Gold is affected by tariffs, and the intraday volatility continues to widen!

The gold market is facing uncertainty brought about by US policies such as "equivalent tariffs", and the escalation of the trade war may have a negative impact on global economic growth, which will increase market risk aversion and be beneficial for the long-term rise of gold prices. After a significant increase in gold prices in the early stages, long positions took profits, leading to a recent pullback in gold prices. However, as market concerns about risk events such as trade wars persist, the market's demand for safe haven gold has not completely disappeared. Once market sentiment becomes tense again, gold prices may rise again.

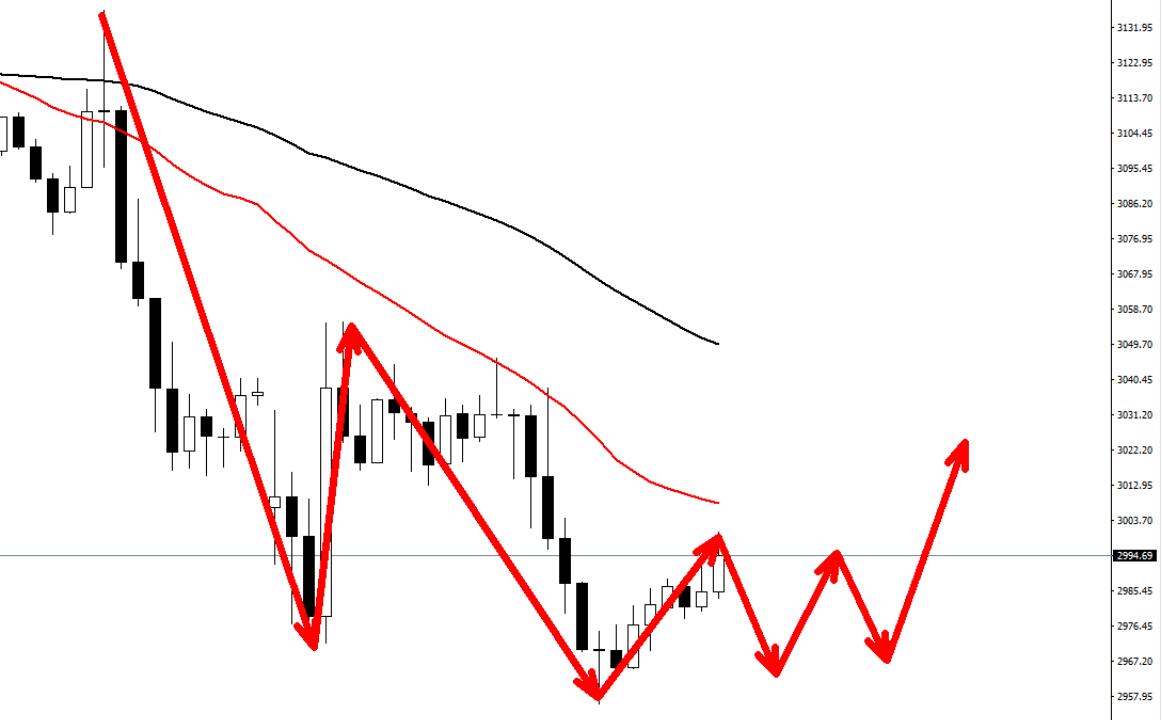

As for the current market view, gold has temporarily stabilized its pace after three consecutive daily declines. It did not further break through the previous low at the early opening today, and the current low point is at the top bottom transition level of the 2955 line. Today's market mainly focuses on the gains and losses of the 2955 line. If gold stabilizes the 2955 line again today, it is likely to hit the bottom and rebound. At that time, I can intervene in short-term long orders around 2970! On the contrary, further decline in gold prices may directly reach the support of the 2912 moving average!

Specific strategies

Buy gold 2970 long, stop loss 2960. Target 3000

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when operating

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights