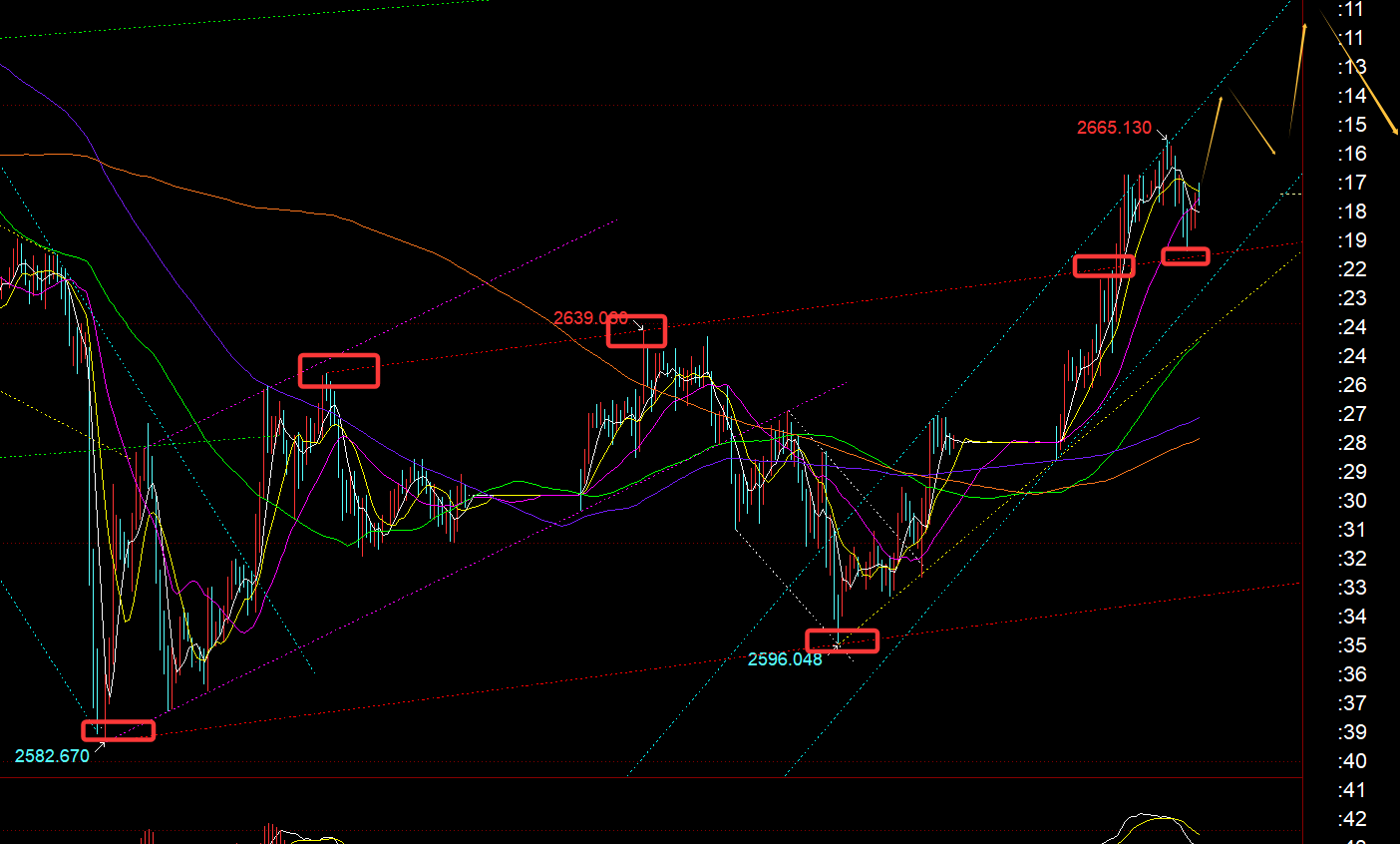

1, the daily level of gold: Yesterday, it closed in a strong bullish trend, and the closing price effectively broke through the 2642 line mentioned in yesterday's research report, which means that there is a probability of opening up further rebound and upward space in the next few days, temporarily ending the weak bottom oscillation between 2640-2600; However, in the short term, it should still be in a period of adjustment under the bullish trend, and should still be treated as a volatile one, with only a slight upward shift in the operating range. Above 2642 will become a confirmed support for the channel, while the resistance above will first pay attention to the pressure points derived from the trend lines of the first two high points between 2790-2726, around the 2690 line; Therefore, the range of oscillation in the following is focused on 2640-2690; Once 2690 is unable to launch a strong upward attack, it will have to turn its head again to suppress and fall back;

2. Gold 4-hour level: Yesterday, relying on the 5-moving average, it continued to close positive and forced a strong bearish trend. Today, under pressure of 2665, there was a wave of backtesting. Therefore, this cycle is once again focused on the 10 moving average, currently moving up 2650. Holding it will maintain a bearish rally and rebound; Losing it will turn into oscillation;

3. Gold hourly level: From the above chart, the upper track of the red box oscillation channel was effectively broken through last night. Today's retracement confirmation is 2650-49, which is the first support position prompted in the morning. The second support point is 2644, which is the retracement confirmation point of the daily level channel. Today, we are trying to follow the bullish rebound around these two points. The first resistance is 2664.5, which belongs to the high point of December 16 last year and is also the high point corrected by the rebound after the top pressure of 2726. The second resistance is 2672-71, which belongs to the 618 split resistance of 2583-2726; Today, we will temporarily focus on the oscillating operation between two supports and two resistances. We will first see a bullish rebound, and then consider a pullback when the resistance suppresses the signal. However, it is best for the pullback not to break through the low point of the day before continuing to rebound and rise at the beginning of next week;

Silver: From the daily level in the chart, the annual moving average has already stabilized. Although it is still a bit close to the bottom of the purple channel, it also indicates that this channel is still effective; The resistance line above is 29.9. If it continues to break above this point, there is a possibility of a rebound to the green trend resistance line in the future. We may consider the 66 day moving average line of 31, and then decline and fall after being under pressure; So, the bullish trend in the short term has been firmly held, but it is also in a period of correction and adjustment in the short term. However, after the bottom stabilizes, the range of oscillation needs to be expanded upwards, which is also a rebound correction of the weak decline of 32.2-28.7 in the early stage; From the intraday hourly chart level, as long as the mid track remains firm and not broken, it will continue to maintain a bearish trend and continue to rise, stabilizing above 29.58 and continuing to see a rebound;

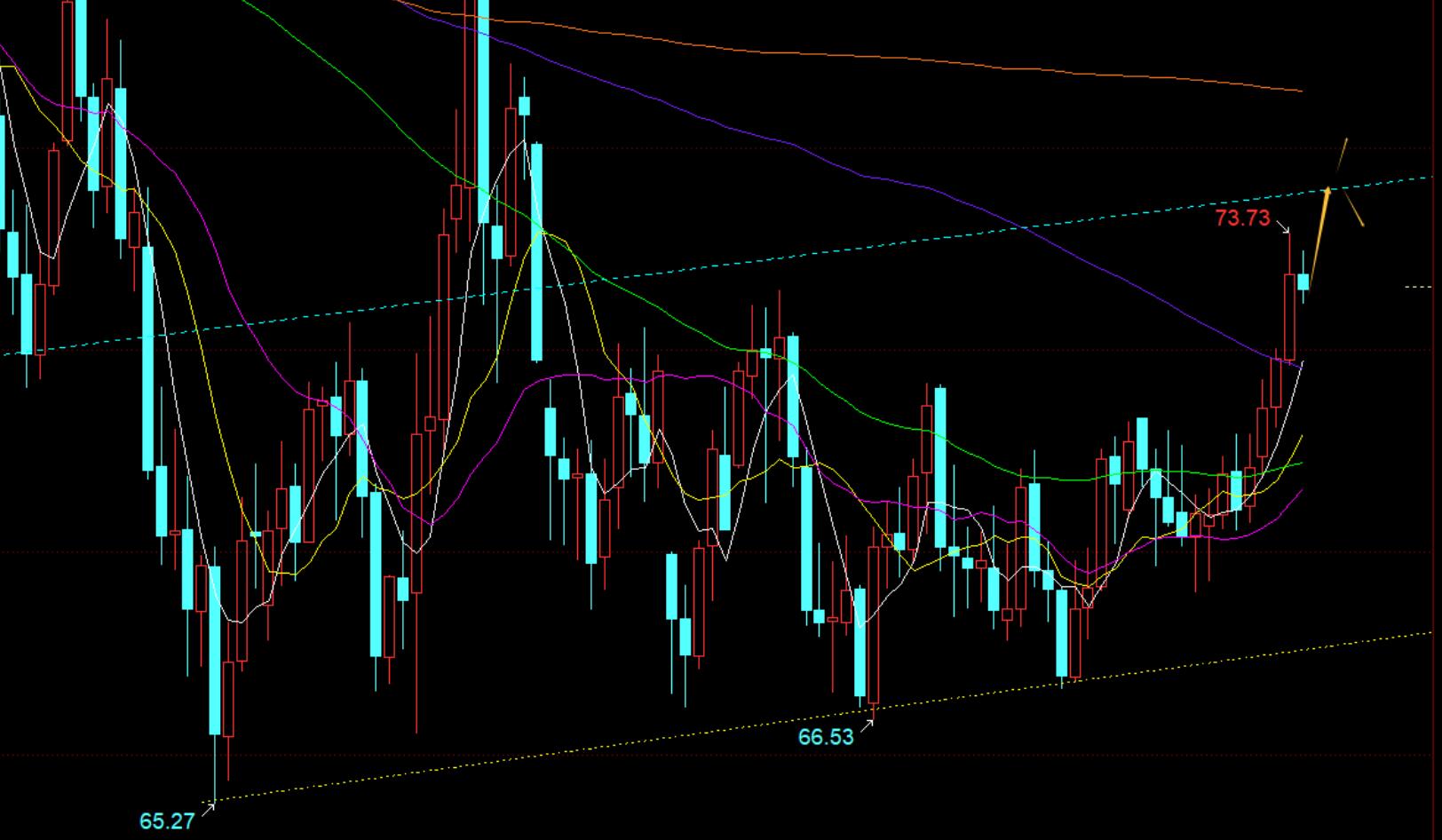

Crude oil: From the channel shown in the chart below, there is still some space above. The resistance on the upper track is about 74.4. After continuing to close positive yesterday, today's rebound and stabilization can only be followed by a bearish bullish trend; From yesterday's segmentation, the 618 support is 72.5, the hourly 66 day moving average is 72.2, and 72.8 is also the starting point of the bullish trend. There is a probability of stabilization at these positions, with resistance targets of 73.48, 73.73, 74.4, etc; However, the timing can wait a little longer, as the European market is experiencing consecutive bearish declines today. If the price remains stable from 22:00 to 23:00, you can choose the opportunity to be bullish and continue the upward trend;

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights