Forex Trend Analysis: Factors Revealing the Strength of USD/JPY

On Thursday (January 16th), global asset markets performed positively after the December core CPI data in the United States was slightly lower than expected. However, despite the slight easing of market concerns about inflation, the US dollar remains strong. In the latest market dynamics, the US Dollar Index (DXY) traded at 109.0770, slightly down 0.01%. As Trump's presidential inauguration ceremony approaches, market attention is gradually shifting towards the upcoming Treasury Secretary nomination hearing, which may have an impact on the trend of the US dollar.

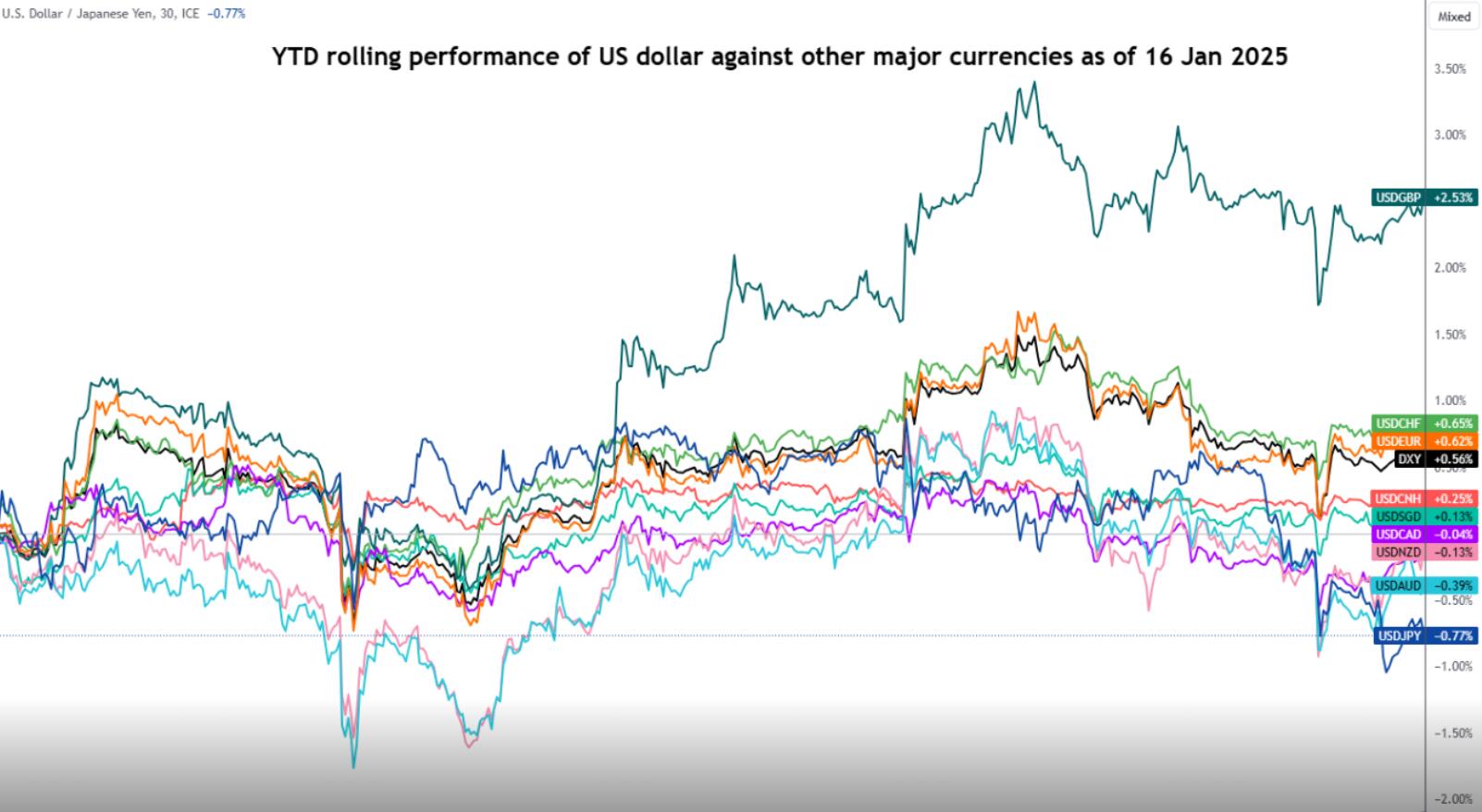

According to the year to date performance as of Thursday, January 16th, the US dollar/Japanese yen exchange rate has performed the weakest compared to other major developed country currencies, with the USD/JPY falling by 0.77% (see Figure 1).

(Figure 1: Year to date performance of the US dollar against major currencies as of January 16, 2025)

This week, in their speeches, Bank of Japan Governor Ueda and his deputy governor Ryozo Himi mentioned that there is a more positive outlook for Japanese companies to raise employee wages compared to December, which is encouraging. These positive comments about wage growth in Japan, coupled with the fact that the year-on-year growth rate of the US core CPI in December fell from 3.3% in November to 3.2%, slightly lower than the expected 3.3%, indicate the possibility of interest rate hikes at the next policy meeting of the Bank of Japan, which will end on Friday, January 24th, thereby weakening the upward momentum of the US dollar/yen.

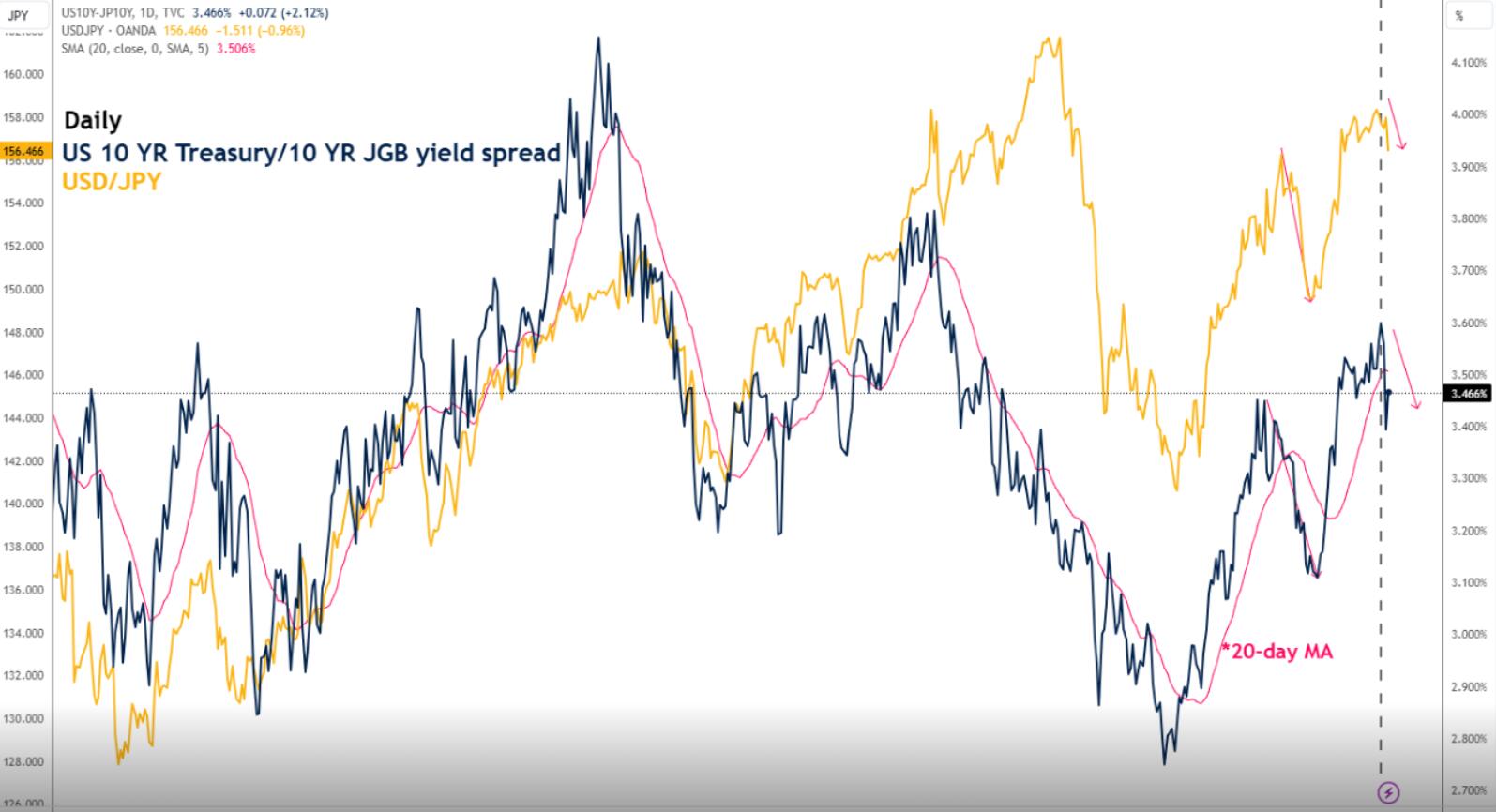

Long term yield premium of US treasury bond bonds narrowed compared with Japanese treasury bond bonds

(Figure 2: Trend of 10-year yield spread and USD/JPY of US treasury bond bonds/Japanese treasury bond as of January 16, 2025)

The yield spread between the 10-year treasury bond bonds of the United States and the 10-year Japanese treasury bond is directly related to the trend of the dollar/yen (see Figure 2). According to previous observations, the 10-year yield spread between US treasury bond bonds and Japanese treasury bond was ahead of the US dollar/yen. The yield spread declined slightly on November 5, 2024, and fell below its 20 day moving average after November 20. This bearish trend of the 10-year yield spread between US treasury bond bonds and Japanese treasury bond preceded the medium-term decline of 7% of the US dollar/yen from November 14 to December 2, 2024. At present, during the period from January 13 to 14, 2025, a similar bearish trend has been detected in the 10-year yield spread between US treasury bond bonds and Japanese treasury bond. The yield premium of US treasury bond bonds has dropped from 3.6% to 3.7%, and it has fallen below the 20 day moving average at the time of writing this article. Therefore, if the 10-year yield spread between US treasury bond bonds and Japanese treasury bond continues to decline slightly, the dollar/yen may face further downward pressure.

The bearish momentum is evident

(Figure 3: Mid term and Major Trend Stages of USD/JPY as of January 16, 2025)

Since January 8, 2025, the daily relative strength index (RSI) momentum indicator of USD/JPY has shown a recent bearish divergence in overbought areas and has just fallen below the 50 level at the time of writing this article. These observations indicate that the medium-term upward trend of the US dollar/Japanese yen, starting from its low of 139.58 on September 16, 2024, faces the risk of forming a potential multi week corrective downward sequence. Pay attention to the key mid-term pivot resistance level of 158.35/80. A drop below 152.90 (also the 200 day moving average) may trigger a corrective decline, exposing the next mid-term support levels of 149.30 and 144.80 (see Figure 3). On the other hand, breaking through 158.80 would render the bearish scenario ineffective, potentially triggering an uptrend and retesting the main resistance level of 160.30/161.70.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights