Trump makes a heavyweight statement on tariffs! What is the reason for the narrowing of the decline after the sharp drop of the US dollar?

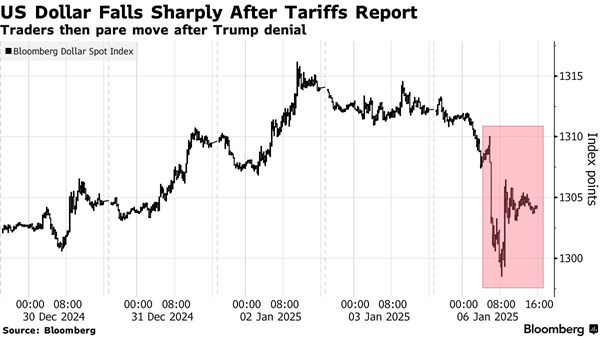

Yesterday (January 6th), after US President elect Donald Trump denied a report that his tariff plan would not be as widespread as initially feared, the US dollar experienced a sharp decline against most major currencies.

(Screenshot source: Bloomberg)

On Monday morning, The Washington Post reported, citing three informed sources, that Trump's aides are considering a tariff plan that applies to all countries but is limited to specific key imported products.

Once implemented, this plan will mean a significant reduction in the "universal tariff" of 10% to 20% proposed by Trump during his presidential campaign, which economists predict will drive up consumer prices and distort the global trade landscape.

The specific industries or products that the new US government will target are currently unclear, but it may focus on areas that Trump wants to bring back to the United States. Trump's focus may include the defense industry supply chain (through tariffs on steel, iron, aluminum, and copper), as well as critical medical supplies such as syringes, needles, small bottles, and pharmaceutical materials.

Two of the informants said that Trump may also target energy materials including batteries, rare earth minerals, and solar panels.

After the report was released, the Bloomberg US dollar spot index fell more than 1%, marking the largest intraday decline since 2023. The euro and the US dollar rose by 1.3% at one point, marking the largest daily increase in 14 months, while the pound/dollar also rose by 1%.

But Trump immediately announced that the above report was untrue.

Trump wrote on the social media Truth Social, "The Washington Post's report cited non-existent so-called anonymous sources and incorrectly pointed out that my tariff policy will be reduced. This is wrong. The Washington Post knows this is wrong. This is just another example of fake news

After Trump's clarifying remarks, the US dollar narrowed its decline. As of Monday's close, the Bloomberg US dollar spot index fell 0.6%.

(Screenshot source: Bloomberg)

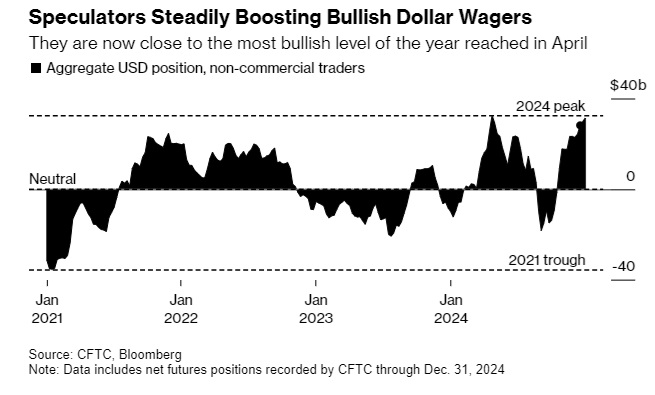

XTB's research director Kathleen Brooks said that the initial decline of the US dollar was an "overreaction to an unconfirmed report, but it did show a trend," and "we have a large number of long positions in the US dollar that face the risk of reversal

According to data compiled by Bloomberg from the US Commodity Futures Trading Commission (CFTC) since 2003, speculative traders' bullish expectations for the US dollar reached their largest quarterly increase on record in the last three months of 2024.

The latest data released by the US CFTC on Monday shows that as of December 31, non-commercial traders held long positions of approximately $31.4 billion, the highest level since April last year.

(Screenshot source: Bloomberg)

Bloomberg pointed out that the US dollar benefits from the expectation that Trump will impose taxes on major trading partners of the United States. But a tariff plan that only covers key industries such as defense industry supply chain has a smaller impact on the global economy and US inflation pressure than a tariff plan that covers a wider range of imported products, which means there is still room for the US dollar to weaken.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights