Trump intends to impose additional tariffs, will gold prices continue to rise after six consecutive bullish days on the weekly chart

On Monday (February 10th) morning trading in the Asian market, spot gold opened low and rose. At one point, it fell to around $2854.72 per ounce due to the rise of the US dollar, but quickly recovered its decline. Currently, it is trading near $2868.25 per ounce, with an increase of about 0.22%; Trump had previously stated that he would announce a 25% tariff on all steel and aluminum entering the United States on Monday, putting temporary pressure on gold prices as the safe haven dollar opened higher. However, gold prices were soon supported by safe haven buying.

Gold prices rose 0.2% last Friday, hitting a record high of $2886.65 during trading. They rose 2.19% weekly to close at $2861.81 per ounce, achieving their sixth consecutive week of gains as the escalating trade tensions between China and the United States prompted investors to buy safe haven assets.

The core focus of the gold market remains the uncertainty surrounding Trump's tariff policies, "said David Meger, head of metal trading at High Ridge Futures

US President Trump launched a trade war last week, fulfilling his threat to impose tariffs on Chinese goods, despite giving Mexico and Canada a one month tariff deferral.

During periods of political and financial uncertainty, gold is often used as a safe haven investment.

Peter Grant, vice president and senior metal strategist of Zaner Metals, said that the continuous growth of the People's Bank of China's gold holdings and China's new plan to allow insurance funds to invest in gold also seemed to have boosted the gold market.

However, the rebound in US dollar and US Treasury yields has raised concerns among gold bulls. The strong employment data correction and decline in unemployment rate are considered to reflect the robustness of the labor market, although overall job growth is lower than economists' expectations. The yield on the 10-year US treasury bond bond rose 5.1 basis points to 4.489% on Friday. The US dollar index closed up 0.37% last Friday, closing at 108.10.

At the same time, a report from the US Department of Labor shows that the US economy added 143000 new jobs in January, while economists expected 170000, and the unemployment rate was 4%, with an expected 4.1%. This may give the Federal Reserve reason to pause interest rate cuts at least until June.

According to a survey conducted by the University of Michigan, the US consumer confidence index unexpectedly fell to a seven month low in February, and concerns about rising prices caused by tariffs have pushed consumer inflation expectations to a year high of over a year.

The US Bureau of Labor Statistics stated that in the 12 months ending March, the US economy created 598000 fewer jobs than previously estimated.

Three Federal Reserve decision-makers stated last Friday that the US job market is robust and pointed out the uncertainty of how Trump's policies will affect economic growth and still high inflation, highlighting the rationality of their approach of not rushing to cut interest rates.

Short term interest rate futures traders now expect the Federal Reserve to only cut interest rates once this year. Traders believe that the likelihood of a rate cut in June has dropped from around 63% before these data were released to just over 50%.

In the short term, investors still need to closely monitor the impact of Trump's tariff policies, which may continue to provide upward momentum for gold prices.

On Sunday local time (Monday, early morning of February 10th Beijing time), Trump said, "We will announce a 25% tariff on all steel and aluminum entering the United States on Monday. We will announce equivalent tariffs on Tuesday or Wednesday, which will take effect almost immediately.

Trump did not specify which countries would be affected, but hinted that this would be a broad measure that could help address the US budget issue.

I will announce a reciprocal trade policy next week so that we are treated equally with other countries, "Trump said last Friday. We don't want more, nor do we want less

This move will fulfill Trump's campaign promise to impose tariffs on US imports at the same rate as trading partners impose on US exports.

Trump announced this news during his meeting with visiting Japanese Prime Minister Shigeru Ishiba. He said that car tariffs are still under consideration, despite reports that the White House is weighing possible exemptions.

Three sources familiar with the plan said that Trump revealed his plan to Republican lawmakers during budget discussions at the White House last Thursday. Trump and senior aides have said that they plan to use higher tariffs on foreign imports to help pay for the extension of Trump's tax reduction policy in 2017. Independent budget analysts said that this tax reduction policy may increase the US debt by trillions of dollars. Raising tariffs can offset some of the costs, although in recent years tariffs have only accounted for about 2% of annual revenue.

In addition, this week we will receive testimony from Federal Reserve Chairman Powell in Congress, which investors need to pay close attention to. In addition, we need to focus on the January CPI data and monthly retail sales rate (commonly known as "terror data") in the United States. This trading day focuses on the January inflation expectations of the New York Fed in the United States.

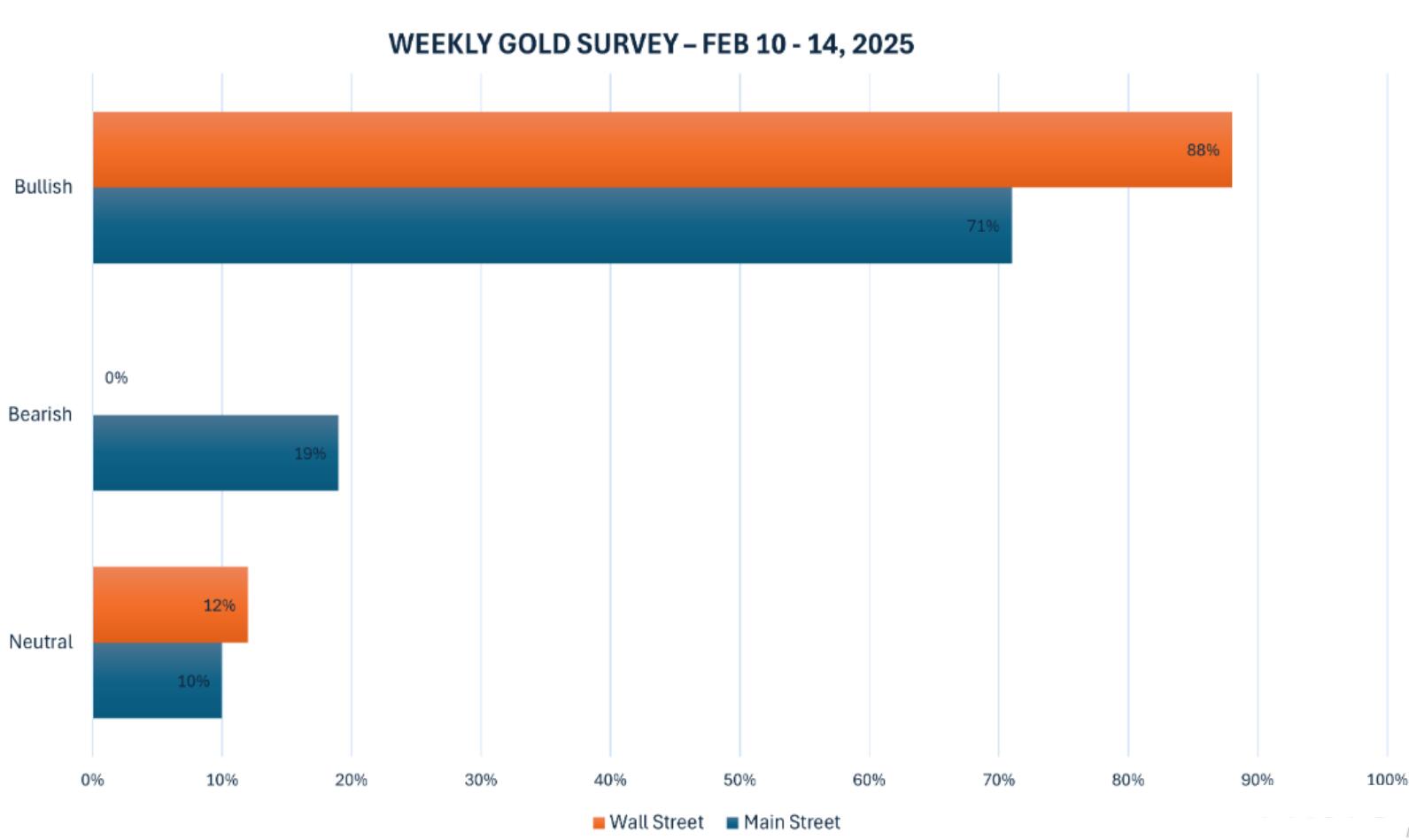

The survey shows that most analysts and retail investors tend to be bullish on the next week's trend of gold.

Last week, 17 analysts participated in Kitco News' gold survey, and all the interviewed analysts saw gold prices rising or fluctuating, while the bearish camp did not. 15 experts (or 88%) expect to see gold prices reach a new record high in the coming week, while two analysts (or 12%) expect gold prices to fluctuate and adjust in the coming week. No one predicts a decline in the price of precious metals.

At the same time, 170 votes were cast in Kitco's online poll, and retail investors are also very optimistic, although not to the same extent as analysts' bullish sentiment. 120 retail investors (or 71%) expect gold prices to rise in the coming week, while another 33 or 19% of retail investors expect gold prices to fall, and the remaining 17 (or 10%) expect gold prices to fall in the short term.

Higher, "said Rich Checkan, President and Chief Operating Officer of Asset Strategy International. The trend is your friend, and last week I clearly underestimated that. The volatility and liquidity in the first few weeks of the new US government were definitely driving investors to take safe haven positions in gold. That should continue

Darin Newsom, Senior Market Analyst at Barchart, said, "Rising." "We can throw out all the analysis we think we know, meaning fundamental, technical, seasonal, etc., and focus on the more unstable world today. Almost every day, the US government says and shares absurd and potentially dangerous ideas, and investors may continue to buy precious metals as a safety barrier against other market sectors. I don't think it's important whether gold is already at a historical high. I also don't see this situation changing soon

Daily chart of spot gold

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights