US tariffs' Sichuan opera changes face ', North American economic recession risk soars

The latest Reuters survey shows that the volatility of US tariff policies has brought serious uncertainty to the three major North American economies - the United States, Canada, and Mexico - leading to a significant increase in the risk of economic recession. Economists generally believe that the frequent changes in trade policy by the Trump administration have made it extremely difficult to predict economic growth, inflation, and interest rates, and have even affected the interest rate decisions of the Bank of Canada. At the same time, the inflation risk in the United States is also increasing, further exacerbating the uncertainty of the economic outlook.

The uncertainty of tariff policies

US President Trump has changed his tariff policies on imported goods from Mexico and Canada twice in just six weeks, from threatening to impose a 25% tariff to calling for a temporary halt. This "Sichuan Opera face changing" policy change has left businesses and decision-makers at a loss. Economists point out that this uncertainty makes it almost impossible to predict economic growth, inflation, and interest rates, even affecting the Bank of Canada's interest rate decision on March 12th. Jonathan Millar, Senior Economist at Barclays Bank, said, "The risk of economic recession has intensified, and the current environment is extremely unstable

The risk of economic recession in North America is increasing

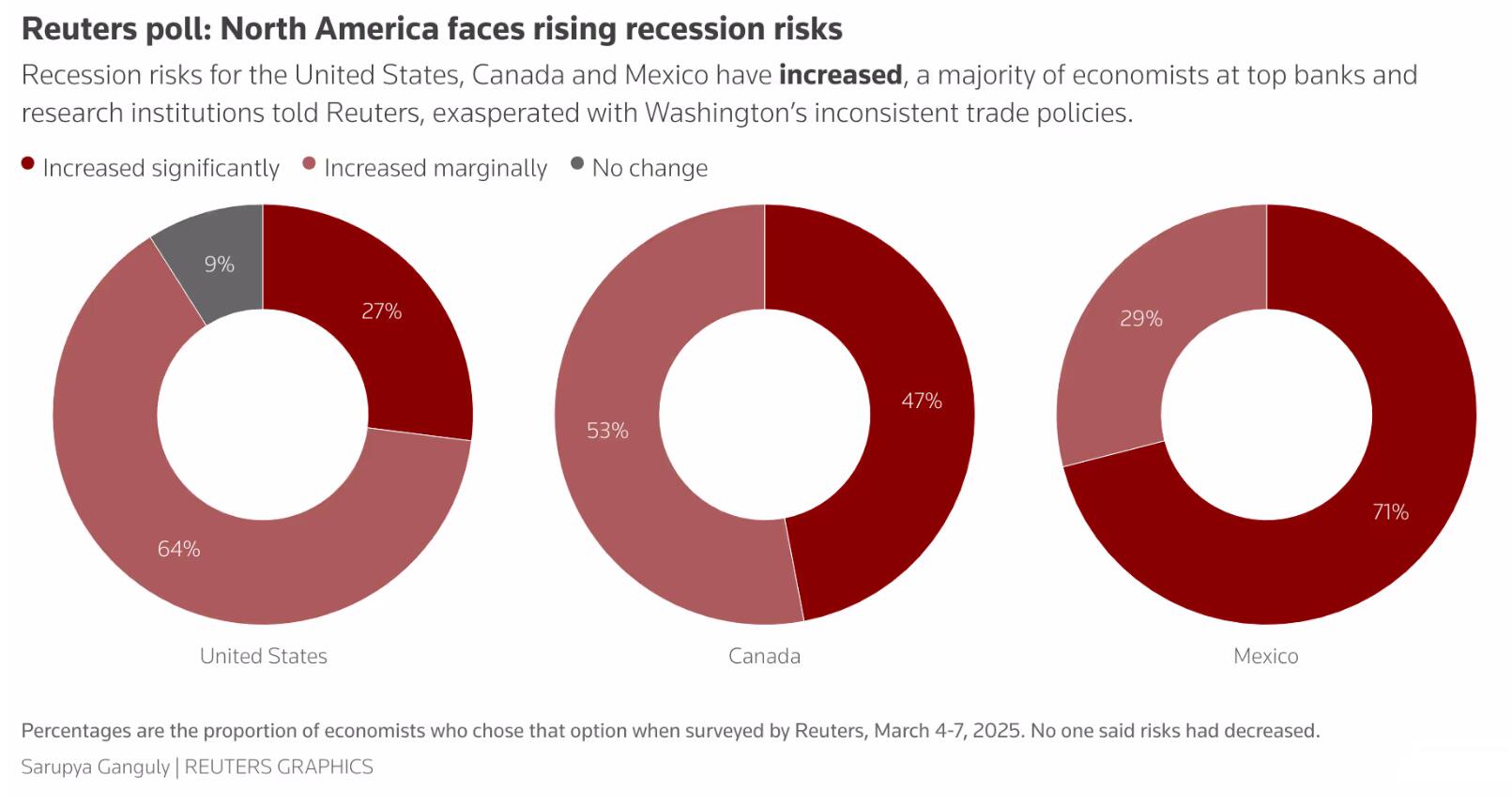

A Reuters survey interviewed 74 economists, of whom nearly 70 believe that the risk of recession in their own economies has increased. The International Monetary Fund (IMF) has also warned that if US tariffs continue, they will have significant adverse effects on Mexico and Canada. Claire Fan, Senior Economist at Royal Bank of Canada, pointed out that "even if tariffs are withdrawn, they have already had a negative impact on market sentiment and volatility will not disappear soon." In addition, economists expect the Bank of Canada to cut interest rates by 25 basis points at its policy meeting on March 12 to cope with downward pressure on the economy.

Outlook for US Inflation and Interest Rates

A survey shows that inflation risks in the United States are intensifying, with nearly 85% of surveyed economists believing that inflation risks have shifted towards rising prices in the near future. Although the market generally expects the Federal Reserve to cut interest rates twice this year, nearly 45% of analysts believe that it may only cut interest rates once or not at all. 56 out of 102 economists predict that by mid-2025, the federal funds rate range in the United States will remain between 4.25% and 4.50%. This prediction reflects the market's divergent views on the direction of the Federal Reserve's policies and a cautious attitude towards the economic outlook.

summarize

The unpredictable nature of US tariff policies not only exacerbates uncertainty in the three major North American economies, but also significantly increases the risk of economic recession. Economists generally believe that the Trump administration's trade policy changes have made it extremely difficult to predict the economic outlook, and have even affected the central bank's interest rate decisions. At the same time, the inflation risk in the United States is also increasing, further exacerbating economic complexity. In the future, with the evolution of tariff policies and the release of economic data, the prospects of the North American economy will continue to be the focus of global attention.

The increase in economic uncertainty and recession risk typically boosts safe haven demand and drives up gold prices; The expectation of rising inflation and falling interest rates will also support gold prices. In the future, with the evolution of tariff policies and the release of economic data, gold prices may continue to be driven by these factors.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights