Epic Escape from US Debt! Withdrawing 15.6 billion yuan in a single week, trade war triggers global capital reshuffle

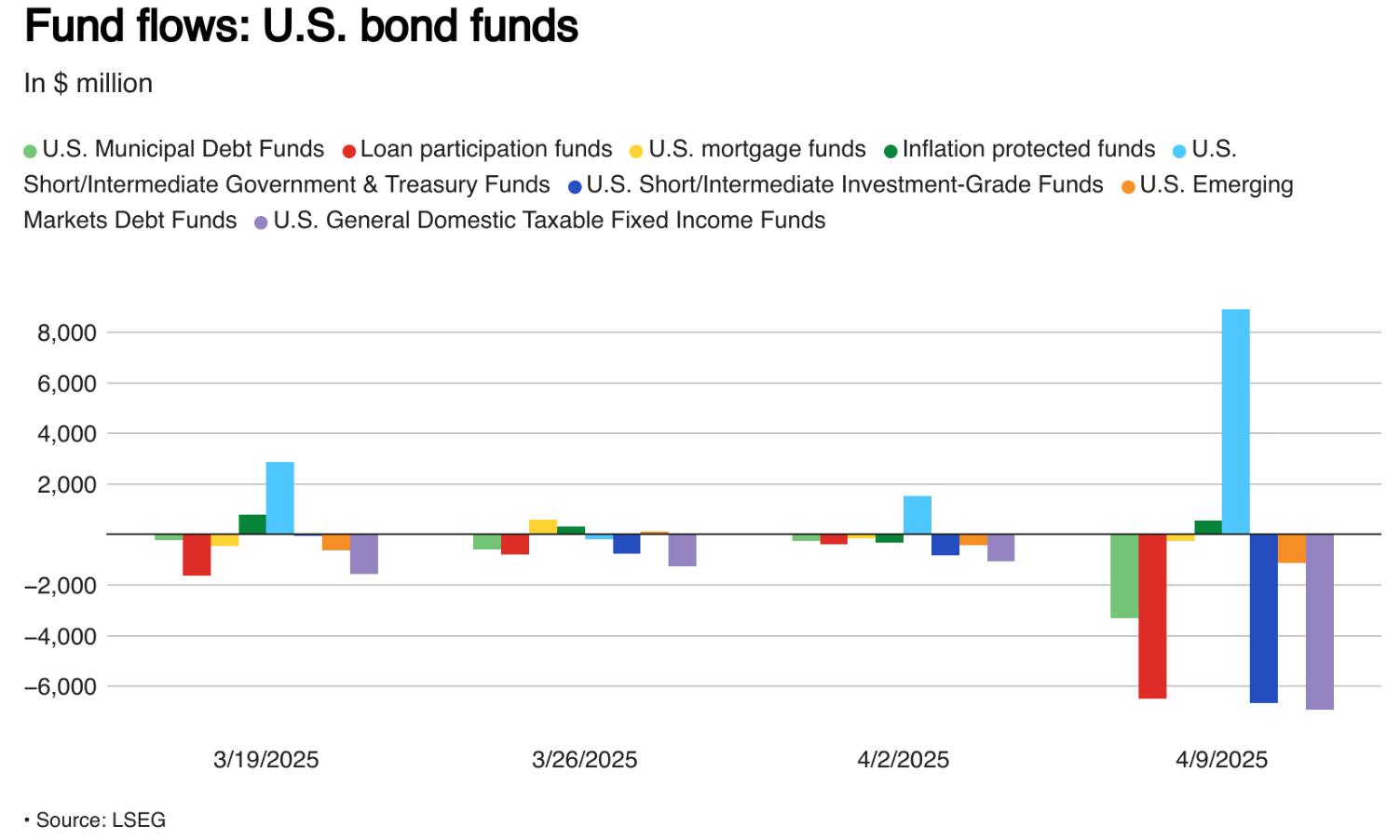

According to Luft, when Trump promoted the escalation of the global trade war, the US bond funds saw the worst capital flight in recent two years! According to data from the London Stock Exchange, the net outflow of the US bond base in the week of April 9 was US $15.64 billion, the highest since 2022. The capital migration triggered by the "tariff nuclear explosion" is reshaping the global asset allocation pattern - funds are crazily withdrawing from fixed income products, but they are back in the stock market with 6.44 billion US dollars, staging a capital drama of ice and fire.

Bond market crash: Three types of funds lose over 20 billion yuan in a single week

Under the dual strangulation of inflation and recession, investors are fleeing the bond market at all costs. Short - and medium-term investment grade funds had a net outflow of $6.66 billion per week, ordinary taxable fixed income funds lost $6.93 billion, and loan funds, once considered safe havens, were sold off for $6.51 billion. The only bright spot is that the short-term and medium-term government bond base has attracted US $8.89 billion against the trend, which shows that the funds are in "emergency hedging" in the treasury bond bond market.

Figure: Capital flow of US bond funds

Stock market counterattack: Wall Street surprises with 64 billion yuan bargain hunting army

When the bond market was in turmoil, stock funds saw a net inflow of $6.44 billion, a shocking reversal from the previous week's outflow of $10.83 billion. Daoming Securities reveals that retail investors are crazily buying bottom prices through low-cost index funds. Large cap funds monopolized $17.71 billion in funds, but mid cap and small cap funds lost $1.9 billion and $1.43 billion respectively, indicating that funds only dare to bet on the "giant safe harbor". The most tragic event was undoubtedly in the financial sector, with a single week outflow of $2.05 billion setting a two-year record, and the banking industry withdrawing capital from the hardest hit areas.

Money market turns sharply: 26.6 billion funds urgently adjust positions

The inflow of money market funds for two consecutive weeks abruptly came to an end, and $26.67 billion of funds suddenly withdrew. This large-scale transfer of liquidity has exposed investors' high sensitivity to the Federal Reserve's policies - as inflation expectations soar to 3.6%, the market is repricing its "cash is king" strategy.

Summary: The Century long Transformation of Global Asset Allocation

The deep logic of this capital migration reflects the market's deep fear of 'Trump inflation'. As indicated by the $2.05 billion outflow from the financial sector, traditional safe haven assets are becoming ineffective as the trade war evolves into a financial war. What is worth pondering is that, at the time when the bond market is flooded with blood, the short-term and medium-term treasury bond have received US $8.89 billion - which may indicate that a more severe storm is brewing, and the monetary policy toolbox of the Federal Reserve is about to usher in a historic test.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights