Gold focuses on 2650 retracement, EUR/USD challenges daily resistance level

The PPI increase in the United States in December was lower than expected, with a month on month increase of 0.2% and a year-on-year increase of 3.3%. Although inflation eased at the end of the year, the situation remains complex. Wholesale prices of goods have risen, energy and food prices have fluctuated, and core PPI has risen for two consecutive months. This does not change the Federal Reserve's view that it will not cut interest rates before the second half of this year, as the labor market is resilient and the Trump administration may impose tariffs to stimulate inflation. Under the influence of PPI data, the US dollar index suffered a setback and gold prices were supported. However, the strength of the US dollar and the rise in treasury bond bond yields were still unfavorable for gold. Investors are waiting for Wednesday's CPI data, predicting a month on month increase of 0.3% and a year-on-year increase of 2.9%, which is important for the Federal Reserve and traders and may become a basis for buying risky assets. In addition, in terms of geopolitical situation, the Gaza ceasefire talks are close to an agreement but there are still variables. The speeches of the President of the New York Federal Reserve and other officials, as well as the brown book on economic conditions, have also received attention. The US economy is full of uncertainty in inflation, employment, policies, and other aspects. The market and investors closely monitor data and events to determine the direction of the economy and policies.

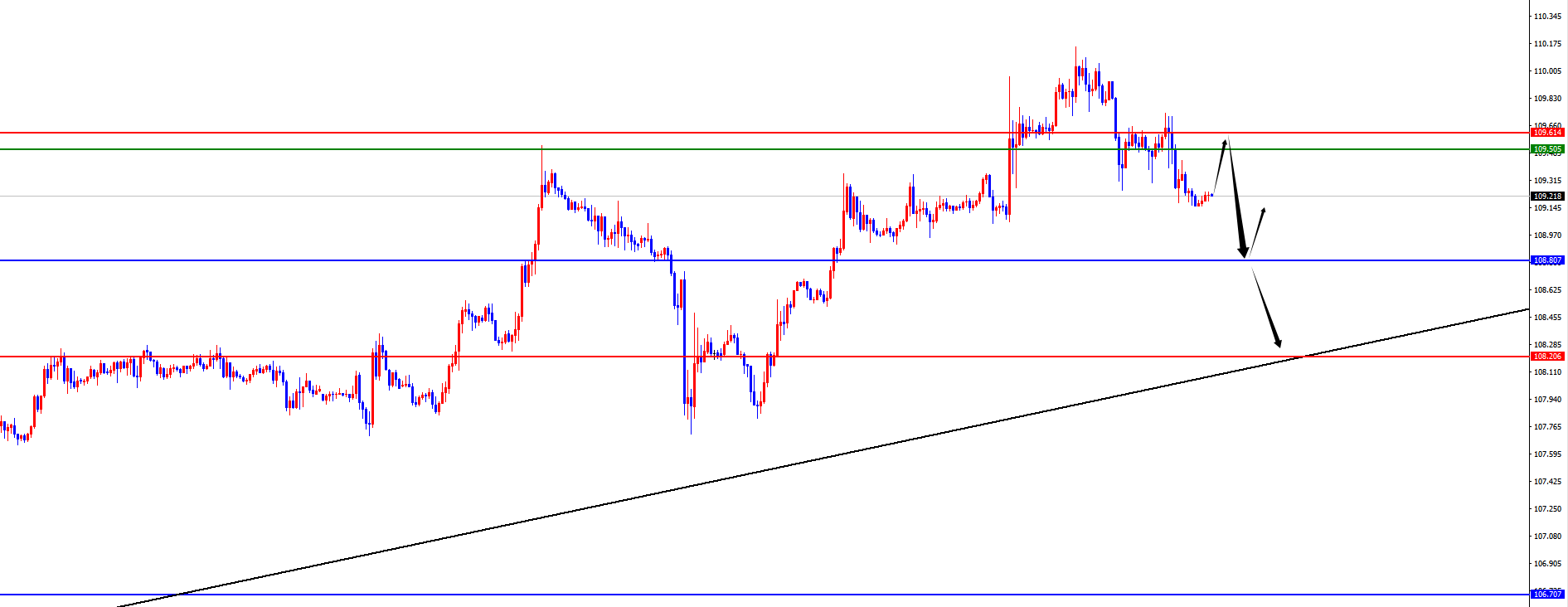

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Tuesday. The highest price of the day rose to 109.736, the lowest was 109.153, and closed at 109.155. Looking back at the price performance of the US dollar index on Tuesday, after the morning opening, the price first fluctuated in the short term. The price fluctuated upwards and tested to a four hour resistance before coming under pressure again. At the time point of the US market, the price continued to fall under pressure, and the daily bearish trend eventually ended. At present, the US Composite Index is under pressure at the four hour resistance level, and we will continue to monitor the pressure. The key position of the four hour resistance level has always been the focus of our emphasis. At present, the weekly support is in the 106.70 area, and according to the daily level, we need to pay attention to the support in the 108.80 area temporarily. At the same time, the resistance in the four hour range is in the 109.50-60 range. We will continue to monitor the pressure and test the daily support area, and pay attention to the gains and losses of the daily support in the future.

Short selling in the 109.50-60 range of the US Composite Index, defending against $5, with a target of 108.80

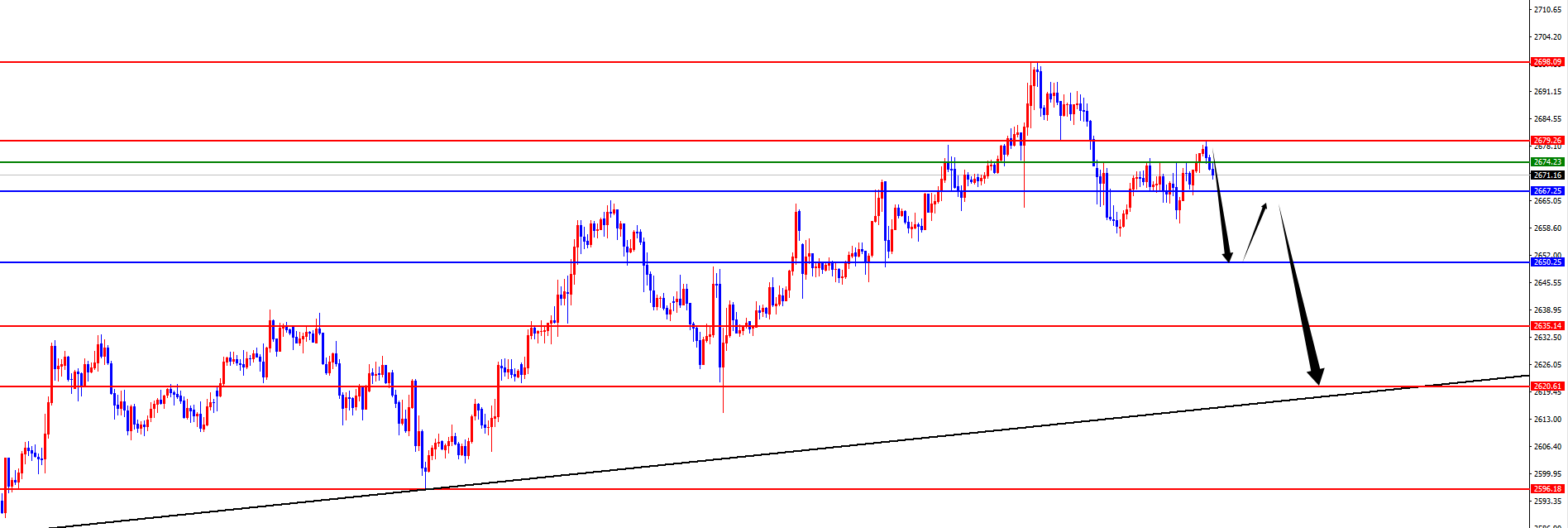

In terms of gold, the overall price of gold showed an upward trend on Tuesday, with the highest price rising to 2678.01 and the lowest falling to 2659.76, closing at 2677.08. Looking back at the details of the gold market performance on Tuesday, the price line was revised upwards during the morning session, and then the price continued to fluctuate. At the same time, the US session was affected by data and rose and fell, but the price did not fall below the previous day's low point, then stopped rising again, and finally closed with a strong bullish trend. Currently, the gold weekly line supports the upper and lower limits of the 2667 position. In addition, from the daily line level, it is necessary to temporarily pay attention to the 2650 area, which determines the key trend of the gold band. At the same time, the price is currently suppressed in the 2678 area in the short term. Therefore, the analytical approach we gave yesterday remains unchanged. If the price has not stabilized, we will continue to pay attention to further retracement of the daily line support 2650 area.

Short selling in the gold 2677-78 range, defending against $10, targeting 2667-2650

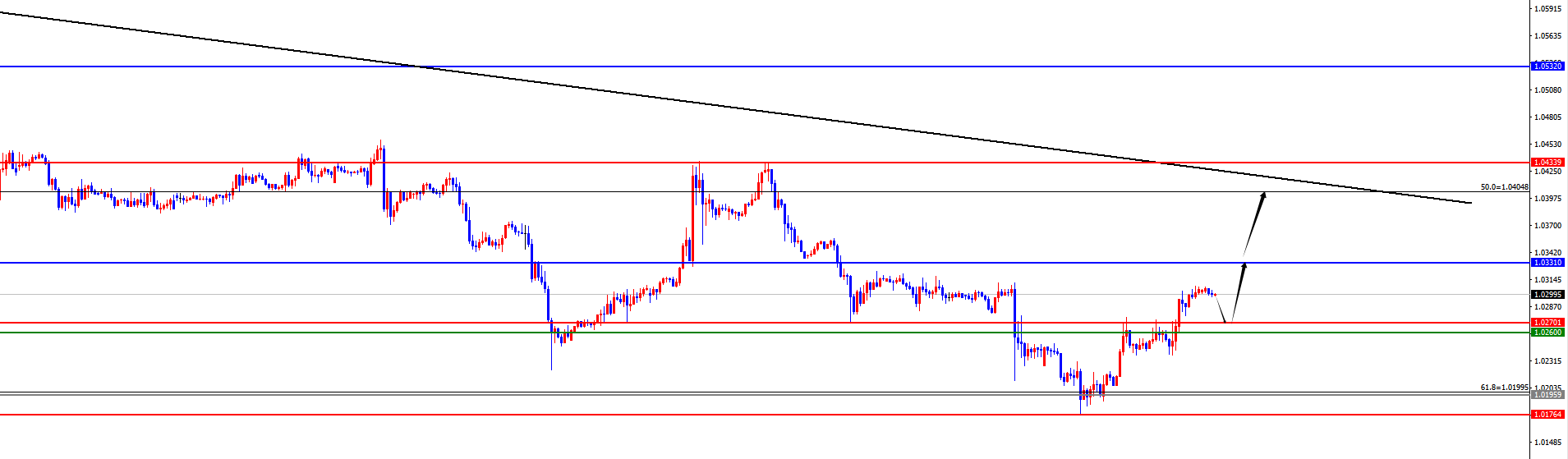

In terms of EUR/USD, the overall price of EURUSD showed an upward trend on Tuesday. The lowest price of the day fell to 1.0237, the highest rose to 1.0308, and closed at 1.0306. Looking back at the market performance on Tuesday, prices fluctuated in the short term during the morning session. As the price hit the key support level of the major cycle on Monday and stopped rising, and broke through the four hour resistance level as scheduled on Tuesday yesterday, the overall trend was bullish. After the intraday price fluctuation, it rose again in the US market, and finally ended in a strong bullish trend on the daily chart. We will continue to pay attention to the gains and losses of the daily resistance range of 1.0330 in the future. After the price breaks through, we will once again exert significant force. For the four hour support, we need to focus on the support range of 1.0260-70 for the time being, and wait until the price is in place for further improvement. We will pay close attention to whether the daily resistance can break through.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights