1.21 Analysis of Gold Crude Oil Trading

① The weakening of the US dollar index has provided some support for gold.

② The policy uncertainty of the Trump administration has increased the safe haven appeal of gold.

③ Federal Reserve Governor Waller hinted that if economic data further weakens, there may be more interest rate cuts. This expectation further supports the safe haven demand for gold.

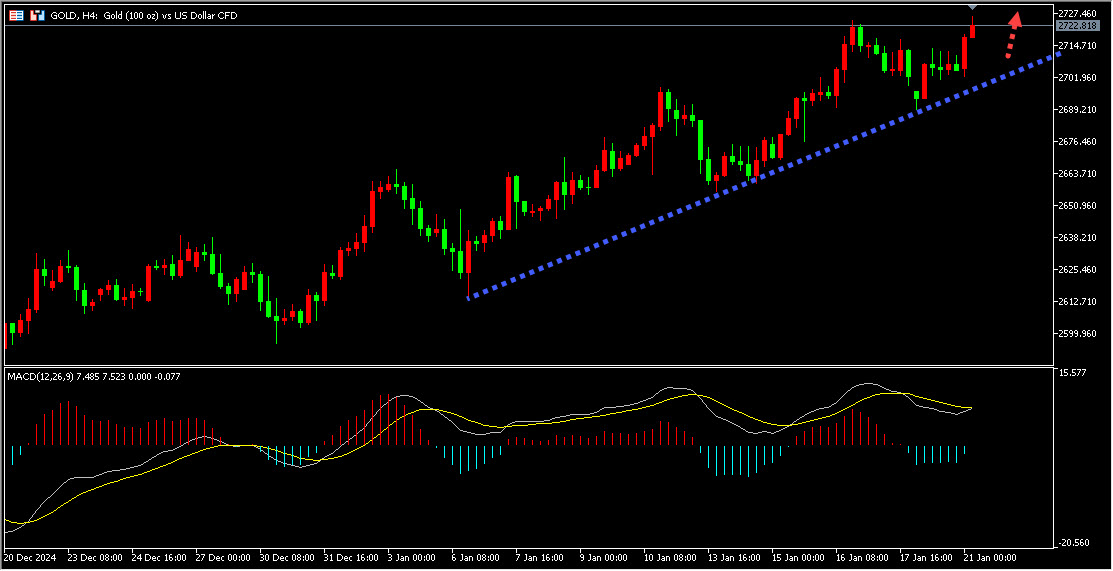

At present, the fundamentals of the gold market are mainly bullish on gold. Today, investors continue to pay attention to the support area of the 4-hour uptrend line below gold, and continue to buy long gold after the pullback stabilizes.

① The new round of sanctions imposed by the United States on Russia still raises concerns in the market about supply shortages

② Europe and North America are experiencing a peak in winter crude oil demand, which provides some support for crude oil.

③ The slowdown in US inflation data has strengthened market expectations for the Federal Reserve to cut interest rates. The loose monetary policy of this kind may stimulate economic activity, thereby driving the growth of crude oil demand and providing support for crude oil.

Overall, the crude oil market is currently affected by multiple factors, but there are still many bullish factors. Investors are paying attention to the support of the 4-hour uptrend line below today, and will participate in the long position of crude oil after the pullback stabilizes.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights