Gold, both long and short are in the sensitive period!

Gold, there is a day when it rises and breaks through without accelerating.

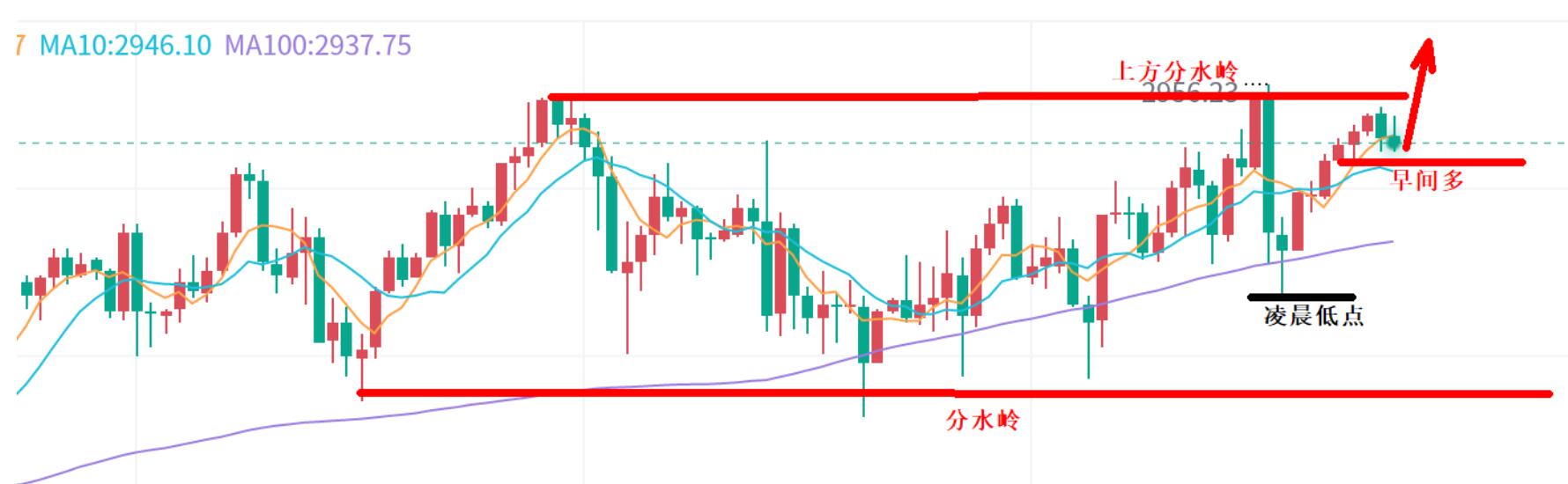

After forming a 30 word candlestick chart, the daily chart bottomed out and rebounded, reaching its highest point of closing after turning positive. This clearly indicates the watershed cross K-low point, which is the defensive level for all long positions.

The expected acceleration still hasn't appeared, and the expected continuous market trend hasn't either.

It has been trading sideways at a high level for four consecutive trading days, with some stagflation but small gains along the way, some retracement but unable to fall.

In this case, the layout?

In terms of daily rhythm, if there is no acceleration, I am still worried about accelerating the rise and then falling again.

2. The watershed for long positions is the bottom of the cross K, so there's no need to worry. Just take a good stop loss strategy when trading.

3. Master the cyclic rhythm.

4. Remember the two time points when the European and American markets fell, neither of which were significant.

Let's take yesterday as an example. In the morning, we bottomed out and rebounded, and continued to return to the high point. Even in the midst of strength, we have been using a mnemonic:

Rising in the morning, whether it can break through the high or not, the European market is the key!

1. The early low point of the watershed.

2. If you are bullish on the European market, you must break through the high.

3. The position for a second long is usually the 382 position in the golden ratio, which happened to be 2935 yesterday

It also formed a slight breakthrough in the European market. But when it came to the US market, it repeated twice.

This emphasizes that the current market lacks continuity. The first time is easy, but the second pullback, especially the pullback in the US market, will no longer be too much.

In terms of today's situation, the morning is still a radical Cardo.

1. Strong early morning closing to the high line.

2. With a strong daily rhythm, this kind of closing must be seen as continuing to break high.

3. Long positions in the morning carry less risk, so if there is a sharp drop in the morning, don't do too much.

4. It's better to have more in the morning to see if we can break through the height early.

5. The current pace doesn't have much room to break through high, it's a combination of defense and offense.

Extremely strong operation, one is the time point 7-8 o'clock, and the other is the rollback at position 236.

Don't emphasize too much pullback, this kind of market will not rise if there is too much pullback.

Just enter the radical point directly, and look at 2961-63 above. There are too many to see, and only the first increase will be made, especially the acceleration of 20-30 US dollars. Don't chase after it anymore, the risk is here.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights