Gold hits bottom and rises sharply, welcoming non farm payroll data!

Gold does not rebound at its peak; Rebound, not top!

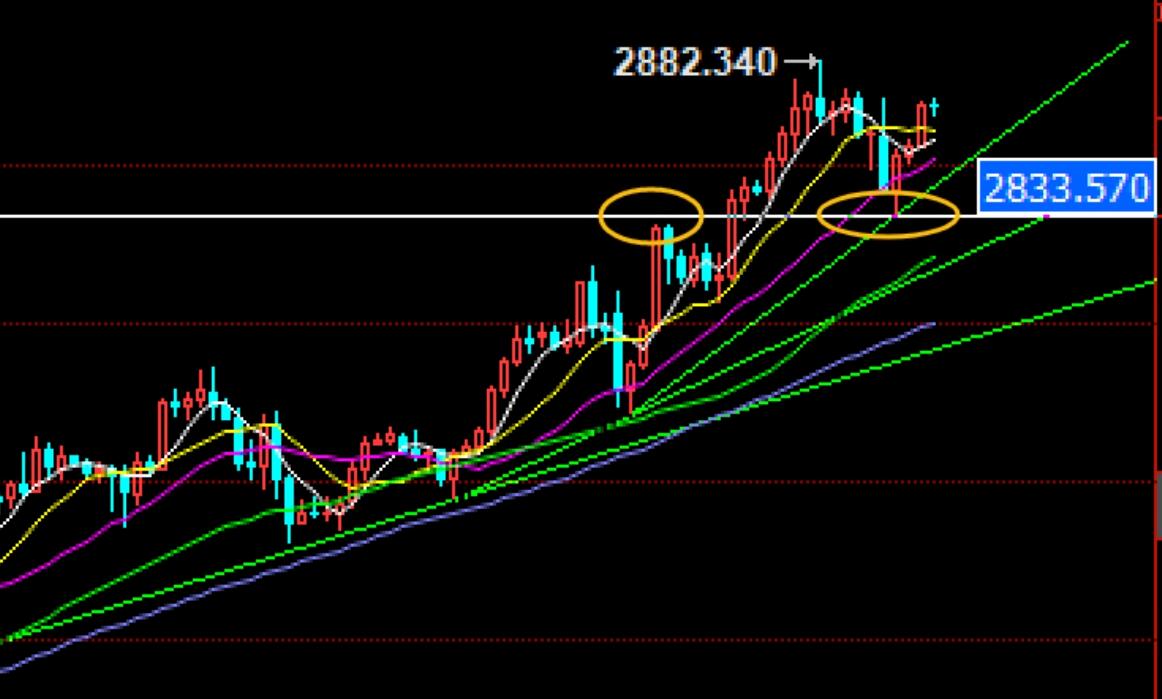

Yesterday, there was a major sweep of gold, with the Asian and European stock markets hitting the 2848 area and rebounding. The US stock market was blocked at 2870 and experienced a sharp drop, with the lowest breaking through the 2840 to 2834 range before stabilizing and rebounding rapidly. In the second half of the US stock market, there was a slow bull rebound, and the daily lower shadow closed with a small bearish candlestick!

Today, there are two major news in the gold market: the release of non farm payroll data in the United States and the announcement of gold holdings by the People's Bank of China!

From the perspective of daily operations, currently 2882 does not have the conditions to reach its peak; Is it a top or a rebound? A rebound is not a top! Yesterday, gold briefly fell below 2840 and was eventually supported by the 2830 area, which saw an upward trend. 2830, as Monday's high, was also the breakthrough point for Tuesday's bulls. Yesterday, it completed a retracement and is likely to move towards a new high of 2882 or even break through; The 2830-35 area below is the key to bullish positions in the future, while breaking the level will lead to a comprehensive bearish trend towards 2800-10 and below. The market will fluctuate before breaking down!

Today there are non farm payroll data and the central bank's gold holdings report, with a pre employment value of 256000 and an expected value of 170000. Based on recent data from the United States, there is a high probability of falling between the expected and pre employment values, so the negative impact on gold is not significant. Only when it is above 256000 is it a significant negative, while below 170000 is a significant positive for gold. The unemployment rate is unlikely to change significantly, with little impact, mainly on the number of new jobs created. It is expected that the gold market will mainly fluctuate before today's news. Pay attention to the pressure in the area of 2773-70, the high point of yesterday, and the vicinity of 2877 and the new high of 2882, supporting short-term 2855 and 2848. Focus on the 2835 area!

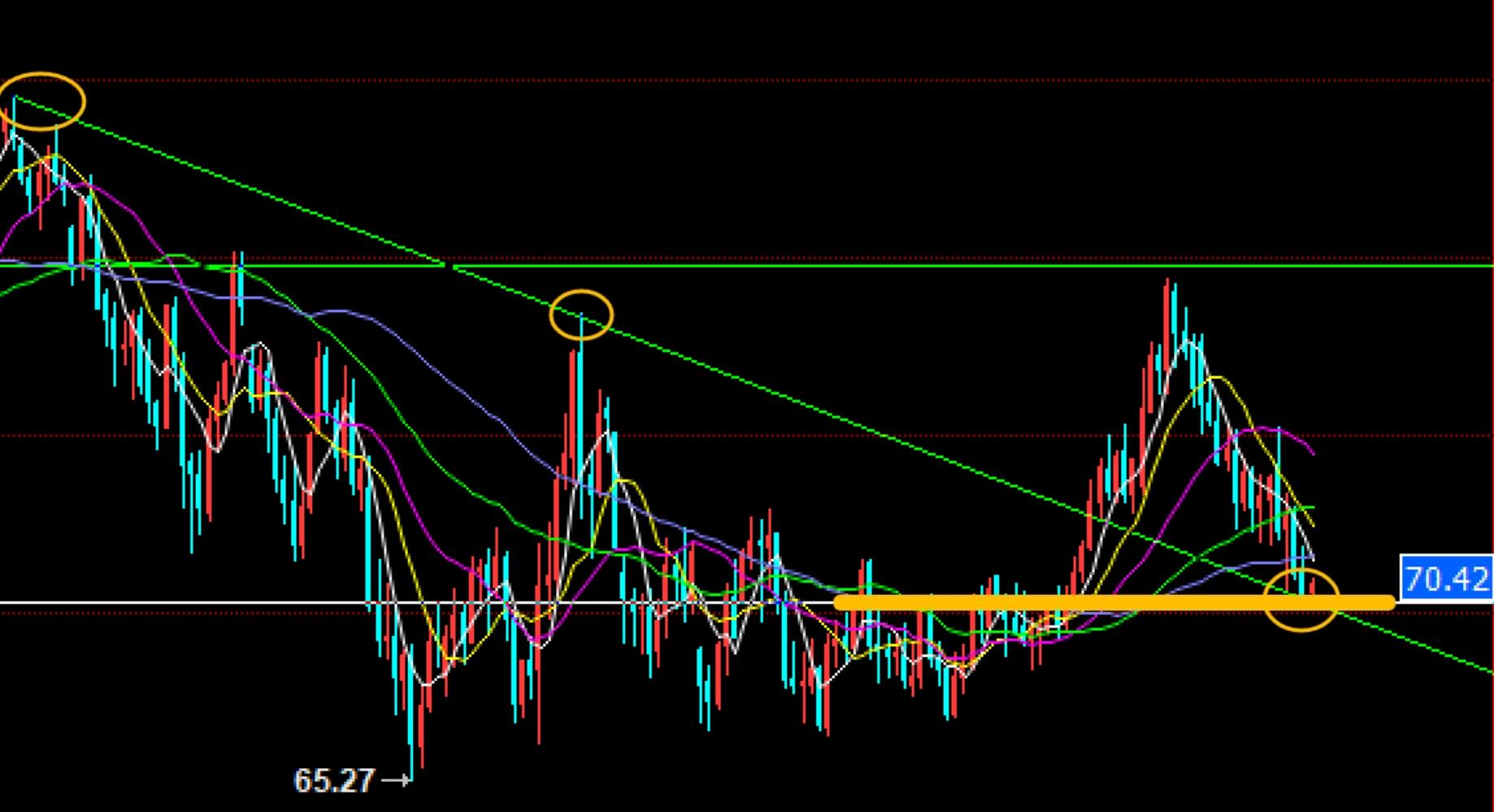

Gold fell on Wednesday at 2882 and after yesterday's sweep, it is difficult for bulls to continue to make significant upward moves; So today, the overall trend is to rise and fall, with the key pressure in the 2882 area of this week's high point. As we are still in a period of change since the 2580 rise today, the suppression in the 2882 region cannot be ignored. If there is an unexpected breakthrough, we should focus on the 2895 and 2910 regions rising and falling back! In terms of operation, observe the white market or refer to pressure and support to sell high and buy low; Non farm farming is mainly focused on high-altitude areas, with a target of backtesting the 2840-30 area and paying attention to the situation of downgrading!

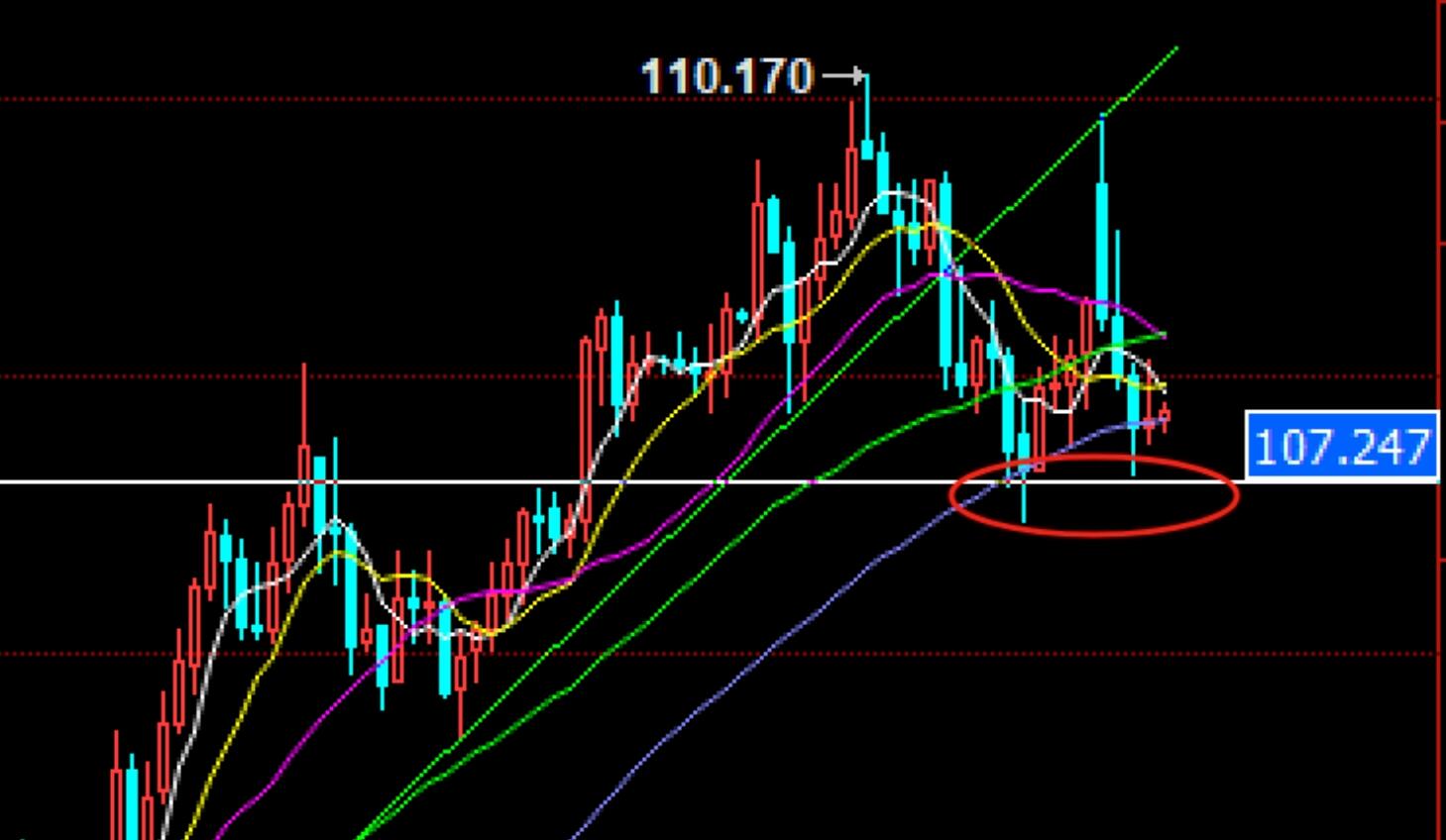

Spot silver has recently broken through the $30 mark and is now in the 31.8 zone, reaching the weekly high of 32.4 in December last year. Please pay attention to the breakout situation. Breaking through, bulls continue to be bullish at 33, or 33.7, and last year's high at 34.5-35; If unable to break through, continue to fall back and test the 31 and 30 levels; In the direction, just follow the gold!

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights