2.13 Gold bottoms out and rebounds, returning to the volatile zone, with high selling and low buying during the day

Yesterday's review:

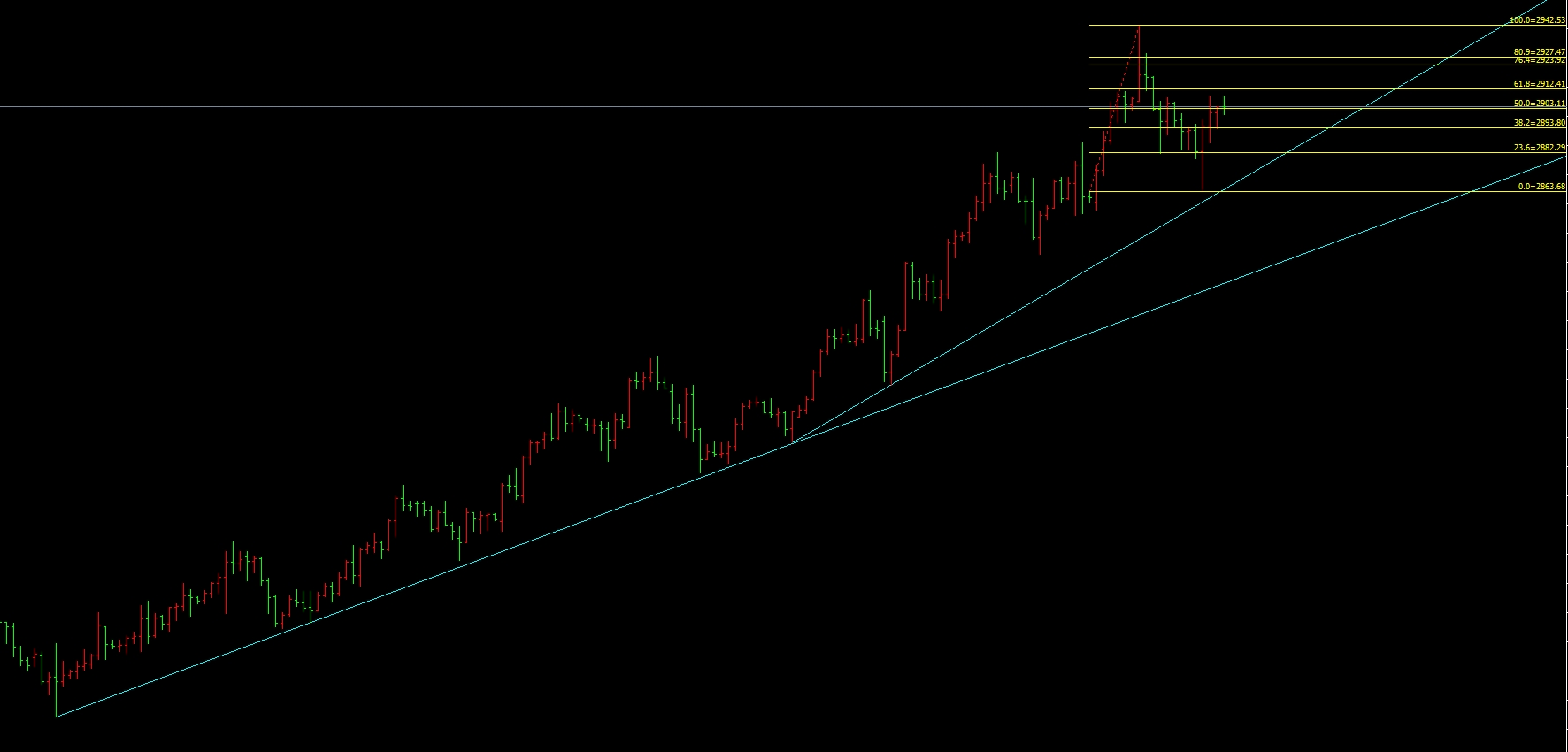

The price of gold showed a trend of bottoming out and rebounding, hitting a low of 2863, then rebounding to 2909, and finally closing at a bullish line with a longer lower shadow.

From the overall trend, the price rebounded after falling from 2942 to 2863. Although it briefly broke through during the session, the four hour chart showed a rapid recovery after the break, and the price returned to the trend line, indicating that the short-term trend may return to an upward trend.

However, from the perspective of K-line combinations, there will be a hanging line that rises and falls on Tuesday, and a long cross that rises and falls on Wednesday, forming a mixed line pattern. This means that if the price cannot break through the previous high or low points on Thursday, it will return to the oscillation range.

Today's analysis:

It is expected that the gold price will maintain a volatile trend today.

Despite the release of non farm employment data and CPI data, it is expected that there will be no unilateral surge or plunge in the market, and the possibility of breaking through the previous high or low points is low.

After yesterday's sharp decline, the market generally expects a rebound and short selling, but currently it looks like there are no real gains.

Therefore, grasping the current market situation is key, and there is no need to overly focus on long-term predictions of whether it will rise to 5000 or fall to 1000 in the future, just like last night's bearish drop of 93 on 07-09. In reality, it is enough to grasp one wave in a day and make more mistakes, so we should focus on the current range fluctuations.

Technical analysis:

Support position:

Resonance support level for one hour and four hour charts: 2876

Tuesday low: 2882

Long Short Balance Point: 2892 (Last night's rebound high point 2909, the low point after falling back)

Resistance level:

One hour and four hour resonance suppression position: 2928

Inter community resistance level: 2924

Operation suggestion:

Left side trading: Operate based on pressure support

It is recommended to conduct high selling and low buying operations within the range of 2928-2876 for the day.

Inter community operation range: 2882-2924.

Short stop loss level: 2932.

Long stop loss level: 2874.

Right side trading: Enter based on the hourly chart and the four hour right side signal.

Other point operations are recommended to be adjusted flexibly according to the intraday trend.

Risk Warning:

The market fluctuates greatly, it is recommended to control positions and strictly cut losses.

The above analysis is for reference only and does not constitute investment advice.

Summary:

It is expected that the gold price will maintain a volatile trend today, and it is recommended to carry out high selling and low buying operations within the range of 2928-2876.

Pay attention to key support and resistance levels, and strictly control risks.

Flexibly adjust operational strategies based on intraday trends.

The above ideas are for reference only. There are risks in the market, and investment needs to be cautious.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights