Gold prices have slightly fallen due to the rise of the US dollar and profit taking, and market sentiment remains bullish

On Monday (March 24th) morning trading in the Asian market, spot gold fluctuated narrowly and is currently trading around $3025.54 per ounce. Gold prices fell 0.7% last Friday as they briefly touched the 3000 integer mark due to the strengthening of the US dollar and profit taking. However, geopolitical and economic uncertainties persisted, and with expectations of a Fed interest rate cut, gold prices were still supported by bargain hunting and safe haven buying. On Friday, gold prices closed around $3023.04 per ounce, with a weekly increase of 1.17%, marking the third consecutive week of gains.

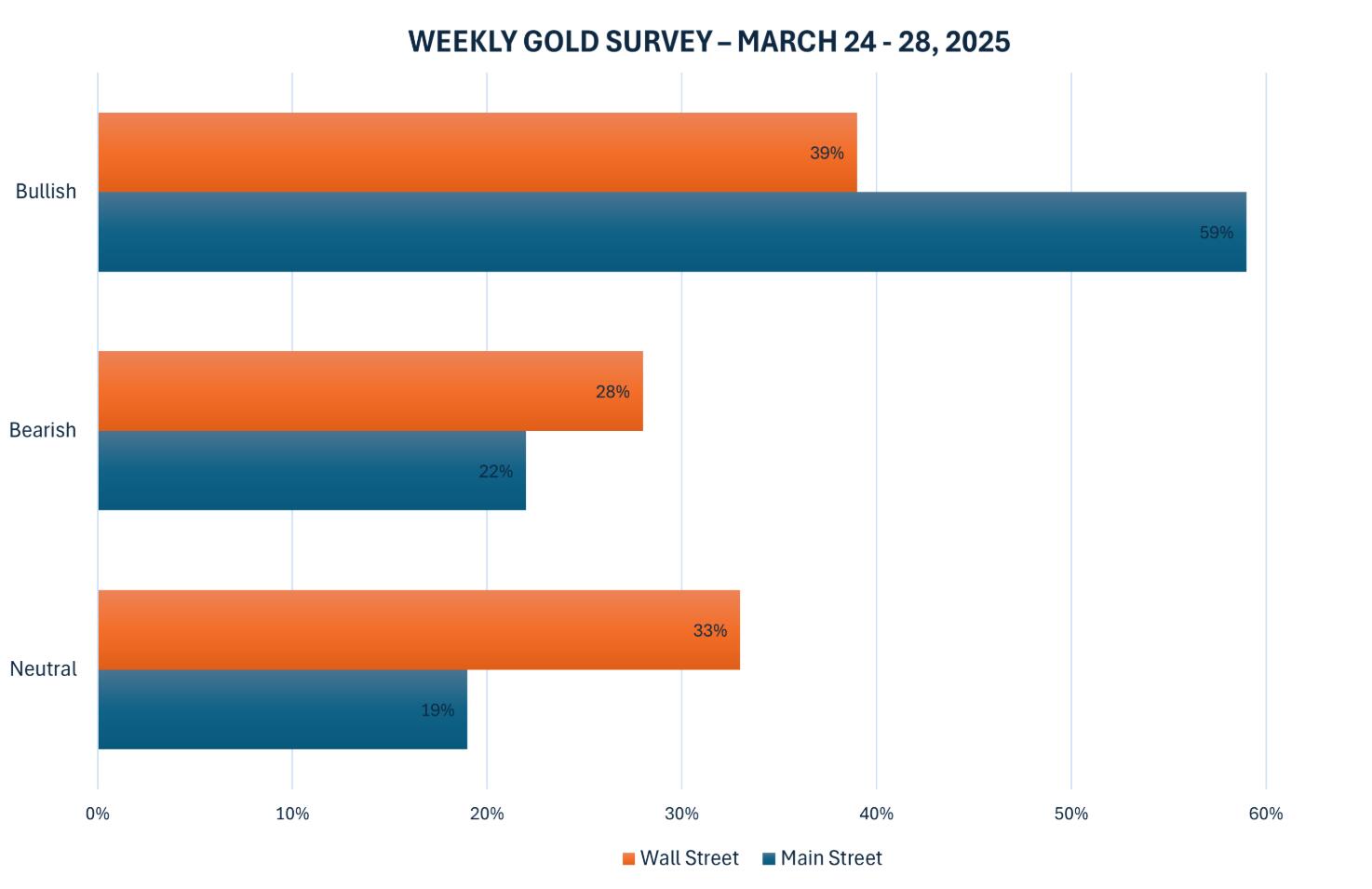

The survey shows that most analysts and retail investors still tend to be bullish on the next week's gold price trend.

Traditionally, gold has been seen as a safe investment in times of geopolitical and economic uncertainty, typically performing strongly in low interest rate environments. This year, gold has hit 16 historic highs, reaching a record high of $3057.21 per ounce on Thursday.

Marex analyst Edward Meir said, "The market is taking a breather. Currently, there is some profit taking in the price range, and the US dollar is strengthening

The US dollar rose 0.34% last Friday, reaching a two-week high of 104.22, making gold priced in US dollars more expensive for overseas buyers.

US President Trump still plans to implement new equivalent tariff rates on April 2nd.

The Federal Reserve maintained its benchmark interest rate unchanged as expected last Wednesday, but stated that it will make two 25 basis point rate cuts before the end of the year.

According to data from the London Stock Exchange Group (LSEG), traders expect the Federal Reserve to cut interest rates by 71 basis points this year, at least twice, each by 25 basis points, with the July rate cut fully absorbed.

In terms of geopolitical situation, Israel announced last week that it would launch a sea, land, and air attack on Hamas in Gaza to force the release of remaining hostages. This move means that Israel has abandoned the two month ceasefire agreement and launched a comprehensive air and ground offensive against Palestinian radical organizations.

On the 23rd local time in the Gaza Strip, the health department stated that the Israeli military launched an airstrike on the surgical building of Nasser Hospital in Khan Younis, southern Gaza Strip that evening, resulting in at least 2 Palestinian deaths and 8 injuries.

According to the local time of the Houthi armed health department on the 23rd, the US airstrike on the Yemeni capital Sana'a that night has caused 4 deaths.

On the night of the 23rd local time, Ukrainian Defense Minister Umerov announced on social media that the talks between the Ukrainian and US delegations in Saudi Arabia that day had ended. The talks were 'productive', with both sides discussing key issues including energy. Umerov emphasized that Ukrainian President Zelensky's goal is to ensure a just and lasting peace in Ukraine and throughout Europe.

Kitco News' weekly gold survey shows that industry experts have a balanced attitude towards the outlook for gold prices, with a similar proportion of members predicting a rise or fall in gold prices in the coming week; But most retail investors still tend to be bullish on the future of gold.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, stated that he holds a neutral attitude towards gold in the coming week and believes that gold may continue to consolidate its recent trend of breaking through $3000 by the end of the month. Adrian Day, President of Asset Management, believes that the pullback after a sustained rise in gold is normal and healthy, although the pullback may be brief and mild. Senior Market Analyst Darin Newsom at Barchart is optimistic, believing that gold will continue to rise in the foreseeable future, especially against the backdrop of increasing global economic and political uncertainty.

However, some analysts are cautious about the short-term trend of gold. Mark Leibovit, publisher of VR Metals/Resource Letter, pointed out that gold is currently overbought and is expected to experience a pullback. Rich Checkan, President of Asset Strategies International, also believes that gold may test levels below $3000, although he remains bullish on gold in the long run.

$3000 has become a key psychological barrier in the gold market. Neil Welsh, head of metals at Britannia Global Markets, said that in the short term, $3000 may become an important support level for gold, attracting bargain hunters. Adam Button, the head of currency strategy at Forexlive.com, also pointed out that there has been a clear buying trend for gold around $3000, indicating the market's emphasis on this level.

However, Button also reminds investors that gold may experience profit taking after experiencing recent strong gains. He stated that the consolidation of gold above $3000 is normal, and the market needs time to digest the previous gains.

Although the gold market may face downward pressure in the short term, most analysts believe that the long-term upward trend of gold has not changed. Global economic and political uncertainty, the Federal Reserve's monetary policy, and geopolitical risks will continue to be the main driving forces supporting gold prices.

Alex Kuptsikevich, Senior Market Analyst at FxPro, pointed out that the upward trend of gold since early March is still intact and is expected to further challenge the high points of $3180 or even $3400 in the future. Kitco senior analyst Jim Wyckoff also believes that the safe haven demand for gold remains stable and expects gold prices to continue rising next week.

March PMI data for European and American countries will be released this trading day, and investors need to pay close attention.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights