Gold is weak, rebound in early trading and continue short selling!

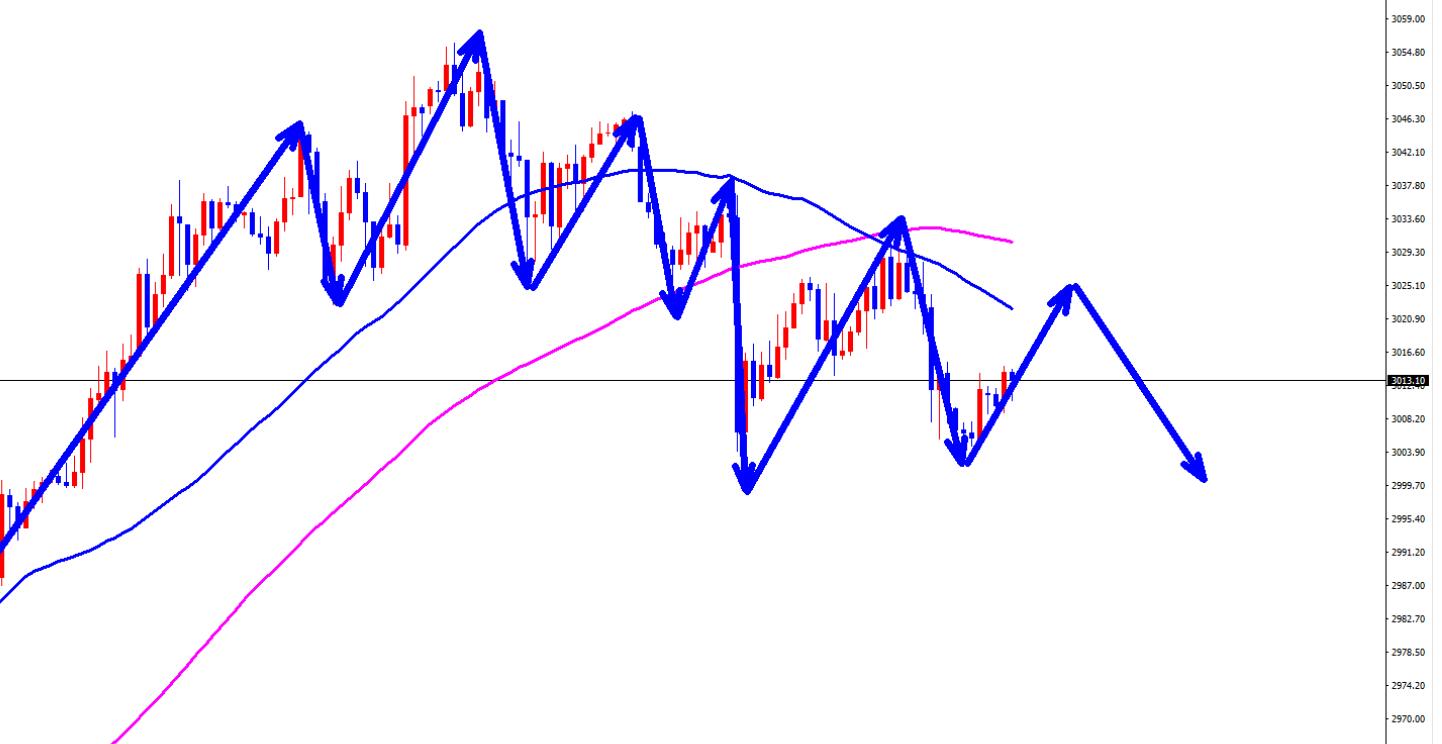

Gold continued to rise and fall yesterday, but it still remains weak. Today's rebound in gold is still bearish, and after rising yesterday, it has fallen again without a strong rebound, indicating that it is now the home ground of gold bears.

The 1-hour moving average of gold has now entered a dead cross pattern, with gold bears taking the lead. Yesterday, gold rebounded to the 3033 line and directly fell back, but there was no strong rebound afterwards, indicating that the strength of gold bulls is limited. Gold continued to hit high levels under pressure of 3033 in the morning session, and can continue to remain empty near the rebound of 3025.

The market is constantly changing, and since gold bulls cannot rise, it is still the home ground for gold bears. The rebound of gold is an opportunity for bears.

Morning trading strategy:

Short selling gold 3025, stop loss 3035. Target 3005-3000;

Disclaimer: The above is purely a personal opinion sharing and does not constitute operational advice. Investment carries risks, and profits and losses are borne by oneself.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights