Gold trading reminder: safe haven buying is a flash in the pan, with the rise of the US dollar putting pressure on gold prices and causing them to fall back

On Tuesday morning (July 30th), spot gold fluctuated narrowly in the Asian market, currently trading around $2383.94 per ounce. Gold prices fell 0.2% on Monday, closing at $2383.44 per ounce, affected by the rise of the US dollar. In addition, the risk aversion caused by Israel and Lebanon quickly subsided, and investors are waiting for any signs of interest rate cuts from the Federal Reserve policy meeting.

The US dollar index rose about 0.2% on Monday, hitting its highest level in over two weeks at 104.75 and closing at 104.57, making gold more expensive for holders of other currencies.

With the decline in demand for gold jewelry, China, the world's largest gold consumer, saw a 5.6% decrease in gold consumption in the first half of 2024. However, the purchase volume of gold bars and coins has increased significantly.

Marex analyst Edward Meir said, "The strengthening of the US dollar and the data we see from major Asian countries showing a decrease in gold consumption is a significant negative factor

After rocket attacks in the Israeli occupied Golan Heights, people are concerned that the Middle East conflict will escalate, which supports the demand for gold as a geopolitical risk hedge tool. Gold prices rose to around $2303 at the beginning of Monday trading, but failed to hold onto the upward trend.

Because later Israeli officials stated that they hoped to strike Hezbollah without a full-scale war. This caused a rapid decline in risk aversion.

Traders are preparing for a series of market events later this week, including policy decisions from the Federal Reserve, the Bank of Japan, and the Bank of England, as well as Friday's US employment report, which may be crucial for the Federal Reserve.

The market generally expects the Federal Open Market Committee (FOMC) of the Federal Reserve to keep interest rates unchanged this week, but may acknowledge that inflation is gradually approaching the Fed's 2% target and will lower interest rates by 25 basis points at its next meeting in September. The market is betting that the Federal Reserve will pave the way for a rate cut in September at its policy meeting on Wednesday.

If the Federal Reserve confirms its dovish stance, the forecast may escalate to possibly three interest rate cuts before the end of the year, "said Fawad Razaqzada, a market analyst at Forex, in a report

Although the FOMC will not hold a meeting in August, Federal Reserve Chairman Powell may use the Jackson Hole meeting of central bank governors in late August to prepare for a rate cut. At that time, more inflation data and Friday's July employment report will be available for decision-makers to weigh the conditions for a September rate cut.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex, said: 'The market doesn't have much confidence right now. The market doesn't have much confidence because everyone is reading the same script, which is the Fed's' dovish stance'. '“

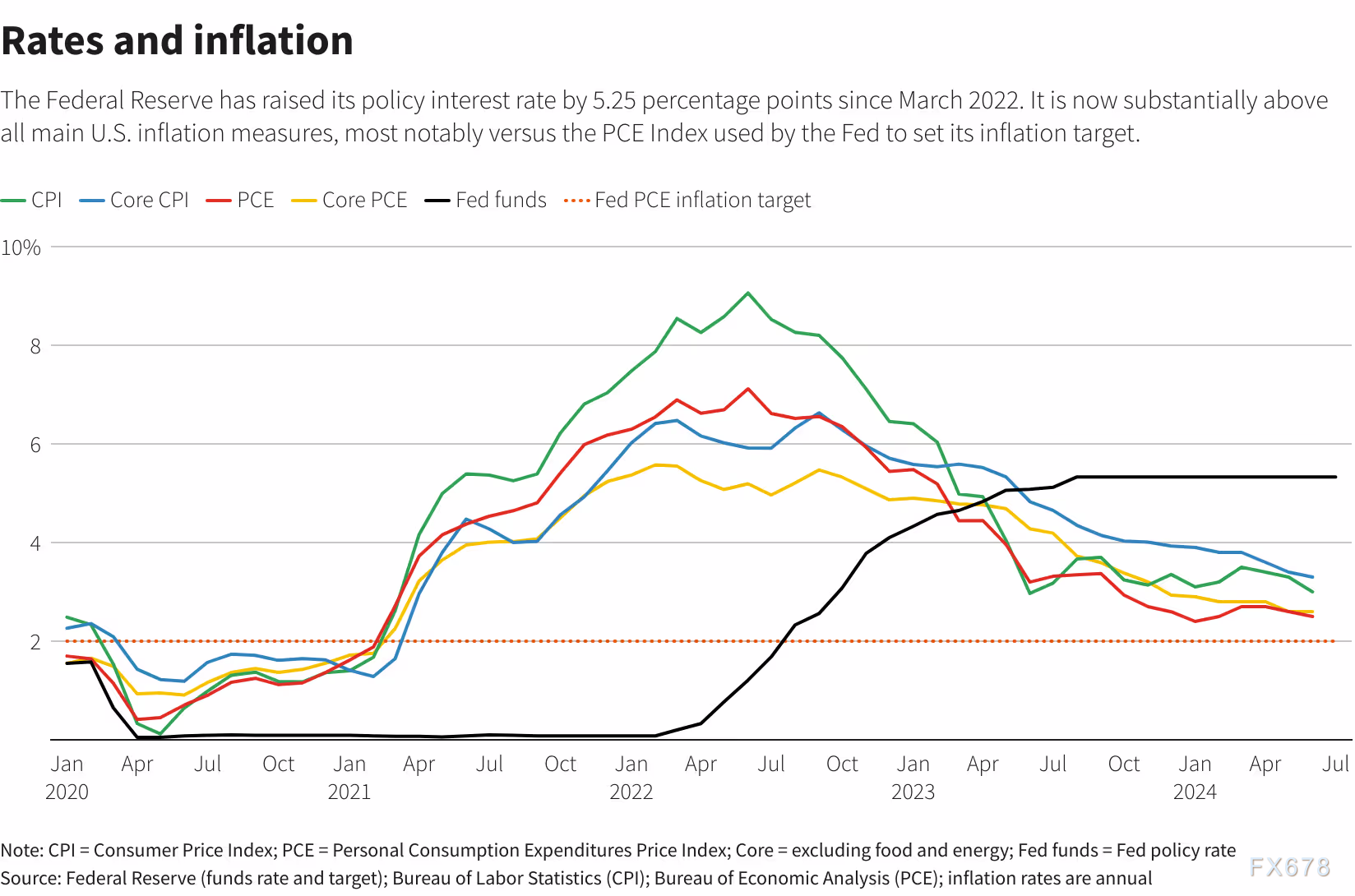

Prior to the meeting on July 30-31, policymakers were unwilling to commit to the timing of the first interest rate cut, but they welcomed recent data showing that price pressures are generally easing. The data shows that the overall inflation rate is getting closer to the Federal Reserve's target, and evidence from employment, real estate, and other markets suggests that this trend will continue.

The data released last Friday showed that the Federal Reserve's preferred personal consumption expenditure (PCE) price index rose 2.5% year-on-year in June, lower than the 2.6% growth in May. In 2022, the year-on-year growth rate of the index reached as high as 7.1%. In fact, since March, the PCE price index has only increased by 1.5% on a month on month basis, which is 0.5 percentage points lower than the Federal Reserve's target. Excluding volatile food and energy prices, the indicator rose by 2.3% during the same period, just one step away from the target of 2%.

Combined with a broader sense that price pressures are easing, these data may be enough to prompt Federal Reserve officials to change their description of inflation as "high" in next week's policy statement and point out that confidence in inflation falling back to 2% is increasing. Decision makers have stated that they should start cutting interest rates before inflation fully returns to target levels, and if the upcoming data remains consistent with those of recent months, they may not have much time left.

The Federal Reserve is only 50 basis points away from its target... so it doesn't seem very far, "said Brad, former chairman of the St. Louis Fed and current dean of the Mitchell E. Daniels Jr. School of Business at Purdue University.

Is the inflation rate still at a high level? Of course. But it's not as high as before, "Brad said. If the statement is slightly modified, such as describing it as "slightly high," it will "send an important signal to the market that you are considering all the inflation declines that have occurred in the past year, that you believe this is true, and that this situation will not reverse

Figure: Trends in US interest rates and inflation

The Federal Reserve has raised interest rates to slow down economic growth after soaring inflation, and has maintained interest rates in the current range of 5.25% to 5.50% since July last year, making the current tightening monetary policy cycle one of the longest in recent decades.

Despite warnings last year that such a strict financial environment could trigger an economic recession, the Federal Reserve seems to have found the best balance point at least for now. The inflation rate has decreased, and although the unemployment rate is gradually increasing, it still remains at around 4.1%. Many Federal Reserve officials believe that this level represents full employment.

Some data, including recent disappointing home sales and rising loan delinquency rates, may indicate economic weakness. But the latest overall economic output report is surprisingly strong, with an annualized economic growth rate of 2.8% in the second quarter. The Federal Reserve believes that the potential economic growth rate consistent with stable inflation is about 1.8%.

They have released encouraging inflation data... It is clear that the US economy is slowing down. The risk balance is different from four months ago, "said Nathan Sheets, Citigroup's global chief economist. I feel like they want to be more certain, so they sent a signal in July and cut interest rates in September

The Federal Reserve will release its latest policy statement at 2:00 am Beijing time on Thursday, and Federal Reserve Chairman Powell will hold a press conference half an hour later.

In the medium to long term, the market seems to still lean towards a bullish outlook. According to data from the World Gold Council (WGC), global gold exchange traded funds (ETFs) that store gold for investors had a net inflow of 9.8 metric tons last week. In July, the gold ETF is expected to have a net inflow of 39 tons, marking the third consecutive month of net inflow.

On this trading day, investors need to pay attention to the June JOLTs job vacancy data in the United States, keep an eye on geopolitical news, and pay attention to changes in market expectations for the Federal Reserve's decision.

Daily chart of spot gold

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights