The probability of Bank of England cutting interest rates this week exceeds 60%, and if stability is maintained, the rebound of the pound will also be limited!

On Thursday, August 1st at 19:00, the Bank of England will hold an interest rate decision. The currency market pricing collected from the overnight index swap market shows that the likelihood of a rate cut currently exceeds 60%, which is higher than the 40% earlier this month.

Market analyst Gary Howes said that if the Bank of England continues to cut interest rates, as the gap between reality and expectations completely narrows, the pound will further weaken.

Valentin Marinov, head of G10 foreign exchange strategy at Credit Agricole, said, "Therefore, a rate cut may be seen as a more dovish outcome than the market currently expects, which will put pressure on the pound. We expect the Bank of England to cut interest rates by 25 basis points at this week's meeting with a 5-4 vote

If the Bank of England cuts interest rates, the risk will asymmetrically lean towards a weak pound, "said Kamal Sharma, a foreign exchange strategist at Bank of America

Market analyst Gary Howes said that if the Bank of England keeps interest rates unchanged, the pound may rebound, but the strength is expected to be limited. This is because if the Bank of England maintains stability in August, the decision will be accompanied by clear guidance for a rate cut in September. Therefore, the increasing possibility of a rate cut in September will suppress the pound.

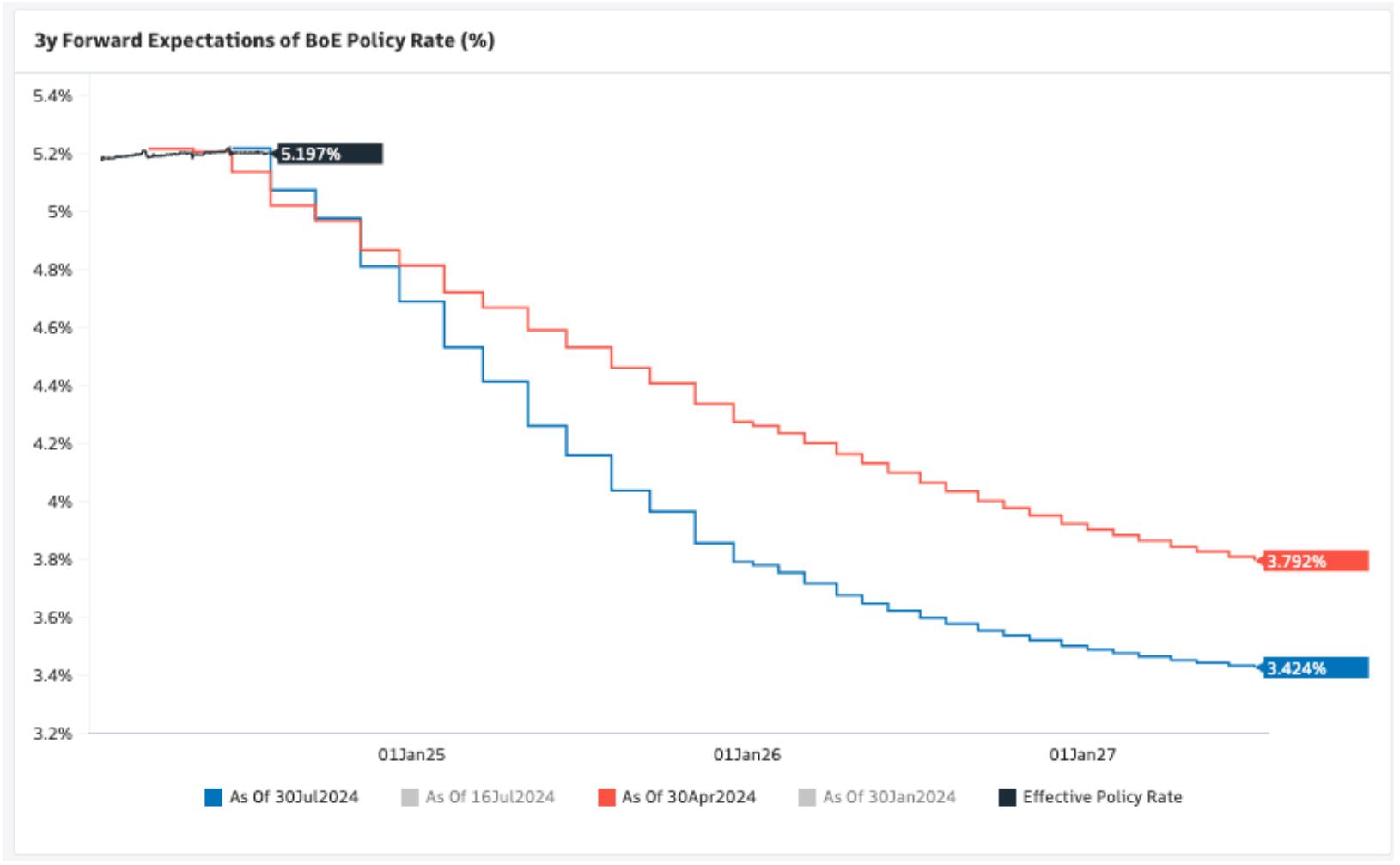

The expected trend of interest rates in the UK over the next three years

We expect the Monetary Policy Committee to keep interest rates unchanged at its meeting on August 1st, and we expect the committee to use monetary policy reports and press conferences to push for a rate cut in September, "said Andrew Goodwin, Chief UK Economist at Oxford Economics

Barclays economists predict that the Bank of England will initiate a rate cut cycle this Thursday, due to the "inclination revealed by core members of the Monetary Policy Committee (MPC) in June to begin easing monetary policy soon".

However, Barclays' foreign exchange strategists believe that the downside space for the pound is limited, stating that the hawkish interest rate cuts by the Monetary Policy Committee are an opportunity for the pound.

These strategists said, "The interest rate differential should not be greatly affected by the redistribution of reduced funds throughout the entire cycle, which means that the damage to the pound is limited. On the contrary, in our view, demand elasticity and willingness to rejoin the EU have a much greater positive impact on the pound, and if the pound weakens further, we will go long again

Daily chart of GBP/USD

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights