Gold prices have risen for eight consecutive weeks, with most analysts and retail investors still bullish on the future market

On Monday (February 24th) during the Asian session, spot gold fluctuated narrowly and is currently trading around $2938.04 per ounce. Gold prices fluctuated at a high level last Friday as investors took profits after setting a record high. Gold prices fell to around 2916.66 during trading, but President Trump's tariff plan still attracted bargain hunting and safe haven buying, closing at $2936.17 per ounce, with a weekly increase of about 1.85%, marking the eighth consecutive week of gains. The survey shows that most analysts and retail investors still tend to be bullish on the future of gold.

Alex Ebkarian, Chief Operating Officer of Allegiance Gold, said, "This is just a typical trend of historical highs and profit taking... (But) the fundamentals of gold remain solid

Last week, the gold price broke historical records twice, once surpassing $2950 per ounce and reaching a high of $2954.72 per ounce, as the uncertainty of global economic growth and political turmoil consolidated investors' appetite for gold.

The demand for gold is currently mainly driven by Western investors and central banks. An analyst from Deutsche Bank stated in a report. ETF investors seem to have also joined this group

Ebkarian said that the safe haven effect of gold has not been fully utilized because the transfer from risky assets to safe assets is not obvious, and funds are still watching.

Given that the market believes that Trump's policies will stimulate inflation, investors are also paying attention to the Federal Reserve's interest rate trajectory in search of clues. Rising inflation may force the Federal Reserve to maintain high interest rates, thereby reducing the attractiveness of high-yield gold.

The latest Kitco News weekly gold survey shows that most industry experts and retail investors are still bullish on the future of gold.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, said, "I have a neutral attitude towards gold for the next week. I believe it is still digesting the gains of recent weeks

James Stanley, Senior Market Strategist at Forex, said, "Bullish. Bulls have not shown any signs of slowing down, and the past week has been a strong week. I think we have a great chance of touching the spot $3000 soon, but I think there may be some volatility there

Adrian Day, President of Adrian Day Asset Management, said, "bearish. Gold does need to pause, as the gains over the past two months have far exceeded the trend. So we may see a pullback, but I suspect it will only be brief and mild. The reasons why people buy gold have not disappeared, and the North American market has not yet joined this ranks in any meaningful way

Day warns that ETFs still have net redemptions and coin dealers still have net sales, although the balance between buyers and sellers is slowly shifting. When they transform, gold will soar again

Rich Checkan, President and Chief Operating Officer of Asset Strategies International, said, "Bullish. Gold has been appearing more frequently in news cycles recently. This, combined with continued market and political uncertainty, indicates that gold will soon begin testing $3000. I believe we will take another step in this direction next week

Marc Chandler, Managing Director of Bannockburn Global Forex, believes that gold prices will experience a pullback in the short term.

Gold hit a historical high of nearly $2955 on February 20th. However, technically, it is starting to appear vulnerable to setbacks. A price shock and slowing down purchases could be triggered by a surge of over 13% in spot prices this year. Momentum indicators have not confirmed historical highs, warning of a 'bearish divergence'

Chandler added, "Initial support may be around $2875-2880. However, I anticipate buying on dips, especially as the threat of US tariffs enters a new phase next month

Darin Newsom, senior market analyst at Barchart, said, "Bullish. The global chaos caused by the US government is not going to disappear soon, which means investors will continue to see gold as a safe haven hedge

Barbara Lambrecht from Deutsche Bank stated that they hold a bullish attitude towards gold in the coming week. Gold profits from this uncertainty, with prices repeatedly hitting new highs, "she said. The threshold of $3000 per ounce is getting closer and is likely to be reached soon

Lukman Otunuga, Market Analysis Manager at FXTM, stated that the weak US dollar may push gold prices to new highs in the coming days. He said, 'If the US dollar continues to be at a disadvantage in the coming week, this could drive up - bringing the $3000 dream of gold closer to reality.'.

Kevin Grady, President of Phoenix Futures and Options, stated that gold prices reflect the market's widespread struggle in calculating the potential impact of Trump's policies and proposals.

The market is really trying to figure it out, "he said. Everything, the stock market, the metal market, commodities, everyone is trying to figure out how tariffs affect you, and the problem with tariffs is that they are moving targets. Nothing is fixed, even if it is implemented, if someone comes back to negotiate, they will give up

It's difficult to trade around this point, "Grady said," so you'll see very volatile markets that will be very news driven

He added that investors need to recognize that algorithms are reading data and reacting before people. This is not a trader sitting there and saying, 'Oh, this is what I should do now,' "he said. This is the reaction of the algorithm, they know it's part of the problem

Grady stated that although the past week has been relatively stable by the standards of the Trump 2.0 market, there will be more volatility in the future. I think we will jump back and forth again, "he said." He's making a big fuss about it. He's been in office for a month now, and they've listed all the achievements he's made. They'll keep moving forward

Grady believes that the recent strength of gold is largely a short-term response to the threat of tariffs, rather than a continuation of the long-term bullish trend of precious metals.

Grady also believes that market participants need to set aside seasonal factors now, as this market is vastly different from any previous year.

I think it's hard to say, 'This is what we usually do,' or 'This is the seasonality of gold,' because the whole chessboard is upside down. Maybe someone will say India is a big buyer of gold by season, but at $3000, you may not see the same desire to buy, so I think it's hard to say that something will be seasonal, and you can act according to previous norms

He also believes that even if gold prices hit a new high, the central bank will continue to buy gold because today's record may look like a bargain in a few months.

"I don't think any of these central banks, such as Türkiye, will say, 'I want to pay a premium.' They are all below the market," he said. But the premium from two years ago is now a big discount. This is very relative

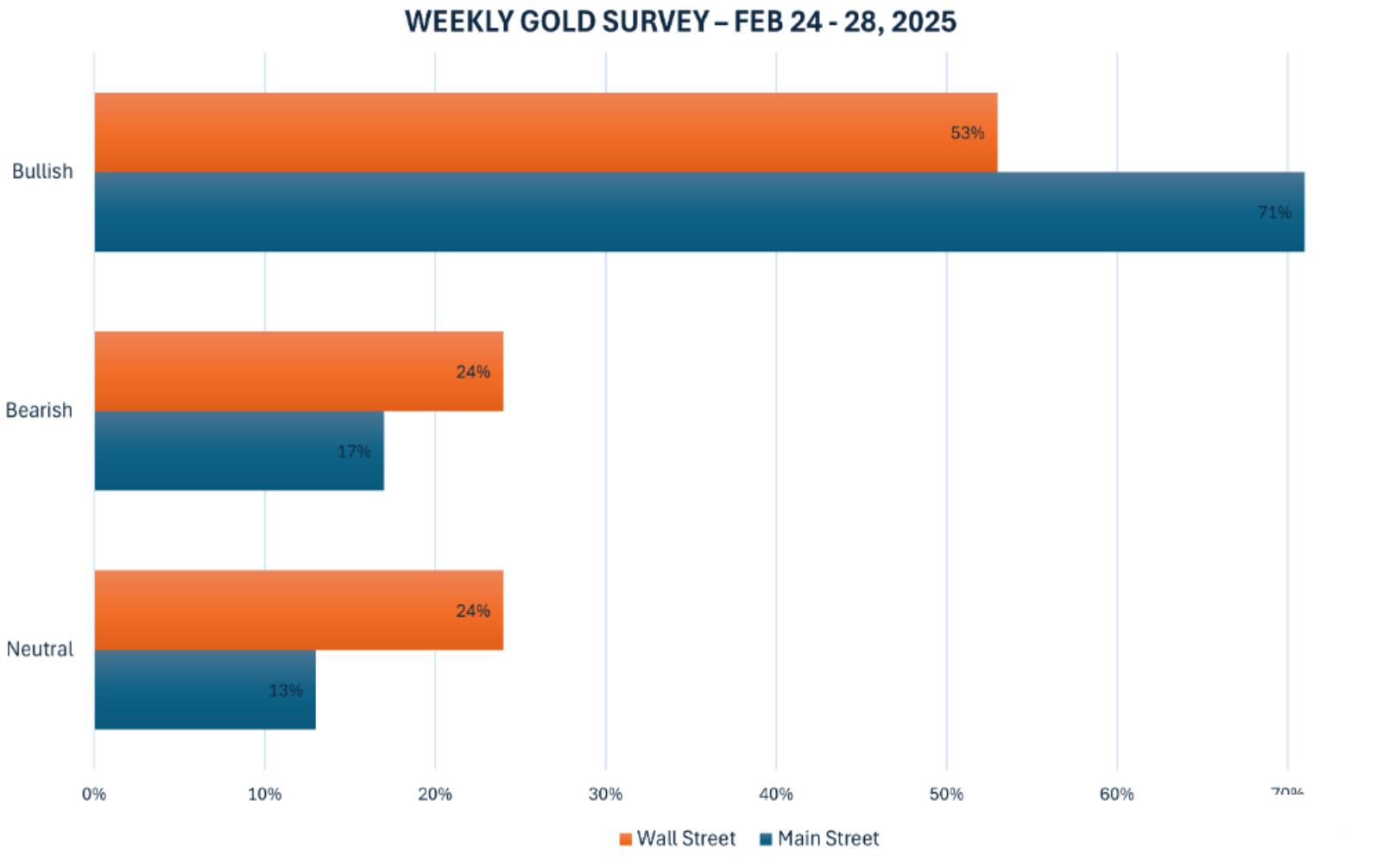

Last week, 17 analysts participated in Kitco News' gold survey, and Wall Street's bullish sentiment slightly cooled down. However, nine experts (53%) still predict that gold prices will rise in the coming week, while four analysts (24%) predict that gold prices will fall, and another four analysts believe that gold will consolidate sideways in the coming week.

Last week, 17 analysts participated in Kitco News' gold survey, and Wall Street's bullish sentiment slightly cooled down. However, nine experts (53%) still predict that gold prices will rise in the coming week, while four analysts (24%) predict that gold prices will fall, and another four analysts believe that gold will consolidate sideways in the coming week.

At the same time, Kitco's online voting received 204 votes, indicating that retail investors have actually become more bullish. 144 retail traders (71%) expect gold prices to rise in the coming week, while another 34 (17%) expect gold prices to fall. The remaining 26 investors (13% of the total) believe that gold will consolidate in the short term.

This week's economic news calendar started earlier than usual as market participants will closely monitor the impact of Sunday's German parliamentary election results. The conservative alliance in Germany, led by Friedrich Merkel, won Sunday's federal election, with a significant lead in vote share over the far right Alternative Party and the Social Democratic Party led by Olaf Scholz.

The February US consumer confidence report will be released on Tuesday, followed by January new home sales on Wednesday.

On Thursday, the market will receive the revised GDP for the fourth quarter of the United States, durable goods orders for January, and weekly unemployment claims, followed by sales data for existing homes in the United States.

But the main events in the economic data will be Friday's US core PCE index and January's personal income and expenditure, as the Fed's preferred inflation indicator will provide a good indication of possible interest rate paths for gold traders.

Adam Button, the head of currency strategy at Forexlive, holds a neutral attitude towards gold for the next week.

Gold may still have one more chance to rush towards $3000, but there is no new bullish risk return now, "he said. I am closely monitoring the US dollar because some weakness has already emerged; if this situation continues, it may add another leg to gold

Mark Leibovit, publisher of VR Metals/Resource Letter, said, "We are still concerned about the cyclical trading peak in February

Sean Lusk, co head of commercial hedging at Walsh Trading, is trying to combine the Fed's latest interest rate forecast with gold's recent strong performance. There's a lot of noise, "Lusk said. Perhaps there is nothing new in the overall picture, but you still have good gold support. The US dollar rose today, but it is falling back

I just don't know what they're going to do with the interest rate, "he added. I think the interest rate cut is over. I don't care who says anything, even considering it is completely absurd. Last year was already absurd

Lusk stated that he believes the Federal Reserve's generous rate cut forecast is based on expectations of weak employment. They are concerned about this, which is the reason for the interest rate cut, which has been reduced by 300 basis points over a three-year period, "he said. But now that this situation has subsided, you no longer hear too much news about it. So is it the Federal Reserve misreading the employment situation, or are they basically saying, 'Government employment doesn't count'? Now these government employees, the latest ones, are going out directly

Lusk stated that even if gold prices hit a new high, there are still plenty of reasons for countries, institutions, and individuals to continue purchasing. Look, we have risen by $300 since the beginning of the year, an increase of over 10%, "he said. The government, namely Trump, wants to lower interest rates, but he knows the only way to achieve this goal is to cut spending. This will take a long time because you won't see direct results. You have to buy out these people, which is not a short-term net positive

We may be walking on a bumpy road, "Lusk warned. I think there is more uncertainty, which is why gold has surged and reached new highs in the past two months, because no one knows exactly where it will be. You saw a 10% increase in the first half of a fiscal quarter, which was fast, but not unheard of, and we have done it before. Seasonally, some of its best performance periods were between mid December and Valentine's Day. We still haven't really seen any market turning points or breakthroughs, although I wouldn't be surprised if there were a turning point

You may see the previous month's trading rise to just over $3000 per ounce, but from a technical or fundamental perspective, will you attract new bulls at this level? "Lusk pondered. This will be a challenge, just like when we first reached $2000 or $2500. We'll wait and see

I just think there is real uncertainty here in many aspects, "he said. For gold, the path of least resistance is still upward

Kitco senior analyst Jim Wyckoff still expects gold prices to further rise in the short term. Due to the safe haven demand and bullish technical outlook, a solid bottom will be formed in the gold market, and gold will rise, "he said.

In addition, investors also need to pay attention to further news on the Russia Ukraine situation and US Russia negotiations.

On February 23rd local time, Ukrainian President Zelensky announced at a press conference that he would hold talks with US President Trump, but he refused to disclose the specific time. On that day, Zelensky also stated that Ukraine had begun auditing its underground mineral resources as part of the preparations for signing a mineral memorandum with the United States. In addition, on the same day, Yermak, the Director of the Office of the President of Ukraine, stated that he had an important dialogue with the First Deputy Prime Minister and Minister of Economy of Ukraine, Sviridenko, and American partners on a mineral agreement

On February 23rd local time, European Council President Costa stated that Ukraine and Europe are currently at a decisive moment in terms of security. The European Council will hold a special meeting on February 6th to discuss defense issues in Ukraine and Europe. During a phone call with French President Macron on the same day, British Prime Minister Stamer reiterated that Britain will steadfastly support Ukraine and emphasized that Ukraine must occupy a central position in any negotiations to end the conflict.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights