Crude Oil Market Analysis: Can Oil Prices Continue to Soar?

On August 26, 2024, the international crude oil market continued its upward trend from last weekend. The rise this time is mainly driven by the intensification of geopolitical tensions in the Middle East and expectations of an upcoming interest rate cut by the United States. At the geopolitical level, the conflict on the border between Israel and Lebanon, especially the incident of Hezbollah launching rockets at Israel, has raised concerns in the market about the security of oil supply in the Middle East. Meanwhile, Federal Reserve Chairman Powell's statement on interest rate cuts further boosted the global economic outlook and fuel demand expectations. Under the combined effect of these factors, international crude oil prices continued to rise during today's trading session.

As of 16:07 Beijing time, Brent crude oil futures prices rose 1.12% to $79.04 per barrel, while West Texas Intermediate (WTI) futures prices in the United States rose 1.26% to $75.77. Market analysts generally believe that the current upward trend will continue in the short term, especially as geopolitical risks continue to rise.

The biggest uncertainty in the current market comes from the evolution of the situation in the Middle East. On August 26th, the conflict on the border between Israel and Lebanon drew global attention. Hezbollah launched hundreds of rockets and drones at Israel, while the Israeli military deployed about 100 fighter jets in retaliation. This incident is one of the most serious conflicts in the region in the past ten months, further exacerbating market concerns about the security of the Middle East's oil supply chain.

Kelvin Wong, Senior Market Analyst at OANDA in Singapore, stated, "Geopolitical risk factors may have a significant impact on the oil market. The possibility of retaliatory attacks by Hezbollah and Iran in a tit for tat manner increases, which may continue to support WTI crude oil." He pointed out that if this situation escalates further, the market may face greater supply disruption risks, which will create sustained upward pressure on crude oil prices.

Expectations of loose monetary policy in the United States and its impact on oil prices

In addition to geopolitical risks, the expectation of loose monetary policy in the United States is also an important factor driving up oil prices. Last Friday, Federal Reserve Chairman Powell's speech clearly stated that the time to cut interest rates had come, which immediately triggered a strong reaction in the market and pushed commodity prices, including crude oil, to rise comprehensively.

ANZ analysts pointed out in a report that "the prospect of loose monetary policy has boosted the sentiment of the entire commodity market." The market generally expects that with the implementation of the Federal Reserve's interest rate cuts, global economic growth will receive some support, thereby driving up fuel demand. This expectation has brought new upward momentum to the crude oil market.

However, ANZ analysts also warned that although the expectation of interest rate cuts has brought short-term optimism to the market, the uncertainty of the outlook for major global economies may still suppress fuel demand. Last week, due to this reason, oil prices fell back after a brief rise.

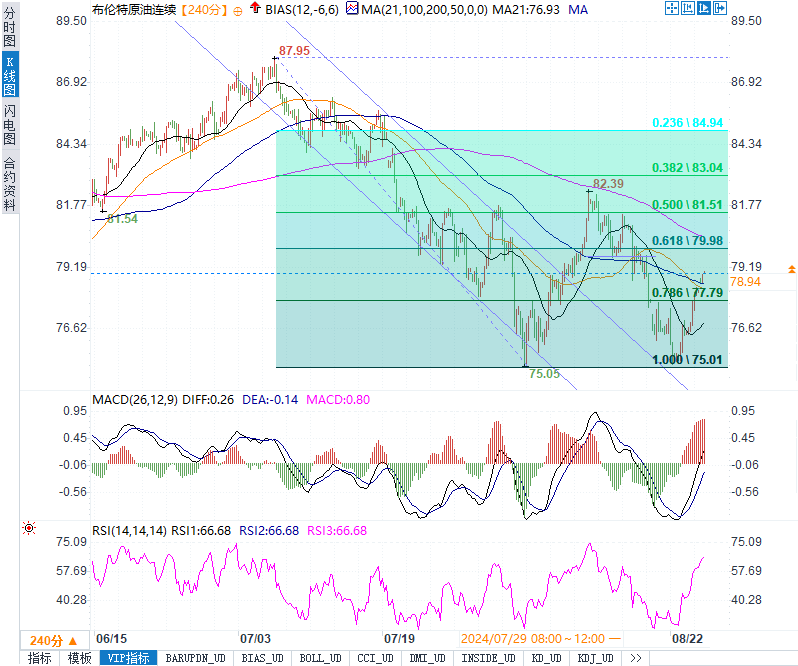

Technical analysis

From a technical perspective, WTI crude oil futures prices have confirmed breaking through the key support level of $75.00 and are currently approaching the level of $76.86. Market analysts suggest that the bullish trend should continue in the short term, and the target price can be extended to $78.35. However, if the price falls back and falls below $75.00, it will face further downward pressure and may experience a pullback towards the $73.70 level.

Similarly, Brent crude oil futures prices have successfully broken through the level of $78.80, temporarily halting the recent downward trend. Technical analysis shows that above this price level, Brent crude oil will build a new bullish wave, with a target of $80.65. However, market participants caution that random indicators may show horizontal fluctuations in the short term, and if the price falls below $78.80, it will once again be under bearish pressure.

Summary of institutional viewpoints

Priyanka Sachdeva, Senior Market Analyst at Phillip Nova, is cautious about OPEC+'s actions. She pointed out that OPEC+'s plan to increase production later this year may exert some pressure on the current rise in oil prices. However, given the current market concerns about geopolitical risks and the global economic outlook, crude oil prices may still maintain a strong upward trend in the short term.

In addition, Baker Hughes pointed out in its weekly report that the number of active drilling rigs in the United States remained unchanged at 483 last week. This data indicates that the growth rate of shale oil production in the United States has slowed down, which also provides potential support for oil prices.

Conclusion and Prospect

Overall, the current crude oil market is in a complex situation of multiple intertwined factors. The escalation of geopolitical risks and the expectation of loose monetary policy in the United States have formed the main driving force for the rise in oil prices. In the short term, oil prices may continue to maintain an upward trend, especially as the situation in the Middle East worsens further. However, the production decisions of OPEC+and the uncertainty of the global economic outlook remain key factors affecting the trend of oil prices.

In the coming days, the market will closely monitor the development of the situation in the Middle East and the monetary policy movements of the Federal Reserve. Any changes in these two factors could have a significant impact on oil prices.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights