The latest heavyweight investment survey for 2025 has been released! Bloomberg: Trump policies will make them the biggest beneficiaries

According to the latest Bloomberg survey released on Monday (January 6th), Donald Trump's policies will drive economic growth in the United States, with the US stock market and the US dollar being the biggest beneficiaries.

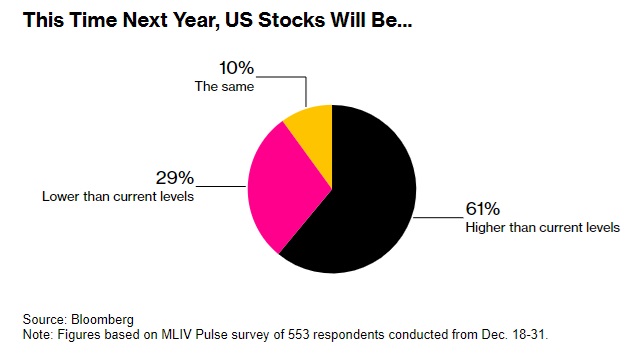

(Screenshot source: Bloomberg)

Among 553 respondents, 61% said that by the end of 2025, the S&P 500 index in the US stock market will rise due to strong growth in the US economy and corporate profits.

Several interviewees believe that the upcoming Trump administration may be a catalyst for stock market growth. This Bloomberg survey was conducted from December 18th to December 31st after the Federal Reserve made its policy decision last year.

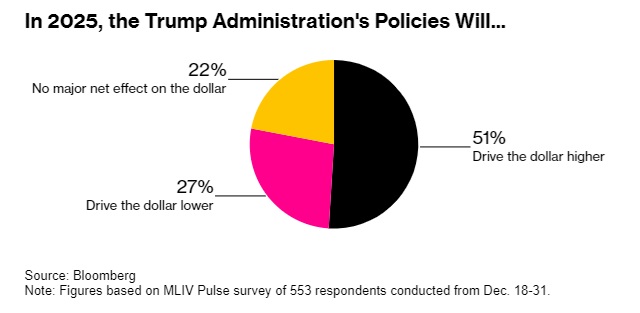

(Screenshot source: Bloomberg)

When asked if Trump's policies will boost or drag down the US dollar, or have no significant impact, about half of the people said that the incoming president will have a net positive impact on the US dollar, citing his preference for the impact of tariffs.

It is worth noting that 27% of respondents believe that the same policy is a reason for the weakening of the US dollar.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights