The Federal Reserve is expected to maintain stability this week, and a rate cut in September is expected!

On Thursday, August 1st at 2:00, the Federal Reserve will hold an interest rate decision. People generally expect that Federal Reserve officials will keep the main interest rate unchanged this week. UBS believes that the Federal Reserve's policy shift is imminent, with a basic forecast of a 25 basis point rate cut for the first time in September.

The probability of the Federal Reserve maintaining stability this week is high

Although some economists say that July is the appropriate time to cut interest rates. However, according to CME's "Federal Reserve Watch", the probability of the Federal Reserve keeping interest rates unchanged this week is 95.9%, and the probability of cutting interest rates by 25 basis points is 4.1%. The probability of the Federal Reserve keeping interest rates unchanged until September is 0%, the probability of a cumulative 25 basis point rate cut is 87.7%, the probability of a cumulative 50 basis point rate cut is 11.9%, and the probability of a cumulative 75 basis point rate cut is 0.4%

During the pandemic, the Federal Reserve maintained interest rates at near zero levels to stimulate the economy with loose monetary policy, and then began raising interest rates from March 2022 to slow down economic growth and curb inflation.

In July 2023, the Federal Reserve raised the federal funds rate to its highest level since 2001 and has remained at that level ever since.

Institutional economists say that at the meeting on August 1st, most Fed officials may reach a consensus on one thing: the downside risk of the Fed's full employment mission is roughly balanced with the upside risk of inflation. It is expected that officials will generally agree that a rate cut at some point in the near future is appropriate, but there may be slight differences in the timing of the rate cut.

Inflation in the United States rose again in the first quarter, but continued to decline thereafter. Some economists say that the Federal Reserve will hold another meeting to ensure that inflation does not accelerate again.

But as economic growth slows and unemployment rates have risen, the economy seems increasingly fragile, and additional external shocks - such as a surge in geopolitical conflicts or a sell-off in credit markets - may push the economy to the edge, "wrote Justin Begley, an economist at Moody's Analytics

He wrote, "Keeping interest rates at such a high level for too long could seriously damage the labor market, further shake business and consumer confidence, all of which are detrimental to personal income

Will Federal Reserve officials signal a rate cut in September?

These factors may lead to a clearer statement from the FOMC at its September meeting on whether to lower the federal funds rate, as observers generally expect.

Federal Reserve officials have stated in recent speeches that they are encouraged by the steady decline in inflation data in recent months, but they will wait for more data before committing to a rate cut.

Michael Gapen, Chief US Analyst at Bank of America Securities, wrote in a commentary, "We expect the Federal Reserve to maintain policy rates unchanged on August 1, while implying that progress has resumed in reducing inflation. The Federal Reserve is optimistic that it may cut interest rates in the short term, but we believe it is unwilling to send signals that September is a foregone conclusion. This is possible, but it depends on the data

If the Federal Reserve keeps interest rates unchanged this week, the September meeting could become a turning point for the Fed's fight against inflation. This will be the first interest rate cut since the outbreak of the pandemic.

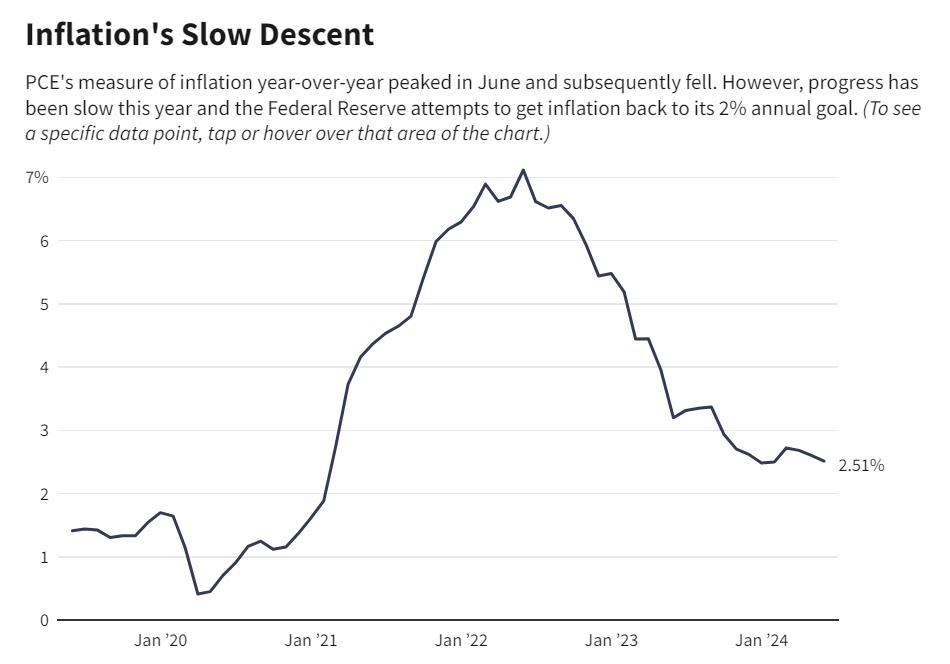

Analyst Cameron Crise stated that the US PCE price index is roughly in line with expectations, but as previously mentioned, after some revisions, the year-on-year change in core data is slightly higher than expected. Considering the general market forecast, the new level of the core index is slightly higher than expected. Excluding the core service expenditure data for housing, it is not as moderate as the corresponding data in the CPI report, with a month on month increase of 0.19%. The corresponding data for the previous month has been raised from 0.1% to 0.18%.

As shown in the figure below, the annual PCE rate in the United States reached its peak in June and then fell back

He pointed out that these data are not enough to prevent the Federal Reserve from cutting interest rates in September, but there is also no indication that the Fed needs to cut interest rates early or by more than 25 basis points. The bond market may be reacting to weaker income/expenditure data as inflation data seems insufficient to support any rebound.

UBS predicts that the US economy will continue to move towards a soft landing. At present, the economy has entered a period of low trend growth, and the growth rate has slowed down to a moderate level. The steady increase in unemployment rate is also consistent with below trend economic growth. There is no indication that the US economy is about to experience a hard landing. At the same time, a general anti inflation process has been put in place. UBS believes that the Federal Reserve's policy shift is imminent, with a basic forecast of a 25 basis point rate cut for the first time in September.

Based on the above news, although the Federal Reserve is expected to maintain stability this week and have little impact on the US dollar index, there is still a possibility of interest rate cuts in September, which will become a factor suppressing the rebound of the US dollar index. Investors need to remain vigilant about this.

Daily chart of the US dollar index

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights