The US Index is facing daily resistance, while the EUR/USD Swordsman Index is facing weekly resistance

After Trump took office, tariff policies have attracted market attention. At first, specific tariff details were not announced, and the market was initially optimistic. But he hinted that a 25% tariff may be imposed on Canadian and Mexican goods on February 1st, causing a reversal in global stock market gains and providing safe haven support for gold prices. Canadian Prime Minister Trudeau stated that Canada is prepared to respond and Trump's actions are uncertain. In addition, Trump also stated that if Putin refuses to negotiate, he may impose sanctions on Russia; The government is studying the transportation of weapons to Ukraine and believes that the EU's support for Ukraine is insufficient; It also claimed to impose tariffs on the European Union, causing the euro to plummet in the short term. The market is greatly affected by Trump's tariff remarks and is currently waiting for next week's FOMC meeting and PCE price index, paying attention to the implications of the Federal Reserve's policies. Analysis suggests that Trump's policies may promote economic growth but stimulate inflation, and the Federal Reserve is expected to maintain interest rate stability this month. Overall, the market needs to pay attention to Trump's dynamics and related conference speeches, as his policies have a sustained and uncertain impact on global financial markets.

US dollar index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Tuesday. The highest price of the day rose to 108.772, the lowest was 107.837, and closed at 107.911. Looking back at the performance of the US dollar index on Tuesday, the price fluctuated briefly after the morning opening and then corrected upwards again. Due to the sustained intraday volatility, the price continued to be suppressed at the four hour resistance level, and the US dollar index is currently in a bearish band, so overall it is still under pressure. At present, the weekly support is in the 107 area, which is the key to the medium-term trend. We will focus on the gains and losses of this position in the future. The daily resistance level is in the 108.80 area, and the price is expected to decline below this level. At the same time, the short-term 4-hour resistance is in the 108.50 area, so we will continue to pay attention to the pressure and focus on the 107.70-107 area below.

Short selling in the 108.90-109 range of the US Composite Index, defending against $5, with a target of 107.70-107.10

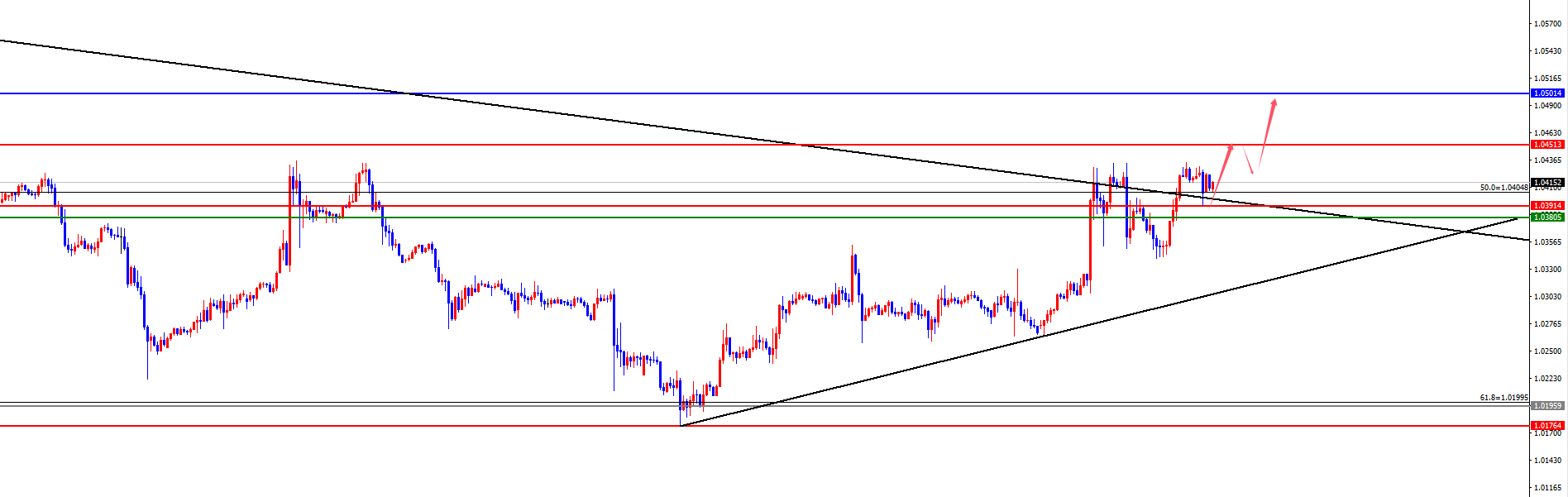

In terms of EUR/USD, the overall price of EURUSD showed an upward trend on Tuesday. The lowest price of the day fell to 1.0341, the highest rose to 1.0434, and closed at 1.0425. Looking back at the performance of the European and American markets on Tuesday, after short-term fluctuations during the morning session, prices have once again corrected. First of all, we emphasize that prices have already reached the key resistance level of the daily line, and we will treat the overall wave band more accordingly in the future. Yesterday, it was suggested to pay attention to the 1.0330-40 range to see if it stopped rising. Looking back, the market just hit this area and stopped rising. The final closing still ended in a strong bullish state. At present, if the price is above the daily support level of 1.0320, it can be treated as a bullish band. For the next four hours, we will temporarily focus on the support range of 1.0380-90 to see an increase, and temporarily focus on the 1.0450-1.0500 area above. Focus on the gains and losses of the weekly 1.0500 position in the future.

Buy more in the range of 1.0380-90 in Europe and America, defend 40 points, target 1.0450-1.0500

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights