CPI Attack, Beware of Extreme Trends in Gold and Silver

At 21:30 Beijing time on Wednesday, the United States will release its December CPI data. Against the backdrop of the Federal Reserve's recent shift towards hawkishness, a new round of pricing after the release of CPI data is inevitable in the market. In a sense, its influence is no less than that of non farm employment data, as the market's expectations of the Federal Reserve's monetary policy will change, and prices fluctuate based on these expected changes.

Usually, this type of data has a more intuitive impact on markets such as the US dollar index, gold and silver, US stocks and bonds. If the data generally meets market expectations, it may continue the existing oscillation trajectory, and if the data deviates significantly from market expectations, it will produce unexpected fluctuations.

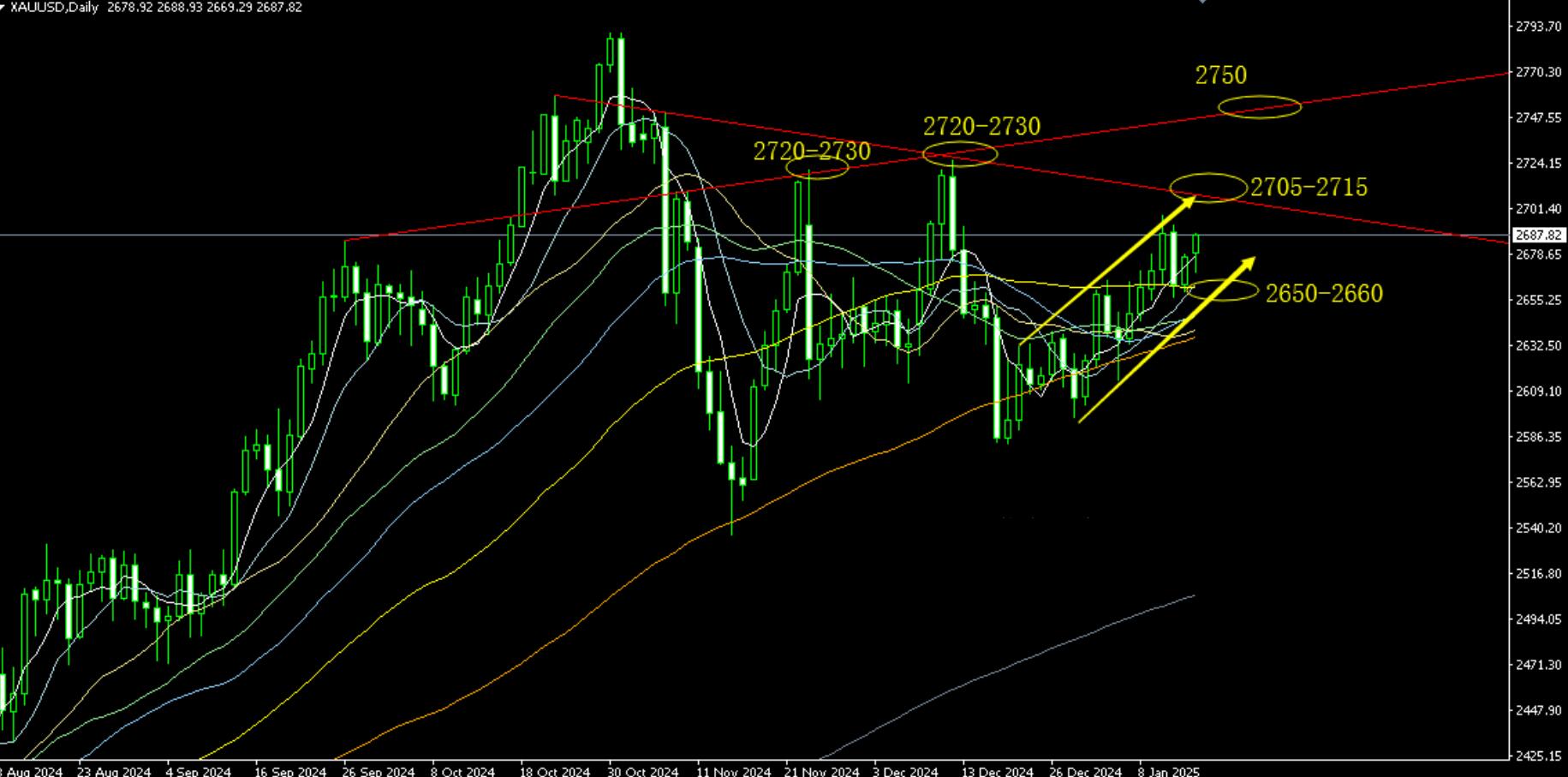

From the perspective of gold and silver technology, silver is significantly weaker than gold. Here is a cautionary scenario: resistance and support in the event of increased volatility may not necessarily be fully touched, but it is worth paying close attention to.

Last week, gold hit the resistance range of 2680-2700 before stagnating, but the weekly line still closed higher. This type of strong bullish trend is commonly seen to break through the corresponding high. Assuming that the resistance above the high level can first focus on the area around 2705-2715, and then the resistance above it is the resistance of $2720-2730 that was hit twice in November and December. In extreme cases, such as the market's reversal of hawkish expectations for the Federal Reserve, coupled with geopolitical factors, there is a possibility of challenging around $2750 in the next few days (with a slightly lower probability compared to the previous two resistance levels). On the contrary, the data is very bearish, with the bottom support focused around $2660-2650 and strong support around the daily small double bottom neck line of $2640. Once the closing falls below, it means a trend reversal.

In the case of similar data, it may fluctuate between the two with larger fluctuations, accompanied by roller coasters. In addition, considering the digestion of the data market and Trump's official inauguration next Monday (will there be a black swan during this period?), I think the focus in the next few days can be on rising and falling.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights