Crude oil trading analysis: US crude oil will end rebound

On Tuesday (February 25th) during the Asia Europe time slot, US crude oil fluctuated narrowly and is currently trading around $9095 per barrel.

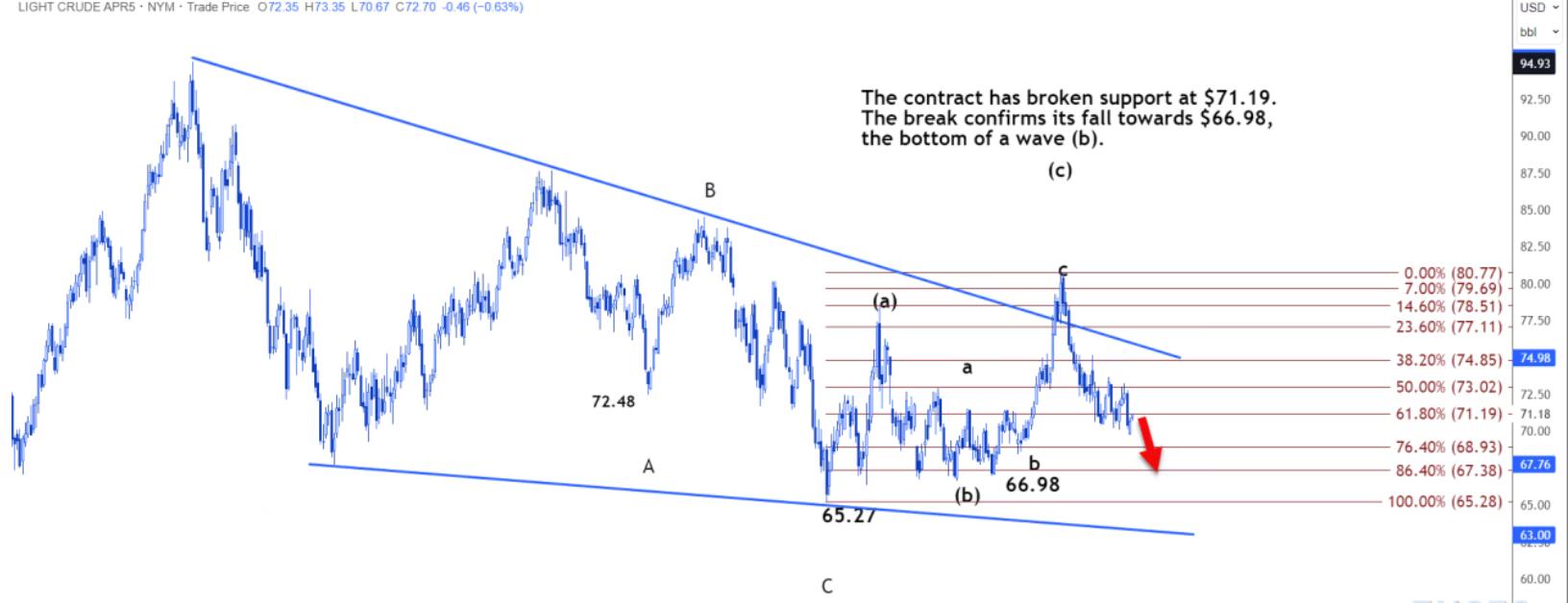

Reuters technical analysts pointed out on Tuesday (February 25th) that US crude oil may end its rebound within the resistance zone of $71.32 to $71.88 per barrel and retest the support level of $70.07.

Analysts predict that the current rebound will be much weaker than the previous two rebounds from $70.12 and $70.43. These rebounds combined form a bearish wedge.

Experience has shown that wedges are usually composed of three waves, and it is rare to see a wedge with five waves. The significant decline on February 21st is considered a continuation of the downward trend.

Breaking through $71.88 may push the price up to the range of $72.58 to $473. This kind of increase may shift market sentiment from bearish to bullish.

A drop below $70.07 may open the way to the range of $68.25 to $68.94. On the daily chart, the contract has fallen below the support level of $71.19. Breaking below this support level confirms its decline towards $66.98, which is the bottom of wave (b).

If the closing price on February 25th is higher than $71.19, it will generate a mixed signal, as the contract may climb to $73.02 thereafter.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights