The Federal Reserve is expected to continue maintaining stability this week, or suggest a suitable interest rate cut in September!

On Thursday, August 1st at 02:00, the Federal Reserve will hold an interest rate decision. Market analyst Jeff Cox wrote that if things go as expected, the Federal Reserve will once again keep short-term interest rates unchanged, roughly at last year's level.

Michael Reynolds, Vice President of Investment Strategy at Glenmede, expects the Federal Reserve to keep interest rates unchanged on Thursday. But the statement after the meeting will receive a lot of attention, and September may be seen as a suitable month for interest rate cuts.

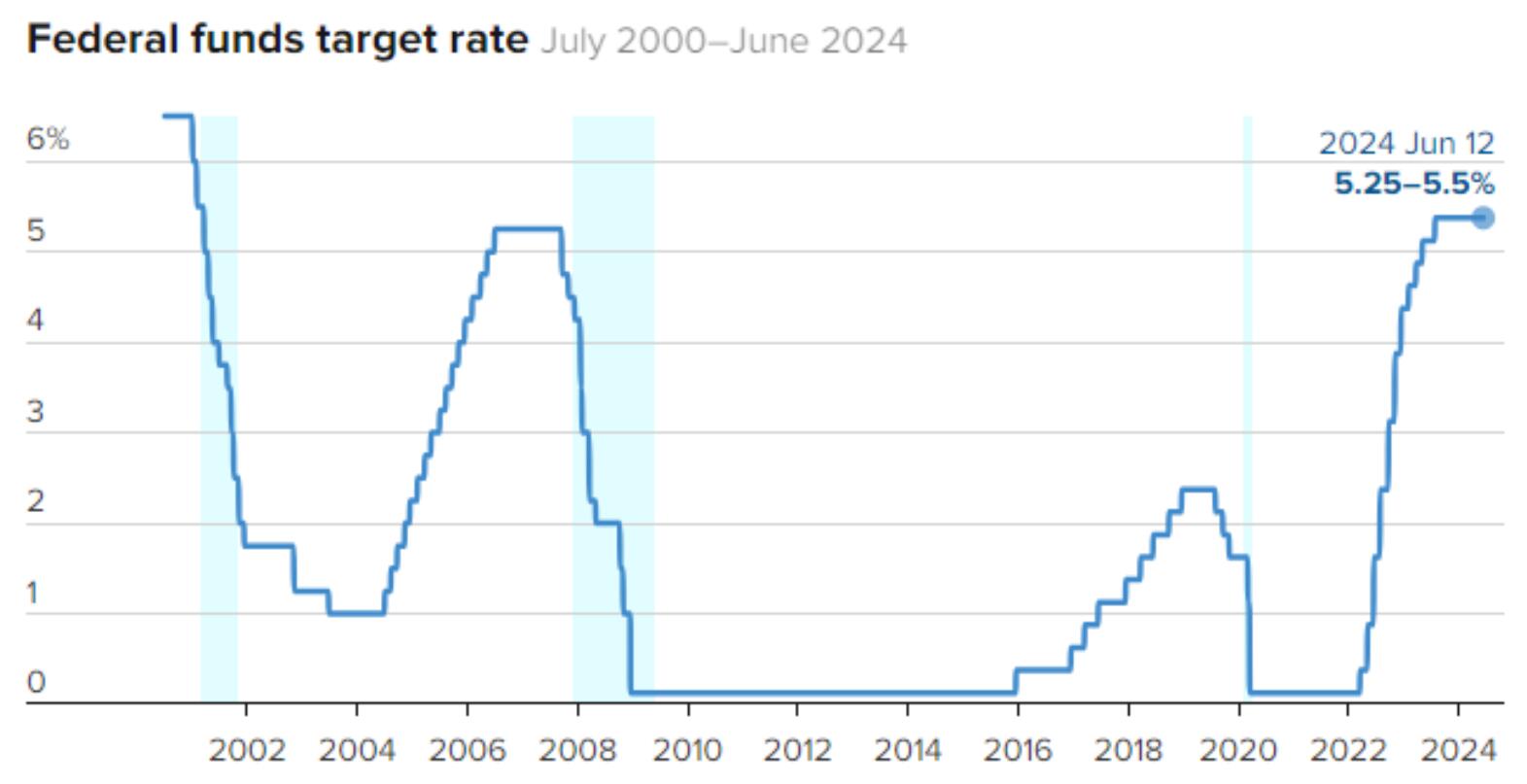

With the release of a large amount of inflation data in recent months, the market generally expects Federal Reserve officials to lay the foundation for the interest rate cuts starting in September. The market expects that the FOMC will send a signal that as long as there are no major data issues, there is a high possibility of a rate hike in September. Over the past year, the Federal Reserve has maintained the benchmark funds rate in the range of 5.25% -5.5%.

Glenmede expects that starting from September, the Federal Reserve may cut interest rates in each of the remaining three meetings, which is basically in line with market expectations.

Federal Funds Target Rate

According to CME's "Federal Reserve Watch", the probability of the Federal Reserve keeping interest rates unchanged this week is 95.9%, and the probability of cutting interest rates by 25 basis points is 4.1%. The probability of the Federal Reserve keeping interest rates unchanged until September is 0%, the probability of a cumulative 25 basis point rate cut is 86.8%, the probability of a cumulative 50 basis point rate cut is 12.8%, and the probability of a cumulative 75 basis point rate cut is 0.4%.

The Federal Reserve has several methods to guide the market to understand its possible intentions without making too many commitments. The subtle language changes in the statement can help achieve this goal, and Powell may prepare some written responses for the press conference to convey possible paths for future policies.

Goldman Sachs economists believe that the Federal Open Market Committee will make some changes.

A key change could be a statement in the declaration that the committee will not cut interest rates until it has "greater confidence that inflation will continue to move towards 2%". Goldman Sachs economist David Mericle predicts that the Federal Reserve will modify this statement to say that it only needs to "slightly increase confidence" to begin easing monetary policy.

Mericle stated in a report, "Recent statements from Federal Reserve officials indicate that they will maintain interest rates unchanged at this week's meeting, but have taken a step towards the first rate cut. The main reason why the Federal Open Market Committee is closer to a rate cut is favorable inflation news in May and June

However, do not expect Federal Reserve officials to show too much enthusiasm.

Bill English, former head of monetary affairs at the Federal Reserve and current professor at Yale University, said, "Inflation data in the United States has rebounded significantly this year. Last winter, we received quite high numbers. We have several months of data. However, I think they are really unsure where inflation is and where it will go

English expects the Federal Reserve to hint at taking action in September, but will not provide a detailed roadmap for specific actions.

The Federal Reserve will not provide the latest quarterly economic forecast summary at this meeting. This includes a "dot matrix" of individual members' expectations for interest rates, as well as informal forecasts for GDP, inflation, and unemployment rates.

Based on the above news, although there is a high probability that the Federal Reserve will keep interest rates unchanged this week, there is still a possibility of a rate cut in September. This is a potential negative for the US dollar index, which may suppress its rebound space. Investors need to remain vigilant about this.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights