After hitting a two-week high, gold prices plummeted, and the market expects the Federal Reserve to cut interest rates faster

On Friday (August 2), during trading in New York, due to weaker than expected data released by the United States, gold prices reversed their trend after hitting a two-week high of $2477, plummeting nearly 1%. This put pressure on the US dollar and led to a sharp drop in the yield of US treasury bond bonds, as investors expected the Federal Reserve to cut interest rates faster than they thought.

Spot gold Spot gold fluctuated as disappointing US economic indicators depressed US dollar and US treasury bond yields

The US non farm payroll data released on Friday disappointed investors who are still digesting the disappointing ISM manufacturing PMI report, which has raised concerns about the health of the US economy.

The US Department of Labor revealed that spot gold added 114000 new workers in July, lower than the expected 175000. The previous data was revised down from 206000 to 179000. Further data shows that the unemployment rate has increased from 4.1% to 4.3%, and the average hourly wage has decreased from 0.3% to 0.2%, a decrease of one tenth.

The spot gold price rose sharply as the yield of the US 10-year treasury bond bond fell more than 15 basis points to 3.815%. The US dollar has also been affected, with the US dollar index plummeting over 1.13% to 103.16.

After the release of spot gold data, most banks began to digest the expectation that the Federal Reserve would adopt a more aggressive monetary easing policy. Bank of America expects the Federal Reserve to cut interest rates for the first time in September instead of December, while Citigroup and JPMorgan Chase expect the Fed to cut interest rates by 50 basis points in September and November respectively.

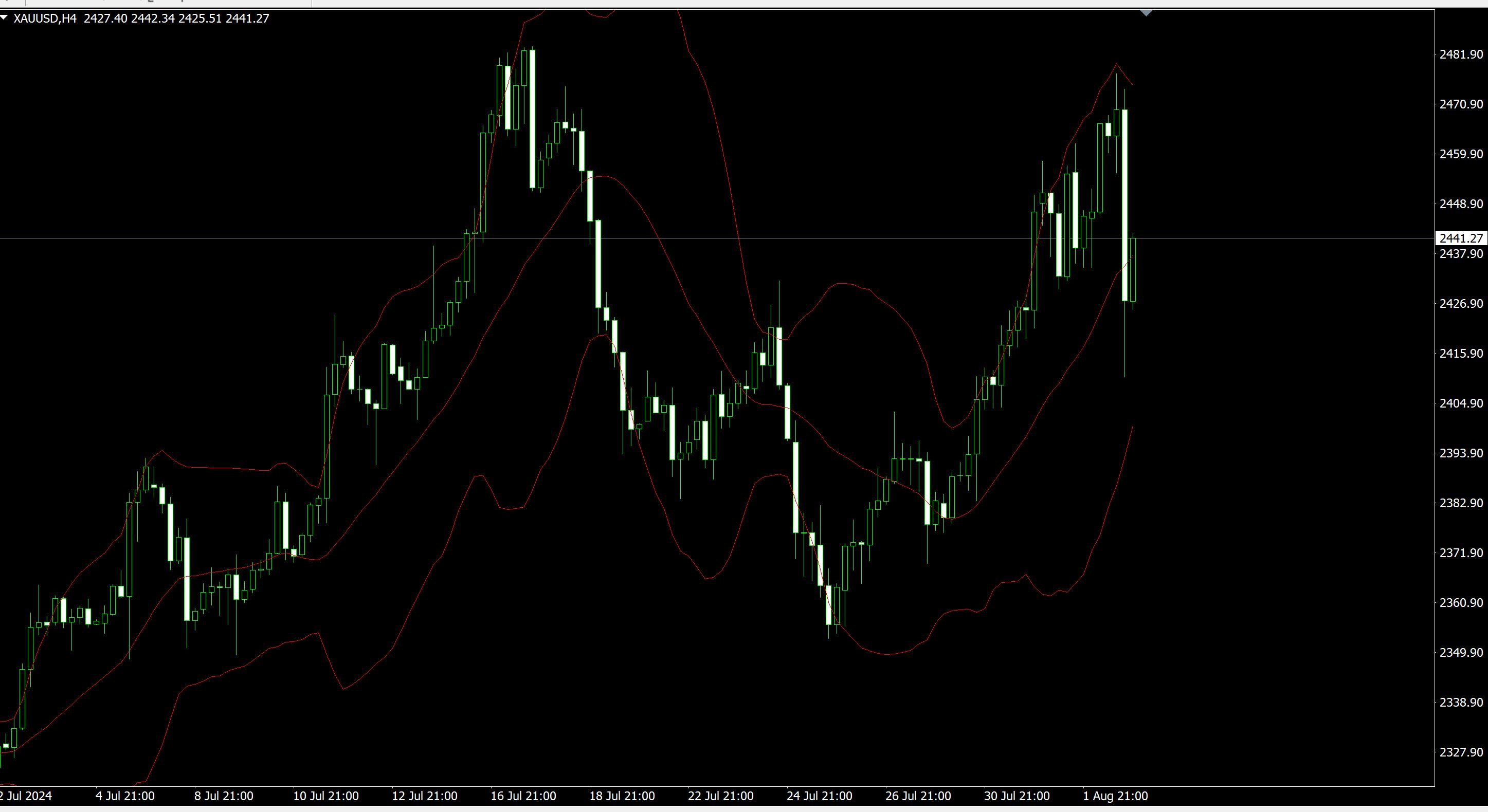

Spot Gold Price Analysis: Technical Outlook

The gold price has fallen back to the low of $2404-2410 on July 31, which may be due to profit taking before the weekend, as the yield of US treasury bond bonds and the US dollar exchange rate are still at a one week low. From a technical perspective, spot gold will remain bullish, and if the buyer's daily closing price exceeds $2450, this may intensify the challenge to historical highs before the $2500 mark.

If the price further weakens, the gold price may fall below $2400, which could pave the way for a pullback to the 50 day moving average of $2364, and then test the 100 day moving average of $2337.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights