What is the next big move for the Japanese yen when the USD/JPY breaks through key technical levels?

In the volatility of financial markets, the trend of USD/JPY has always been a focus of attention for professional traders. On Monday (August 12th), during the European session, the USD/JPY rose and traded near the 147.285 level, with a daily increase of 0.43%

Under the influence of the Japanese holiday, market trading was relatively light, but the slow decline of the yen against the US dollar did not stop as a result. The expectation of the Federal Reserve's interest rate cut next month has become the focus of market participants' attention, although the market still holds a contradictory attitude towards it. The strong performance of US employment data has reduced market bets on the Fed's interest rate cuts this year, but investors still have doubts about whether the Fed can bear the cost of slow rate cuts.

The upcoming release of US inflation data has brought uncertainty to the market. According to the FedWatch tool of a well-known institution, investors' expectation of a 100 basis point easing before the end of the year is consistent with the scenario of an economic recession. In addition, the convening of the annual meeting of global central banks and the release of Nvidia's financial report will also have an impact on market sentiment.

Technical observation

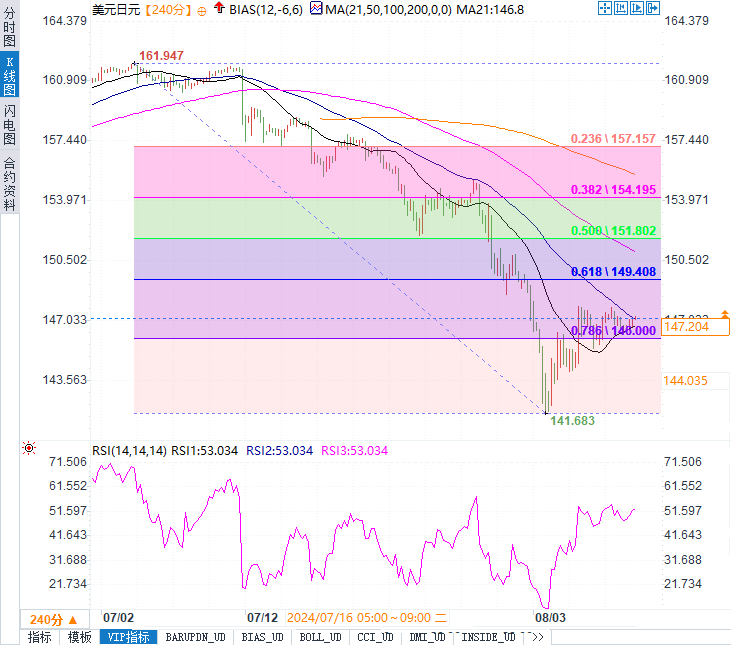

From a technical perspective, the US dollar/Japanese yen has closed above the Fibonacci retracement level of 146.00 for three consecutive trading days, indicating a bullish signal. The market expects the currency pair to rise to 149.408, which is a 38.2% retracement of the decline from 161.947 to 141.68.

Analyst's viewpoint

Christopher Wong, a foreign exchange strategist at OCBC Bank in Singapore, pointed out that the market should be slightly prepared before the release of US inflation data. The Mizuho analyst team reminds investors to pay attention to other employment and inflation data that will be released during the Federal Reserve's September meeting. They believe that the market is showing a delicate balance before this week's inflation data is released.

Morgan Stanley analysts have revised their forecast for the Japanese yen against the US dollar for the second quarter of next year to 144 yen, suggesting that the yen will consolidate in the coming months. They believe that although carry trades have wiped out the gains since the beginning of this year, there is reason to be optimistic about the medium-term prospects of the US dollar.

Based on the above analysis, we can conclude that despite the uncertainty in the market, the downward trend of the Japanese yen against the US dollar has not changed. Traders should closely monitor the upcoming US inflation data, as well as the impact of global central bank annual meetings and Nvidia financial reports.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights