The US Composite Index is volatile, with pressure on the upper edge, and the EUR/USD is expected to maintain daily resistance

Under the joint mediation of Qatar, Egypt, and the United States, Israel and Hamas signed a ceasefire and hostage release agreement. On January 19th, the first phase was launched, with Hamas releasing 33 detainees, Israel releasing some prisoners and implementing a comprehensive ceasefire, Israeli troops withdrawing from densely populated areas in Gaza, and humanitarian aid being able to enter. There will be permanent ceasefire negotiations and the return and reconstruction of remains in the future. All parties have responded positively to this, but Trump and Biden are competing for credit. In terms of the US economy, data from last Wednesday showed that the overall December CPI met expectations, with a slowdown in core CPI growth. Several Federal Reserve officials have expressed their views on slowing inflation, while also mentioning their views on achieving the 2% target and interest rate cuts. The Trump economic team is discussing monthly increases in tariff rates, and Trump also stated that a "foreign tax service agency" will be established. At the hearing, US Treasury Secretary nominee Bessent expressed his views on tax cuts, debt, and sanctions against Russia. Looking ahead to the future, Trump's inauguration ceremony this week is a global market focus, and his policies may cause fluctuations in financial markets. Economic data is also being monitored, and attention should be paid to market closures and trading adjustments in multiple regions, as both regional and economic situations are full of variables.

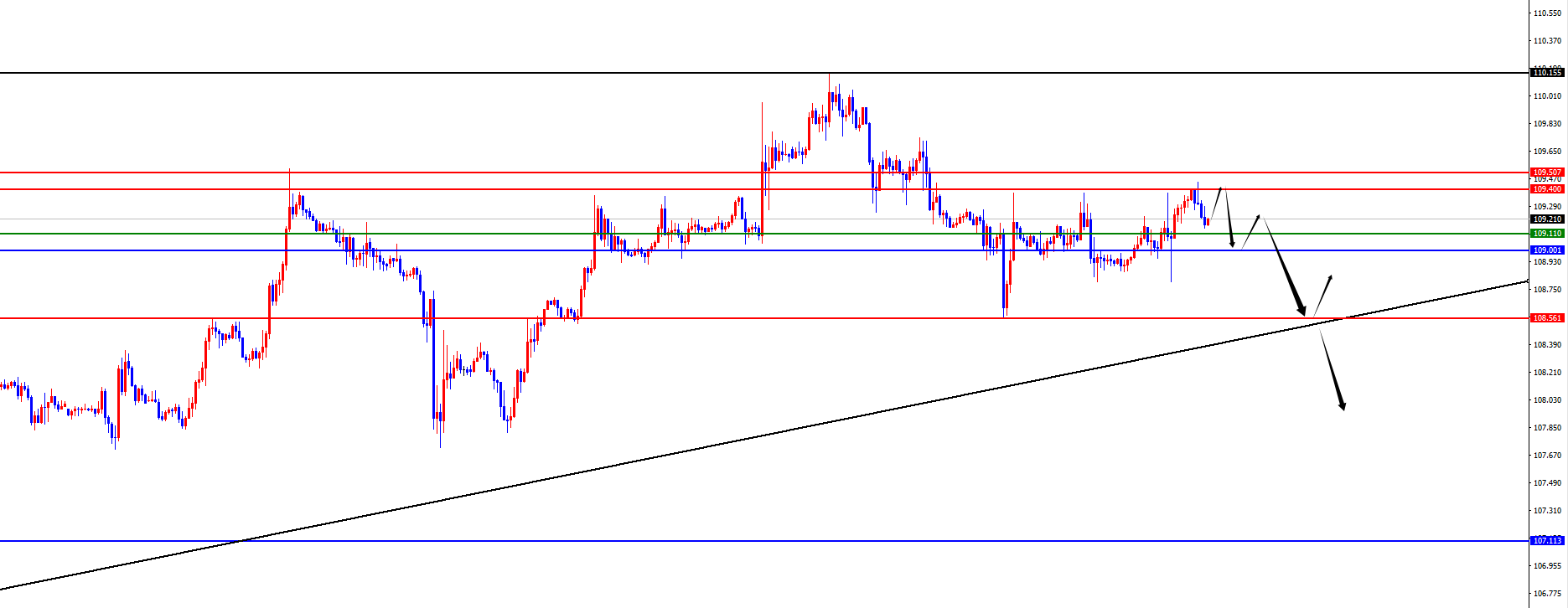

US dollar index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend last Friday. The highest price of the day rose to 109.396, the lowest was 108.802, and closed at 109.393. Looking back at the performance of the US dollar index prices last Friday, the price fluctuated briefly after opening in the morning and then rose again. After the US market opened, the price fluctuated significantly and finally closed at a high level, ending with a strong daily bullish trend. From the weekly chart, it appears that the week will end in a bearish trend, and there is hope for further pressure in the future. The 107.10 area below is the watershed between bullish and bearish on the central line, with daily support in the 109 area and 4-hour support in the 109.10 area. At the end of last week, the price continued to fluctuate and was suppressed in the 109.45 area, so we will continue to focus on the resistance in the 109.40-50 range in the short term, and then pay attention to the gains and losses of daily and 4-hour support. Once it breaks, we will continue to see pressure in the future.

Short selling in the 109.40-50 range of the US Composite Index, defending against $5, targeting 108.60-108.30

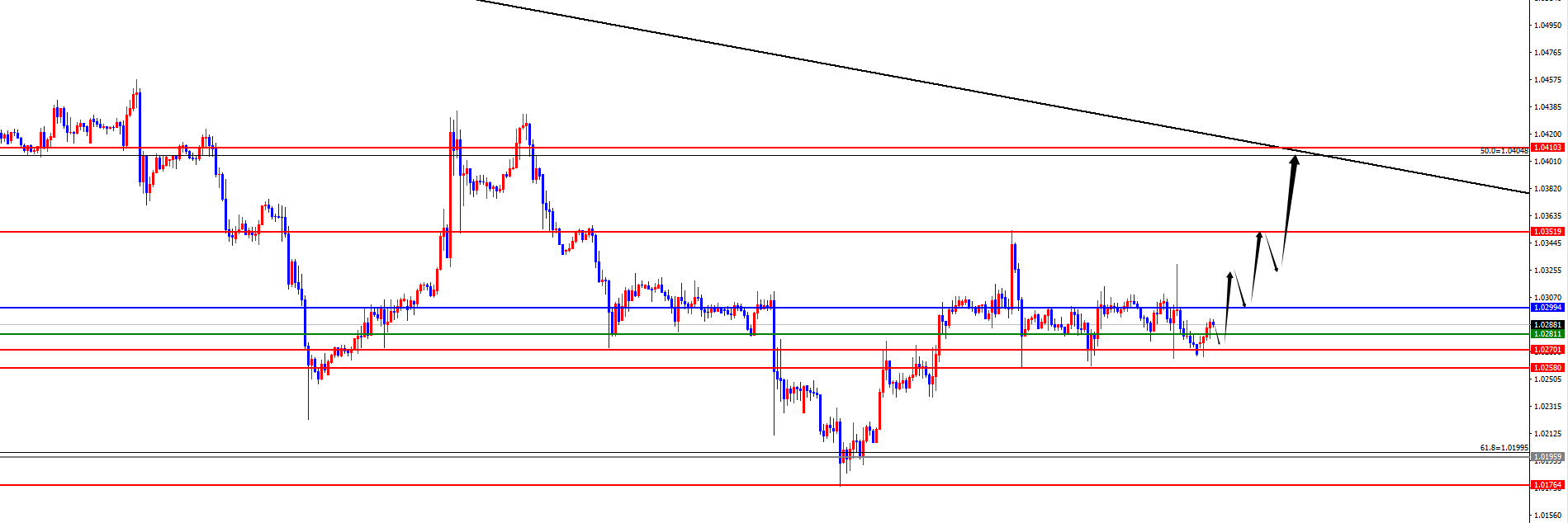

In terms of EUR/USD, the overall price of EURUSD showed a downward trend last Friday. The lowest price of the day fell to 1.0264, the highest rose to 1.0330, and closed at 1.0269. Looking back at the market performance last Friday, during the morning session, the price was temporarily suppressed at the daily resistance level, and then further fluctuated and came under pressure. After the US session, the price fluctuated sharply again, and ultimately closed with a bearish candlestick. From the weekly chart, the price closed positive last week, and the price was tested and stopped at a key support area last week. We will continue to monitor the price and continue to rise. At the same time, the daily price continues to suppress at the daily resistance level, and as time goes on, it is necessary to pay attention to further stabilizing at this 1.0300 resistance level. At the same time, we will temporarily focus on the 1.0280 area at the 4-hour level. In recent days, the price has continued to fluctuate above 1.0260, so we will pay close attention to this area stopping its upward trend and focusing on the daily resistance stabilizing performance. Once it stabilizes, we will start a wave of upward market trend.

Buy long in the EUR/USD 1.0270-80 range, defend 40 points, target 1.0300-1.0350-1.0400

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights