Warning of US Treasury Collapse! Funds have been fleeing wildly for five consecutive weeks, and Trump's tariff policies may trigger a comprehensive crisis

The latest data shows that the US bond market is experiencing an unprecedented capital flight. Under the shadow of the Trump administration imposing tariffs that could exacerbate inflation, investors are withdrawing from the bond market at a record pace, and this capital outflow has been ongoing for a full five weeks without easing.

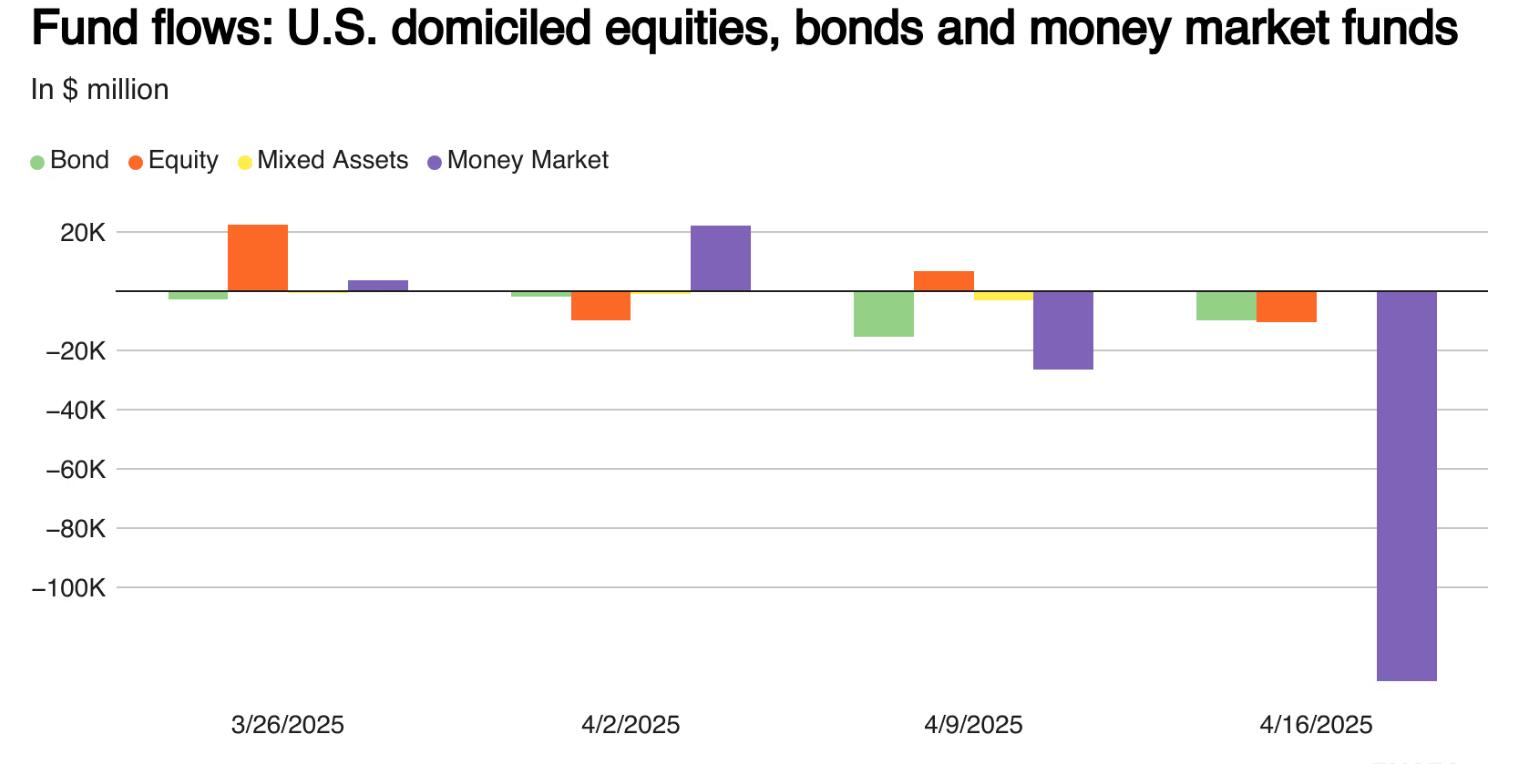

Figure: Capital flow of domestic stocks, bonds, and money market funds in the United States, with green bars representing bonds

US Bond Fund Encountered "Five Consecutive Kills"

According to the latest report of London Stock Exchange Group (LSEG) Lipper, as of the week of April 16, the net outflow of US bond funds was as high as US $10.07 billion. This is the fifth consecutive week that this type of fund has experienced fund outflows, with a staggering cumulative outflow scale. It is worth noting that although the "massive loss" of $15.64 billion from the previous week has eased, market panic continues to spread.

The flow of funds is now extremely differentiated

Against the backdrop of a sell-off in the overall bond market, the flow of funds is polarized:

Short - and medium-term investment grade funds have become the hardest hit areas, with a net outflow of $6.3 billion in a single week, continuing the withdrawal trend of $6.66 billion from the previous week

In the short to medium term, the government and government bond funds rose against the trend and attracted $6.82 billion, becoming a rare safe harbor

General domestic taxable fixed income funds were not spared, with a net outflow of 2.22 billion US dollars

The formation of a dual kill pattern of stocks and bonds

This capital flight is not limited to the bond market:

The net outflow of US stock funds in a single week was $10.62 billion, forming a strong contrast with the net inflow of $6.5 billion in the previous week.

The technology, healthcare, and consumer goods sectors experienced net outflows of $819 million, $514 million, and $348 million, respectively.

Money market funds have suffered a staggering loss of 131.74 billion US dollars for the second consecutive week.

In depth analysis

Market analysts point out that this round of capital migration directly reflects investors' deep concerns about Trump's tariff policies. As the pressure of rising import commodity prices intensifies, the market generally expects inflation to rise again, forcing the Federal Reserve to postpone its interest rate cut plan. Under this expectation, funds are accelerating their withdrawal from risky assets and shifting towards more defensive investment products. The market turbulence caused by policy uncertainty is likely to continue to impact the global investment landscape.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights