1.20 Analysis of Gold, Foreign Exchange, and Crude Oil

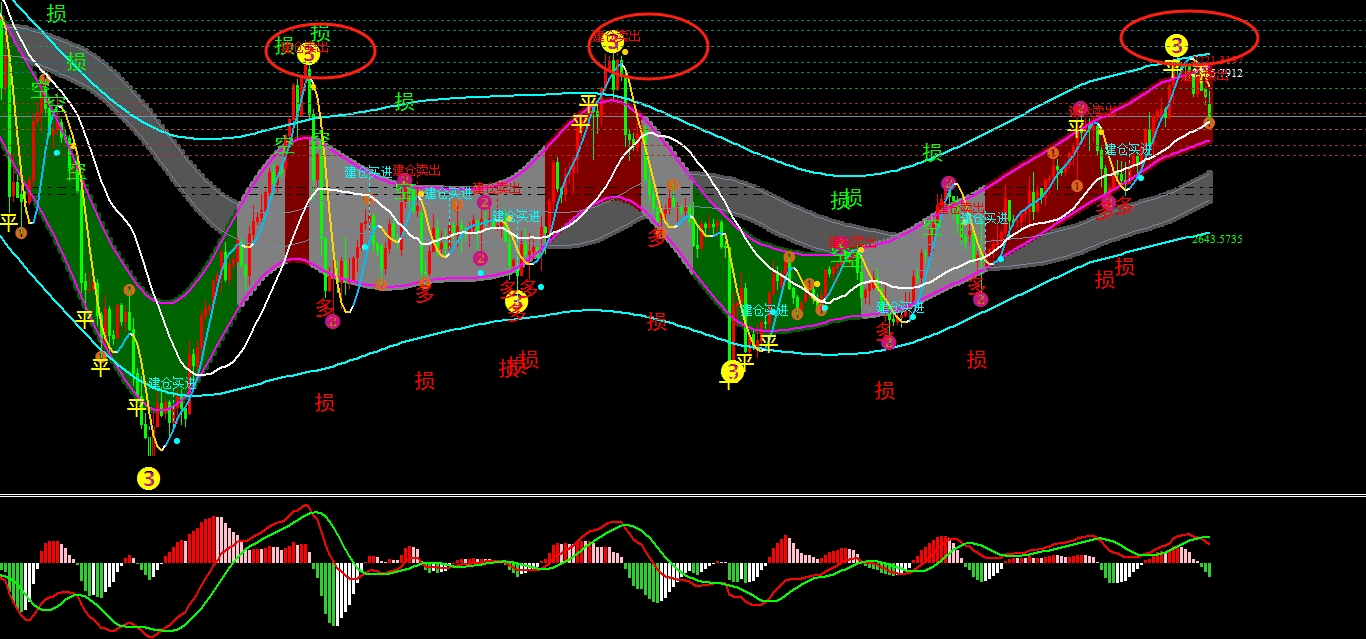

After fluctuating repeatedly last Friday, gold first retreated four hours in the US market and then suppressed the downward trend, finally emerging from a four hour level downward trend. However, for now, the morning market continues the downward trend directly, and the short-term expectation is to retreat to the four hour bottom line and weekly chart gap. The hourly chart is also arranged with empty heads. Therefore, for the current market situation, theoretically speaking, it is definitely a rebound short, but if the rebound does not change, it will fall. Today, there is no US market, so waiting for a rebound short can only be a slogan. Although the market continues to decline, it is not suitable to chase short. Therefore, my personal opinion is to wait until the four small declines approach the bottom line support, and cooperate with the weak and long hourly chart to buy. As for the short, it is still a statement, falling. If there is no rebound, even if the rebound is short, it is a short selling. Therefore, the conclusion drawn from the overall analysis is as follows:

In terms of operation, wait for the four small investors to approach the bottom line around 2680, and cooperate with the weak bullish signal on the hourly chart to enter. As for the short position, it can only be attempted after the European market rebounds.

GBP/JPY: Still weak, but the downside space is limited, waiting for a wave of bottom buying on the 187.5 front line.

Crude oil: sell high and buy low between 76.35-78.5.

The above ideas are for reference only. There are risks in the market, and investment needs to be cautious.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights