What is the spread in foreign exchange gold trading?

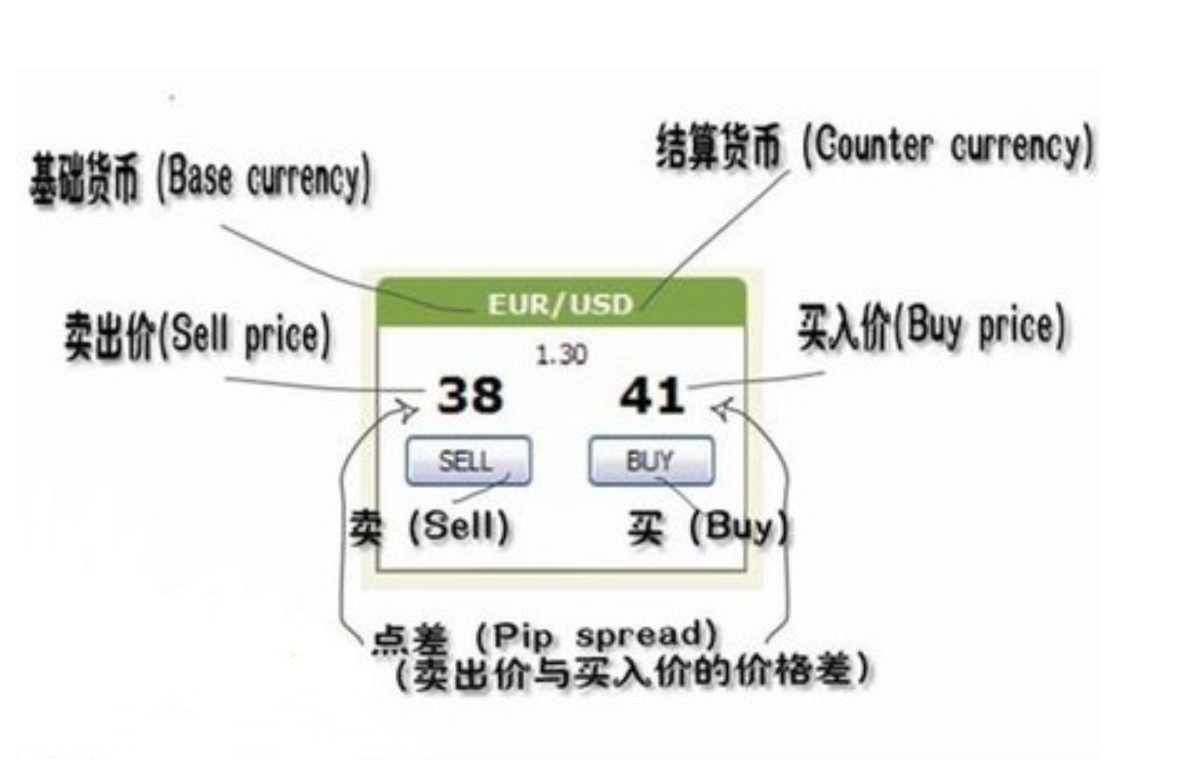

Spread refers to the difference between the bid and ask prices, representing one of the costs of foreign exchange gold trading. For example, the selling price of the euro against the US dollar is 1.1474, while the buying price is 1.1478. The difference in the middle is 4 points, and this 104 points is what we call the "spread", which can be seen as the transaction fee charged by the platform.

The smaller the number of people trading, the greater the bid bid bid spread of currency.

The spread is also related to the size of your funds.

How to calculate point values?

Point value is the profit and loss amount of a price fluctuation of 1 point Taking the euro/US dollar as an example, the trading volume is one hand (100000). If the euro/US dollar overflows from 1.1483 to 1.1484, a little bit is equivalent to 0.0001, and the point value is 0.0001x100000/1.1483=8.71 euros. Due to trading in US dollars, converting to US dollars is equivalent to 8.71x1.1483=10 dollars. Therefore, when investing more in the euro/US dollar currency pair, if there is a slight increase, it can earn 10 dollars.

Traders usually do not need to calculate point values themselves, and almost all foreign exchange gold platform software will automatically settle, but familiarity with the calculation methods is still quite useful for traders.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights