Secret War of Oil Hegemony: Saudi Arabia's Breakthrough under Trump's Tariff Storm

The global trade war whirlwind initiated by the Trump administration is causing waves in the crude oil market. Although this crisis poses severe challenges to Saudi Arabia, it may also become an opportunity for this oil kingdom to restructure its industry order. Against the backdrop of global supply-demand imbalance, Saudi Arabia is attempting to reshape the oil market landscape in a crisis with an unexpectedly tough stance.

Market dilemma

In recent years, the crude oil market has been struggling under multiple pressures: global production continues to rise, consumption growth is weak, and the long-term demand outlook is unclear. Despite the OPEC+alliance's efforts to maintain production cuts, oil prices are still being suppressed within a narrow range of $70-90. As the actual leader of OPEC, Saudi Arabia can no longer bear to see member countries in the alliance repeatedly overproduction - Kazakhstan, Iraq, and the United Arab Emirates, the three major "deserters of production cuts", contributed most of OPEC+'s total overproduction of 1.2 million barrels per day in February alone.

Saudi Arabia's thunderous tactics

After Trump announced the imposition of tariffs on April 3, oil prices plummeted immediately. They have been falling for several consecutive trading days, with a drop of nearly 20%. US crude oil has fallen below the 60 mark, and Brent crude oil has also approached the 60 integer mark at one point,. Saudi Arabia quickly seized this opportunity to send a strong signal to the market:

Lightning Action: On the day after the tariff news was announced, Saudi Arabia, together with seven OPEC+member countries, suddenly announced the accelerated lifting of the 2.2 million barrels per day production reduction plan, causing a sharp increase of 411000 barrels per day in global supply in May.

Price Surprise: Saudi Aramco significantly lowered the price of Asian crude oil in May, and the premium of flagship Arab light crude oil hit the largest decline in two years, dropping by $2.3 to $1.2 per barrel.

These combination punches demonstrate Saudi Arabia's determination to rebuild market discipline even at the cost of short-term financial losses.

Warning of the cycle of history

The current situation is reminiscent of the epic price war launched by Saudi Arabia in 2014. At that time, through six months of crude oil dumping, Saudi Arabia successfully halved the Brent oil price to $51, dealing a heavy blow to the US shale oil industry. Now history seems to be repeating itself:

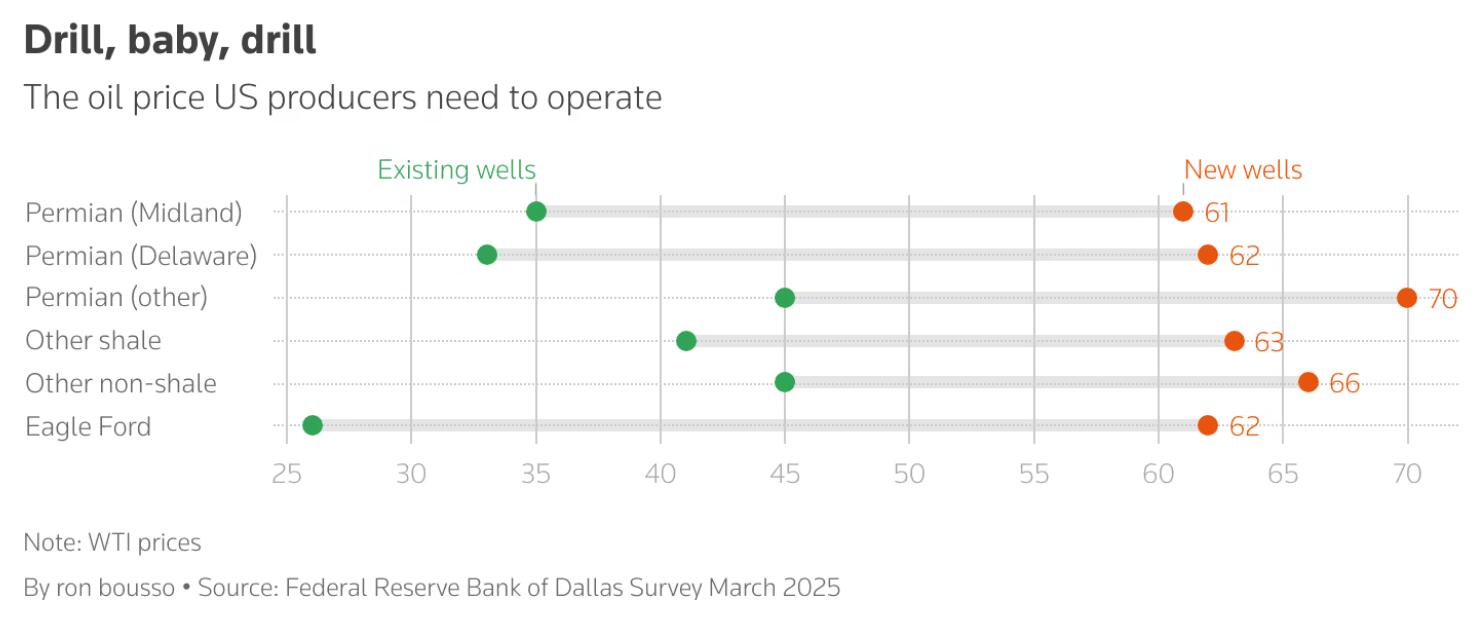

The breakeven line for shale oil in the United States is $65, while the current WTI oil price has fallen below $60.

Image: Oil Prices That US Oil Producers Need to See for Operations

Trump's steel and aluminum tariffs have further increased the cost of shale oil extraction. But this time Saudi Arabia is facing a completely different situation:

US production has entered a plateau period, and suppressing shale oil is no longer the main target

The OPEC+alliance is fragile internally, and a long-term price war may lead to the collapse of the system

Saudi Arabia's fiscal balance requires an oil price of $91, far higher than the $50 offered by allies such as the United Arab Emirates

The Road to Breakthrough

The current market turbulence has given Saudi Arabia a rare strategic opportunity: it can both punish non compliant allies and squeeze high cost competitors. But Riyadh must be cautious in balancing its position - the price war it is forced into cannot be fought too fiercely or dragged on for too long. Under the shadow of the global trade war, Saudi Arabia is walking on a steel wire full of risks, and every decision it makes will profoundly affect the future global energy landscape.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights