The Bank of Canada cut interest rates "one step ahead", and the US bond market fluctuated violently. Will the Federal Reserve act ahead of schedule next week?

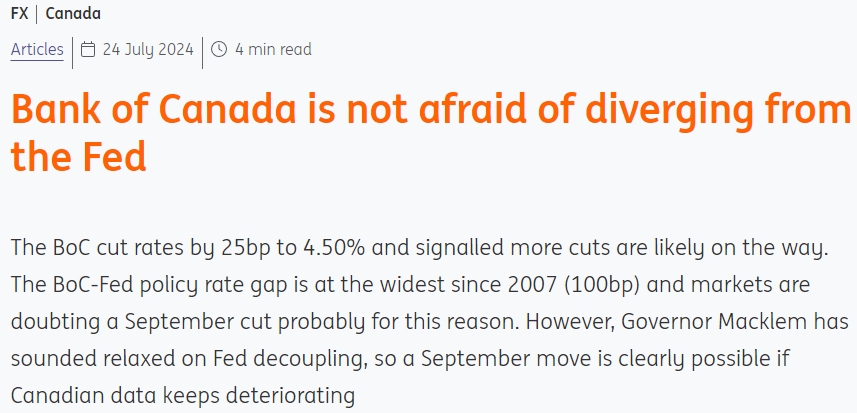

The Bank of Canada has lowered interest rates by 25 basis points to 4.50% and hinted at the possibility of further cuts, becoming the first economy in the G7 to lower rates, resulting in the largest gap between its policy rates and those of the Federal Reserve since 2007. ING expects the Federal Reserve to cut interest rates in September, but the sharp fluctuations in the US bond market prove that the pricing of the Federal Reserve's interest rate cut next week is deepening, and doves may come ahead of schedule in July.

After the Bank of Canada cut interest rates, Governor Tiff Macklem's accompanying statement and press conference opening speech further boosted dovish pricing. He emphasized the downside risk of the economy even more: "We need economic growth to rebound so that inflation does not fall too much, even if we strive to lower the inflation rate to our target of 2%

(Source: ING)

ING believes that this is a fairly moderate viewpoint. At the same time, the statement also contains some cautious remarks about deflation, and the method of successive meetings and relying on data remains the basis for further policy decisions. Canada's new quarterly forecast has been released, which includes a target of overall and core inflation rates reaching 2.0% by the end of next year. The Gross Domestic Product (GDP) will decrease from 1.5% to 1.2% in 2024 and from 2.2% to 2.1% in 2025.

Some analysts say that one concern currently calling for keeping interest rates unchanged is the widening interest rate gap between the Bank of Canada and the Federal Reserve, currently at -100 basis points. This is the largest negative gap since 2007, and if the Bank of Canada cuts interest rates again before the Federal Reserve, the gap will be the largest in 25 years. But is this really the concern of the Bank of Canada?

(Source: ING)

McClelland stated that he does not believe the policy divergence of the Federal Reserve will become a serious issue. This is understandable because Canada's deflation process is more advanced than the United States, and the job market is also more relaxed. Canada's unemployment rate is 6.4%, which is 2.3% higher than the United States.

In terms of foreign exchange, some people are concerned that due to the divergent positions of the Bank of Canada and the Federal Reserve, the USD/CAD may experience excessive depreciation. But ING emphasized, "We must note that the latest statement and monetary policy report from the Bank of Canada did not mention inflation risks related to foreign exchange. By the way, since mid July and the Bank of Canada's interest rate cut, the US dollar/Canadian dollar has only risen by 1.2%, while the gains of other G10 currency pairs are much larger. We believe that as long as the US dollar/Canadian dollar remains at 1.40, currently below 1.38, or even higher, there will be no discussion about excessive currency depreciation

Despite the current dovish stance of the meeting, the market's expectation for the September 4th meeting is only -15 basis points, possibly due to the Bank of Canada meeting being two weeks earlier than the Federal Reserve meeting. After the interest rate cut, the year-end expectation has been hovering around -45 basis points.

ING mentioned, "Our latest forecast from the Bank of Canada is in line with market expectations. The Bank of Canada suspended interest rate hikes in September, followed by consecutive 25 basis point cuts in October and December. However, McLham's loose remarks about the Fed decoupling today mean that the possibility of a rate cut in September is higher. This largely depends on whether Canada's inflation continues to decline, and if there are signs of further deterioration in the job market and overall economy, the inflation rate may further decline. After all, McLham seems to have shifted from focusing on inflation to focusing on growth, and no longer on inflation

ING emphasized, "Obviously, the pricing of the Federal Reserve will have a certain impact. If the market expects the Federal Reserve to cut interest rates in September, then the market may also partially expect the Bank of Canada to cut interest rates in September. However, in our basic forecast, the Federal Reserve will cut interest rates in September, and if domestic conditions permit, the Bank of Canada is likely to cut interest rates two weeks before the Federal Reserve cuts interest rates. At that time, the risk of the Bank of Canada cutting interest rates again by the end of the year will be tilted

The Canadian dollar has not been truly impacted by the Bank of Canada's interest rate cut, which has been fully reflected in prices. Recently, the protection of the Canadian dollar has been significantly stronger than that of the Australian dollar, New Zealand dollar, Norwegian krone, and Swedish krone. This situation may continue in the short term, as the risks brought by Trump's new term have a much smaller impact on the Canadian dollar than other high beta G10 currencies, and the better liquidity of the Canadian dollar makes it more resistant to risk aversion.

However, the widening spread between the US dollar and the Canadian dollar means that the currency pair will face continued pressure to appreciate. ING Outlook states that if the market digests the impact of the Bank of Canada's September rate cut, it is entirely possible to break through 1.380, and the trend may continue to 1.390. In the short term, once the Federal Reserve relaxes its policy, the US dollar/Canadian dollar may still experience a correction. We still believe in a medium-term bullish outlook, with the US dollar falling below 1.350 against the Canadian dollar

Former New York Federal Reserve Chairman William Dudley called on Wednesday (July 24) for the Fed to cut interest rates as early as next week to address concerns of an economic recession, reversing his long held belief that the Fed would adhere to a long-term high interest rate system.

(Source: Bloomberg)

"The facts have changed, so I also changed my mind. The Federal Reserve should cut interest rates, preferably at the policy setting meeting next week," Dudley said in a Bloomberg column before the Federal Reserve's policy meeting on July 30-31.

For a long time, the strong performance of the US economy has indicated that due to the soaring stock market and the still loose financial environment, the measures taken by the Federal Reserve to slow down growth are insufficient, but these facts have now changed. Dudley emphasized, "Now, the Federal Reserve's efforts to cool down the economy are producing significant results

He pointed out that as the labor market cools down, low-income families are feeling the impact of rising credit card and car loan interest rates.

Dudley added that there are signs of slowing growth in the labor market, and he expressed concern that the three-month average unemployment rate has risen 0.43% from the previous 12-month low to a level that could trigger an economic recession.

He stated that this interest rate is now very close to the threshold of 0.5% set by the Sahm Rules, which undoubtedly indicates a recession in the US economy. Dudley's concerns about the labor market are not unfounded, and Federal Reserve Chairman Powell recently hinted that the weakness in the labor market now needs to be closely monitored.

Powell testified before the Senate Banking Committee earlier this month, stating that "rising inflation is not the only risk we face," and pointed out that "by multiple indicators, the labor market has clearly cooled down.

Meanwhile, the inflation rate continues to slow down to the target level of the Federal Reserve. Dudley added that the Federal Reserve's favored consumer price indicator, the core deflator of personal consumption expenditure, rose 2.6% in May compared to the same period last year, "not far above the central bank's 2% target".

Dudley acknowledged that the Federal Reserve may not want to cut interest rates too early and take on the risk of inflation rising again, and the Sam Rule has not yet dominated discussions at the Fed.

Despite the strong dovish sentiment, the market still generally expects the Federal Reserve's voting committee to vote in favor of keeping interest rates unchanged in the range of 5.25-5.5% at next week's meeting.

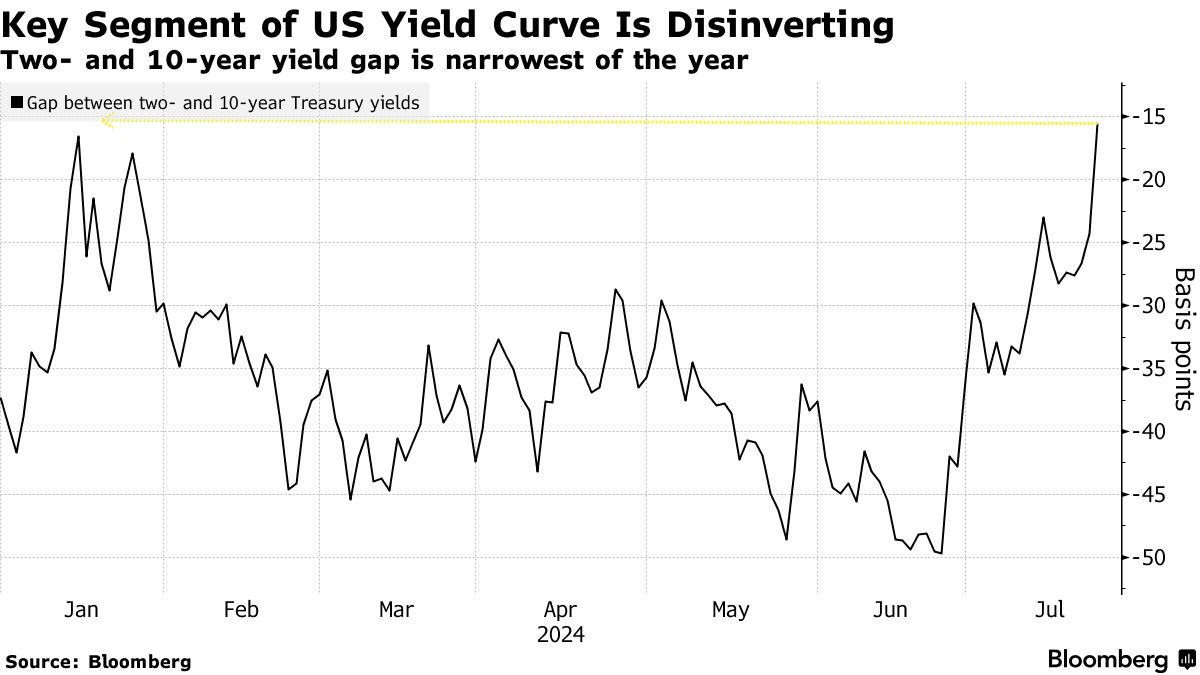

Faced with the Bank of Canada's interest rate cut, further dovish rhetoric from McClelland, and Dudley's call for the Federal Reserve to cut interest rates next week, traders have quickly taken action.

Bloomberg pointed out that the yield gap between two-year and 10-year US treasury bond bonds narrowed to about 14 basis points, the smallest gap since October 2023.

(Source: Bloomberg)

(Source: Bloomberg)

With the call of the Federal Reserve to cut interest rates as early as next week growing, the yield curve of US treasury bond bonds sharply steepened.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights