Is the gold breaking below 2900 a sudden change?

In terms of gold, we slowed down today because we got up early yesterday and rushed to the evening market.

Yesterday morning, it was seen that the price continued to rise strongly, but the result was that the price did not break through the low point of the early morning before 11 o'clock. This bottoming out in the afternoon established yesterday's retreat. If it weren't for the strong morning rush, yesterday's flight would have been very smooth.

Breaking the midnight low in the morning, the European market is definitely bearish.

3. The strategy we have always emphasized is that the European market falls and the US market cannot remain high.

To avoid two falling time points, one is a morning surge and the other is a decline in the US market. If the US market falls, don't take the knife and see if the price easily breaks through the 2900 line.

4. In fact, Bitcoin was one step ahead of this decline, and Bitcoin fell sharply first, basically leading gold by 2 hours, adding this correlation.

5. The European market fell and rebounded 6-8 points. Yesterday's US market was definitely a double short, while the high point of the European market's decline was in the 2942-3 line. It depends on oneself how much space can be made.

The key point is that for the current upward retracement, as long as it is a decline in the US market, do not buy too much. The speed of the decline is like a knife, and it is easy to cut your hands.

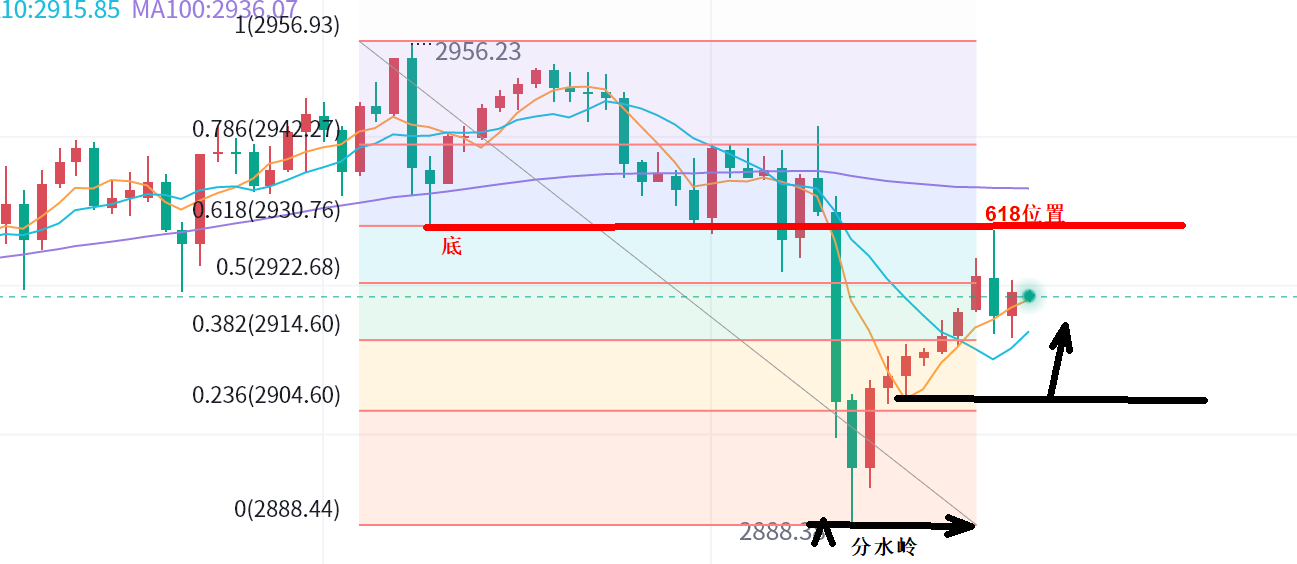

In terms of today's situation, the gold price has bottomed out and rebounded after breaking through 2900. Although the daily chart is bullish, the strength of the pullback is sufficient. What do you think about today?

The rebound time is in the early morning, and the US market is extremely weak. A rebound in the early morning indicates that it is not weak.

2. Bottom up and rebound, with a daily bearish trend. In a strong trend, when the daily decline is corrected, it is often a single bearish pattern. Therefore, in a strong form, it will continue to rebound and close positive today.

3. At 2930 in the morning, it is a high point of 2954, a drop of 2888, and a rebound at 618. It is better to be wrong than to let go, as it can be left empty in the morning.

If the rebound continues in the morning, then the European market is crucial, and the 618 position is crucial, which means 2930 is crucial today.

This is a time point for distinguishing strength and weakness. If there is no rebound in the morning, the current position cannot be operated.

If you continue to go up to 2930, you must not be short twice. In a strong situation, you can only catch the first pullback.

2. For long positions, the daily chart is bearish, with a correction from early morning to early morning at the support level of 2906-7. The European market cannot be too weak, as if the European market is weak, it will be meaningless to be bullish.

According to the current situation, it still belongs to a strong oscillation, and both long and short positions can participate.

4. Pay attention to Bitcoin, as it has recently experienced both high-level sideways and downward movements, which are very similar. You can make forward-looking predictions and follow suit.

5. Missing the first wave of bearish sentiment in the morning, there is currently no opportunity. We will wait and see in the European market, and still rely on the strength of the European market to lay out in the US market.

When the location is unclear, forcing the location is meaningless, such as the 2906-7 line. If you say too much now, you won't dare to come.

If the European market becomes stronger, this position will not be reached.

The European market is suppressing below 2930, while the US market still needs to retrace and shake to test the bottom.

So, it's not something that can be described in a single sentence.

The current market situation is not simply about strength or weakness. We can directly plan for a strong position, but based on the current position, you cannot provide a reasonable point for the European market.

Short selling, if you miss the first wave, it's easy to make mistakes in the second wave, and everyone doesn't know where to make the wrong judgment.

Therefore, today's intraday strategy can only rely on the strength of the European market and lay out in the US market.

The above only represents the author's personal views and opinions. Investment carries risks, and caution is required when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights