Forex Trading Analysis: US Index Looking Upward, EUR/USD Short term 4-hour Resistance Suppresses

Recently, the United States has been taking frequent actions in the fields of trade and economy, attracting much attention. In terms of trade, Trump launched a trade war last week, imposing tariffs on Chinese goods and giving Mexico and Canada a one month tariff suspension. On February 9th, it was announced that a 25% tariff would be imposed on imported steel and aluminum on February 10th, with subsequent announcements of equivalent tariffs. It was also mentioned that the implementation of equivalent trade policies and automobile tariffs are still under consideration. It attempts to raise tariffs to pay for the extension of the 2017 tax reduction policy. In terms of economic data, the United States added 143000 fewer jobs in January than expected, with an unemployment rate of 4% lower than expected. The job market is mixed, and the number of jobs created in the past 12 months is lower than estimated. The yield of 10-year treasury bond rose. Financial markets and public expectations have been affected, with gold investment limited by the rebound in US dollar and Treasury yields, consumer confidence index falling to a seven month low, and inflation expectations rising. Federal Reserve decision-makers believe that the job market is stable and are not in a hurry to cut interest rates. Traders expect only one rate cut this year, and the possibility of a rate cut in June is reduced. Investors need to pay attention to data such as Powell's testimony, January CPI, and monthly retail sales rate this week.

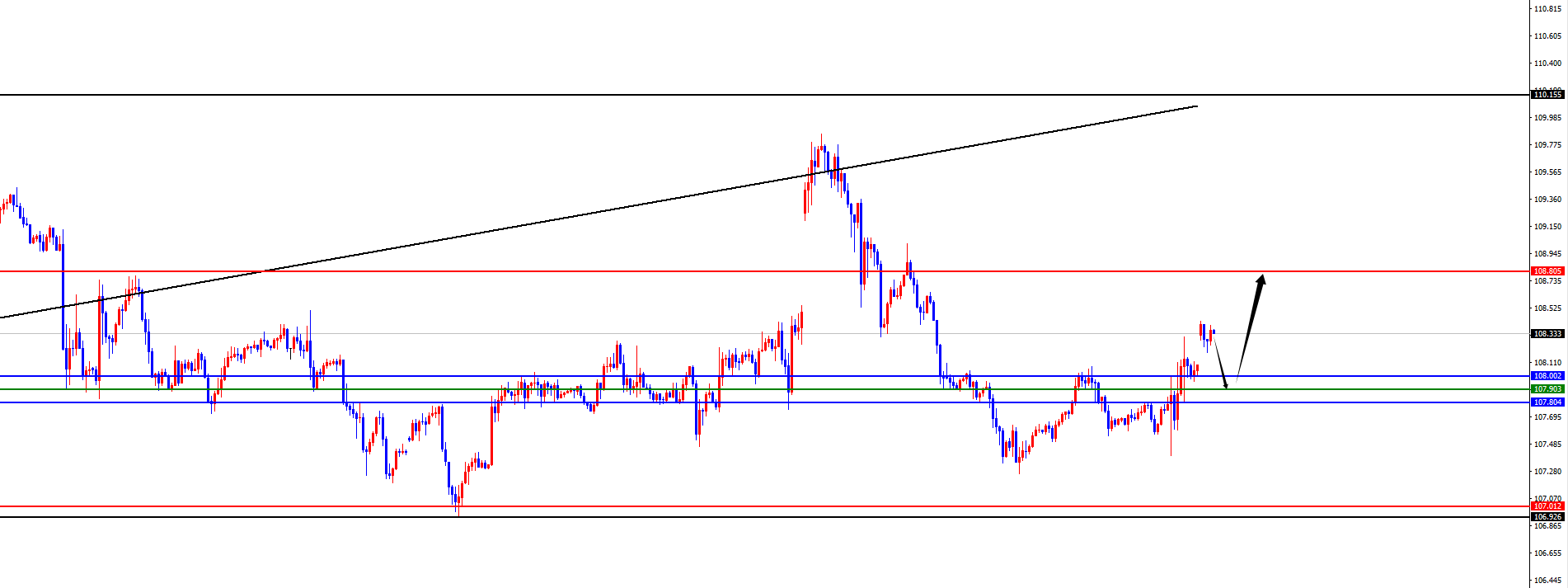

US dollar index

In terms of the US dollar index, the overall price of the US dollar index showed a volatile state as scheduled last Friday. The highest price of the day rose to 108.308, the lowest was 107.4, and closed at 108.093. Looking back at the performance of the US dollar index last Friday, the price fluctuated in the short term after the morning opening, but the price did not break below the previous day's low point. At the same time, after the release of non farm payroll data, the US dollar index bottomed out and rebounded, then continued to rise overnight and finally closed with a strong bullish trend. At present, the weekly support is at the 107.80 area support, the daily support is at the 108 area support, and the short-term 4-hour support is at the 107.90 area support. Before breaking through the weekly support, temporarily focus on the rebound, and the short-term support above is at the 108.80 area.

Buy long in the 107.90-108 range of the US Composite Index, defend 40 points, target 108.80

Last Friday, the EUR/USD price showed an overall downward trend. The lowest price of the day fell to 1.0305, the highest rose to 1.0411, and closed at 1.0325. Looking back at last Friday's market performance, European and American prices fluctuated in the short term after the early opening of the market. Subsequently, prices tested upward for four hours and fell again under pressure in the daily resistance zone. Prices continued to be weak until the close. At present, the price on the weekly chart is expected to end in a strong bullish trend. From a position perspective, the weekly resistance is in the 1.0410 area, the daily resistance is in the 1.0390 area, and the short-term 4-hour resistance is in the 1.0350-60 range. Therefore, in the short term, we will wait until the price test reaches the 4-hour resistance line to see pressure, and pay attention to the 1.0280-1.0240 area below.

Short selling in the 1.0350-60 range of EUR/USD, defending 40 points, targeting 1.0280-1.0240

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights