The correction of the US index is weak, and the EUR/USD breaks through after monitoring the volatility

Federal Reserve Chairman Powell testified before the Senate Finance Committee that due to the overall strength of the US economy and inflation rates above the 2% target, the Fed is not in a hurry to cut interest rates. Currently, the economic situation is good and the policy rate is appropriate. If inflation does not continue to decline and the economy is stable, the Fed may maintain its current policy restrictions; If the labor market weakens or inflation resistance progresses beyond expectations, interest rate cuts may occur. Previously, Powell avoided issues such as tariffs during Trump's first congressional hearing after his inauguration. Investors still expect the Federal Reserve to cut interest rates later this year, but it may only cut rates once by 25 basis points. Trump's decision to raise tariffs on imported steel and aluminum to 25% without exception has sparked widespread attention and controversy, with Mexico, Canada, and the European Union condemning it. Traders are paying attention to Wednesday's US inflation data, and the market expects January CPI to rise 2.9% year-on-year, with core CPI rising 3.1% year-on-year. Investors also need to pay attention to Bostic's speech and the video conference of EU trade ministers.

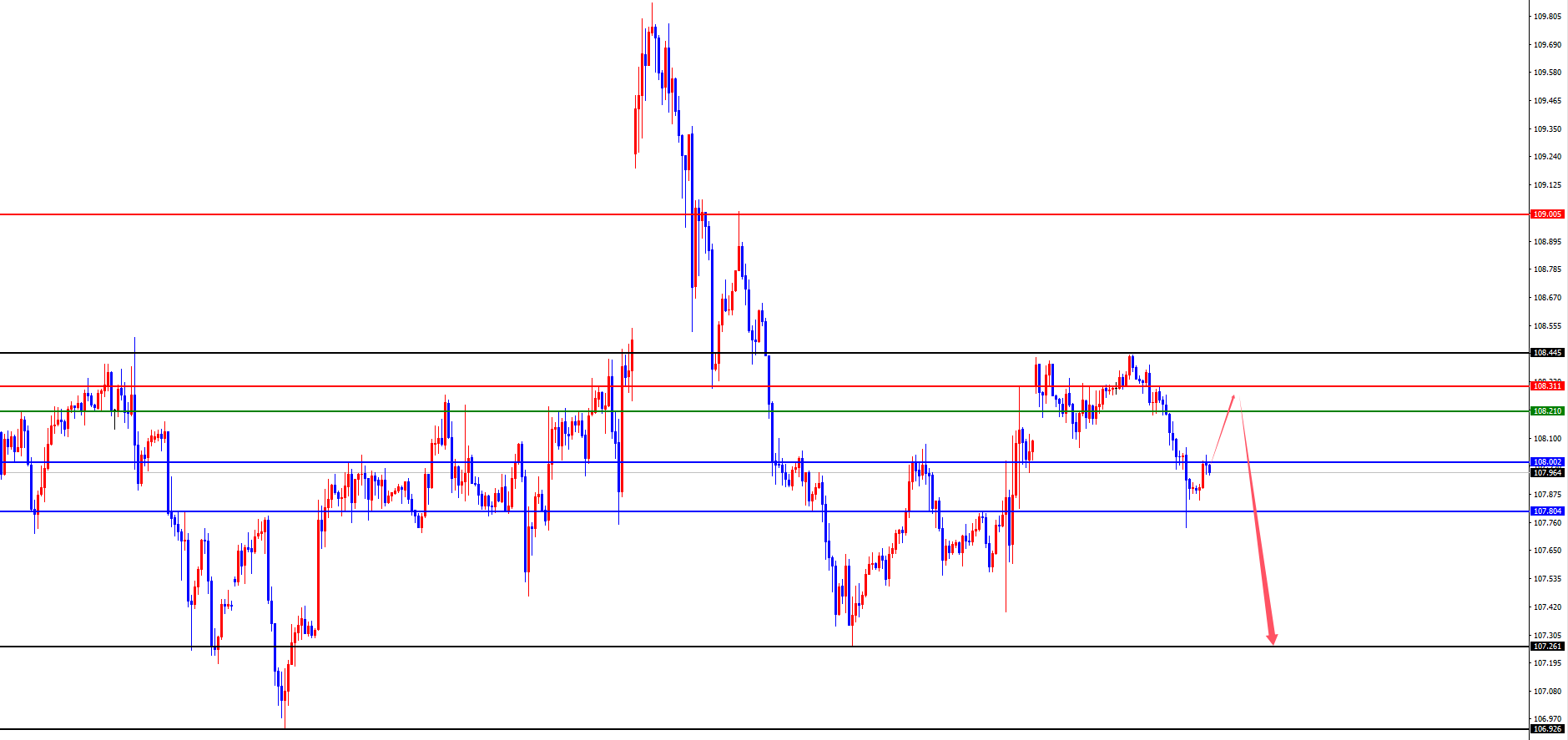

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Tuesday. The highest price of the day rose to 108.438, the lowest was 107.74, and closed at 107.904. Looking back at the performance of the US dollar index on Tuesday, after the morning opening, the price rose in the short term, and then fell under pressure. The European and US markets continued to decline, and the daily chart ended in a big bearish trend. At present, the overall outlook for the US Composite Index is fluctuating within the range of 107.25-108.45. From a weekly perspective, the 107.75 position below is a critical watershed. At the daily level, we will temporarily focus on the 107.90 area, while at the 4-hour level, we will temporarily focus on the resistance in the 108.20-30 range. In the short term, we will focus on the pressure after the volatility, and it will continue to persist after breaking through the weekly support.

Short selling in the 108.20-30 range of the US Composite Index, defending against $5, targeting 108.60-109

In terms of EUR/USD, the overall price of EUR/USD showed an upward trend on Tuesday. The lowest price of the day fell to 1.0291, the highest rose to 1.0381, and closed at 1.0360. Looking back at the performance of the European and American markets on Tuesday, after the morning opening, the price initially fell under pressure in the short term, and then gained support again to rise. After the European session, the price continued to consolidate around the four hour resistance, and after the US session, it exerted strength again, finally ending with a strong daily bullish trend. At present, the weekly resistance is in the 1.0420 area, which is a key watershed for the midline trend. At the same time, the daily resistance level is temporarily focused on the 1.0390 area. From a 4-hour perspective, we are currently focusing on the support range of 1.0330-40. Due to the overall low volatility and bottoming out performance of the market, the price did not explore further downward support yesterday but directly rose. Therefore, we will pay attention to further upward movements in the future.

Buy long in the EUR/USD 1.0330-40 range, defend 40 points, target 1.0390-1.0420;

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights