Can bulls still persist despite a significant short-term adjustment in gold?

Gold opened lower by nearly $40 in early trading, hitting a low of $3312, a drop of nearly $200 from yesterday's historic high of $3500. There are two main reasons for the emotional trend in the market. Firstly, the US Treasury Secretary's suggestion that international trade tensions will ease has sparked optimism in the stock market, causing funds to flow out of the gold market and suppressing safe haven demand for gold. Another point is that the gold price rose strongly in the early stage, and after the short-term surge, there was a demand for profit taking among the bulls, leading to a pullback in the gold price.

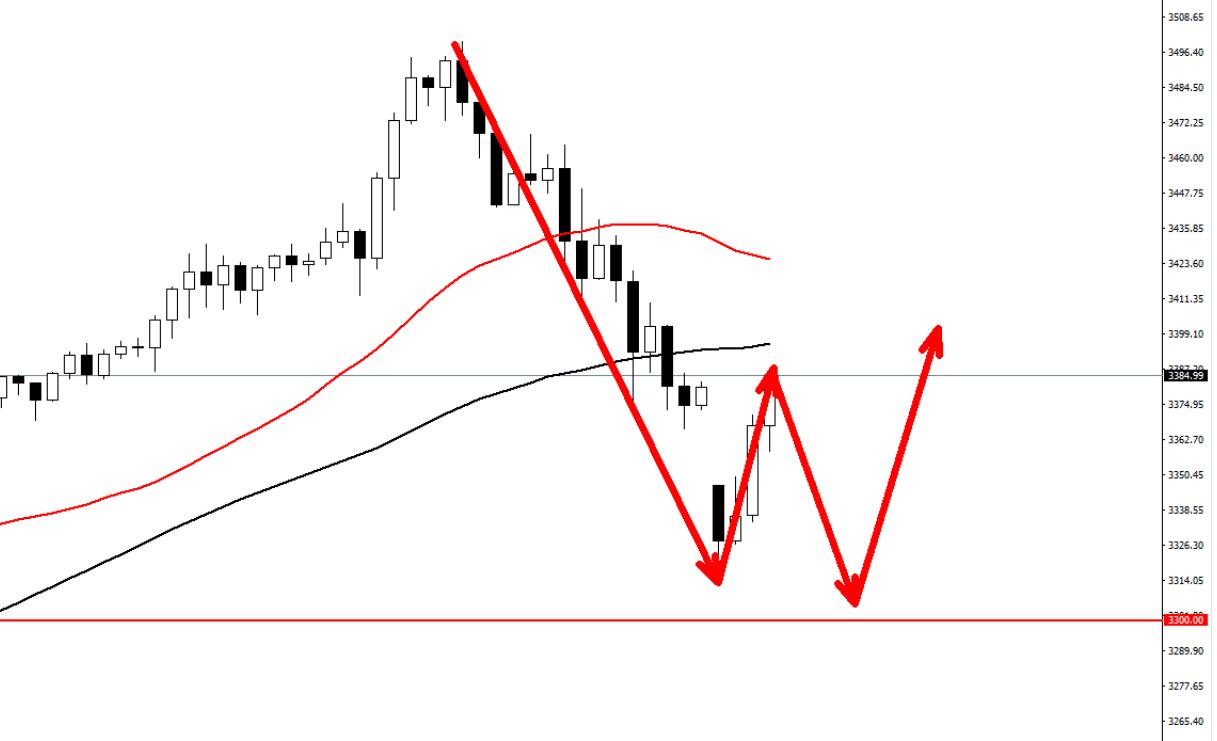

For short-term operations, the market opened short this morning and further declined, but did not continue. The key support level for this round is the 3284 line, which was the starting point of the previous uptrend. If this level has not fallen below, it means that the upward trend of the market has not been broken, and the future market is still mainly bullish! In the morning session, the lowest point reached the 3312 line and began to rise, indicating strong support above the 3300 line. The intraday retracement continued to increase near the 3300 line, with a focus on the watershed of the 3284 line below!

Specific strategies

Gold 3290-3300 buy long, stop loss 3280. Target 3400

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when operating

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights