World Gold Council: Global gold ETF fund inflows soar sharply in July

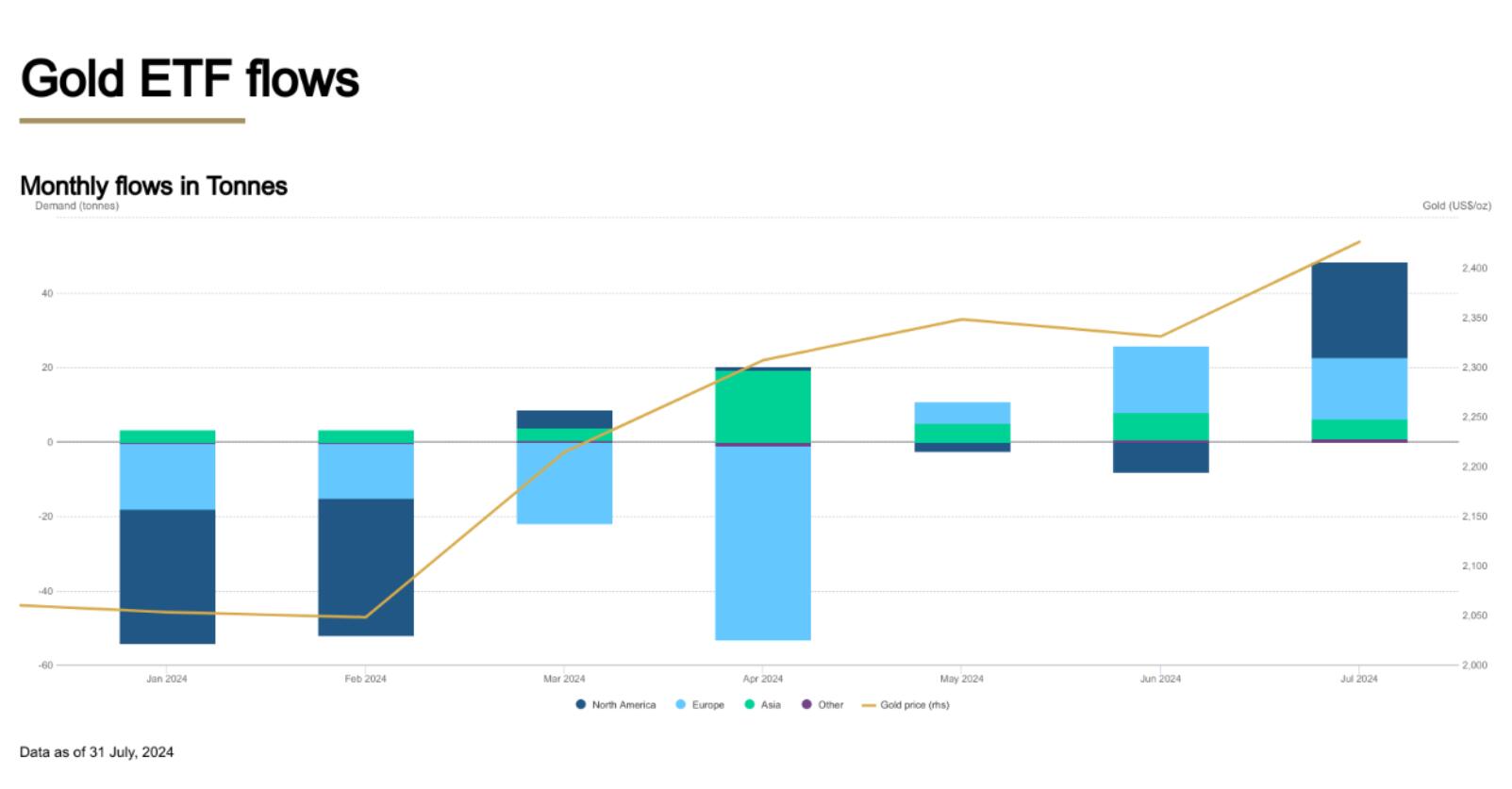

According to data from the World Gold Council, after North American funds finally joined global gold ETFs, global gold ETFs experienced their strongest month of inflows since April 2022.

Analysts from the World Gold Council stated in their latest July gold ETF liquidity report that global gold backed exchange traded funds (ETFs) have seen inflows for the third consecutive month, with an increase of $3.7 billion in gold investments for the month. Although these numbers are very strong, what is most surprising is the regions driving growth.

The World Gold Council wrote, "It is worth noting that all regions reported positive liquidity this month, with Western gold ETFs contributing the most. In July, capital inflows combined with a 4% increase in gold prices drove the total assets under management (AUM) globally to grow by 6%, reaching $246 billion, setting a new record for the end of the month. Collective holdings increased by 48 tons in July, reaching 3154 tons

The World Gold Council pointed out that "continuous inflows of funds in recent months have narrowed the month on month losses of global gold ETFs to $3 billion. Although collectively held assets have decreased by 72 tons (-2%) so far in 2024, their total asset management scale has increased by 15% supported by a 17% rise in gold prices

The World Gold Council stated that although the trend changed in July, funds in Europe and North America are still generally negative in 2024, while the inflow of funds from Asia this year is quite substantial.

From a regional distribution perspective, North American funds recorded an inflow of $2 billion, offsetting the small outflow of funds in May and June.

The World Gold Council pointed out that "July was unprecedented on the political front, first with an assassination attempt against Trump, and then with Biden's withdrawal from the presidential campaign. Gold ETFs had inflows of funds around both dates, indicating an increase in safe haven demand. At the same time, inflation rates have decreased, labor markets have cooled, and Federal Reserve Chairman Powell stated at a recent meeting that the September rate cut is" on the table, "which has intensified investors' expectations of an imminent relaxation. In turn, the yield of US treasury bond bonds fell and the US dollar weakened, driving gold prices to a record high this month and stimulating investors' interest in gold ETFs. In addition, we believe that the volatility of the stock market, especially in the second half of July, also supports the demand for gold ETFs

(Recent months' inflow of gold ETFs: Deep Blue North America, Blue Europe, Green Asia)

So far this year, the total outflow of funds from North America has been $2.9 billion, with an overall decrease of 52% in holdings, second only to Europe. Despite this, the total asset management scale of North American funds increased by 14% year-on-year, driven by recent capital inflows and a significant strengthening in gold prices, "analysts said

But a few months ago, the situation in Europe had already changed. The World Gold Council pointed out that the region has recorded three consecutive months of capital inflows, attracting $1.2 billion in July, the strongest level since March 2022, with the UK and Switzerland leading the way in capital inflows.

The World Gold Council stated that "the common background in the region in July was the continuous decline in government bond yields." Although the European Central Bank kept interest rates unchanged at its July meeting, Lagarde's comments on the "fully open" decision in September intensified investors' expectations for another interest rate cut in the near future. At the same time, investors had expected the Bank of England to launch its easing cycle on August 1st - and it did not disappoint market consensus by cutting interest rates by 25 basis points, the first in four years. In addition, the new British Chancellor of the Exchequer, Rachel Reeves, promised to meet financial challenges, which will help restore some confidence in public finance and help reduce the yield of British treasury bond bonds. "

The World Gold Council stated, "With the opportunity cost of holding gold decreasing, investors in the region are showing increasing interest in gold ETFs - record breaking gold prices further boosting this trend

The inflow of funds in the past three months has narrowed Europe's losses so far this year to $3.7 billion and reduced its total holdings to 66 tons. Analysts said, "Similar to North America, the rise in gold prices, coupled with recent positive demand, has led to a total asset management scale of $103 billion for funds in the region, an increase of 12%

At the same time, Asian investors have also been impacted by high gold prices, with a net inflow of gold funds in the region reaching $438 million in July, marking the 17th consecutive month of inflows into Asia, with India having the highest inflow of funds.

The World Gold Council stated that "India's strong demand is mainly due to the recently announced budget changes, which have effectively shortened the qualifying period for long-term investments, lowered relevant tax rates, and made the investment environment for gold ETFs more fair and attractive." The strengthening of gold prices denominated in local currency has also helped. China and Japan have also experienced net inflows of funds, possibly driven by similar factors such as weak stock markets and strong local gold prices this month

Despite a relatively slower growth rate in July, Asia still has a capital inflow of $3.6 billion in 2024, "significantly exceeding all other markets," with China and Japan being the main driving forces. Supported by record inflows and rising gold prices, the asset management scale of Asian funds has reached $15 billion, the highest level in history, while total holdings have increased by 47 tons, "analysts said

The World Gold Council stated, "In other regions, July marked the second consecutive month of moderate capital inflows, mainly from South Africa, where political uncertainty after the country's elections may have helped. Australia also experienced positive capital flows, possibly driven by strong gold prices due to currency depreciation. So far, funds listed in other regions in 2024 have received $40 million in inflows, mainly from South Africa

The trading volume in the global market has also rebounded, averaging $250 billion per day in July, a 27% increase from June and far higher than the average level of $163 billion per day in 2023.

Analysts pointed out, "Similar to June, strong LBMA trading volume drove global over-the-counter (OTC) activity to grow by 16%, reaching $150 billion per day, a 13% increase by tonnage. In July, trading volume on all major exchanges increased, with a staggering 51% month on month increase, led by COMEX. Global gold ETF trading activity also increased, with a 9.3% month on month increase, mainly driven by North American funds

COMEX's total net long position also increased significantly by 2% in July, reaching 783 tons. The World Gold Council stated, "Amid intensified expectations of interest rate cuts, gold prices continue to strengthen and yields continue to decline, driving fund managers' net long positions (the main component of COMEX's net long positions in gold) to 588 tons at the end of July. This represents a 2% monthly growth rate, the highest end of month level since February 2020.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights