The gold price will not experience a significant pullback like in 1979 and 2011

Although the price of gold fell by 50% or more after reaching historical highs in 1979 and 2011, according to an analysis by Tim Zyla of The Jerusalem Post, the current price level may actually be sustainable.

He wrote, "Over the past 50 years, gold has experienced two major peaks - in 1979 and 2011, but only joined this club in 2024 after the price recently broke through the trend lines of two top connected peaks separated by 32 years." He shared a chart showing that gold broke through the 45 year historical trend line.

Zla believes that the key question is whether this milestone should be interpreted as bearish or bullish. He said, 'Although traditional views suggest that linear charts are difficult to provide conclusive evidence of any one-way trend, let's compare the global economy in 1979 and 2011 to gain insight into the next move in gold prices.'.

He first described the geopolitical and economic environment during the sharp rise in gold prices 45 years ago. This year is 1979. The Soviet Union had just invaded Afghanistan, Margaret Thatcher was elected as Prime Minister, and the United States was experiencing its first Three Mile Island nuclear accident. More importantly, the inflation rate has reached an unprecedented 11%, and the unemployment rate is close to 6%. This sounds worse than the economy after the COVID-19 epidemic - at least before Paul Volcker intervened, it was. "

Zla said that the incoming Federal Reserve Chairman has proven himself to be a "hawk among hawks". He saw the economic problem and said there is only one way to solve it, and that is pain

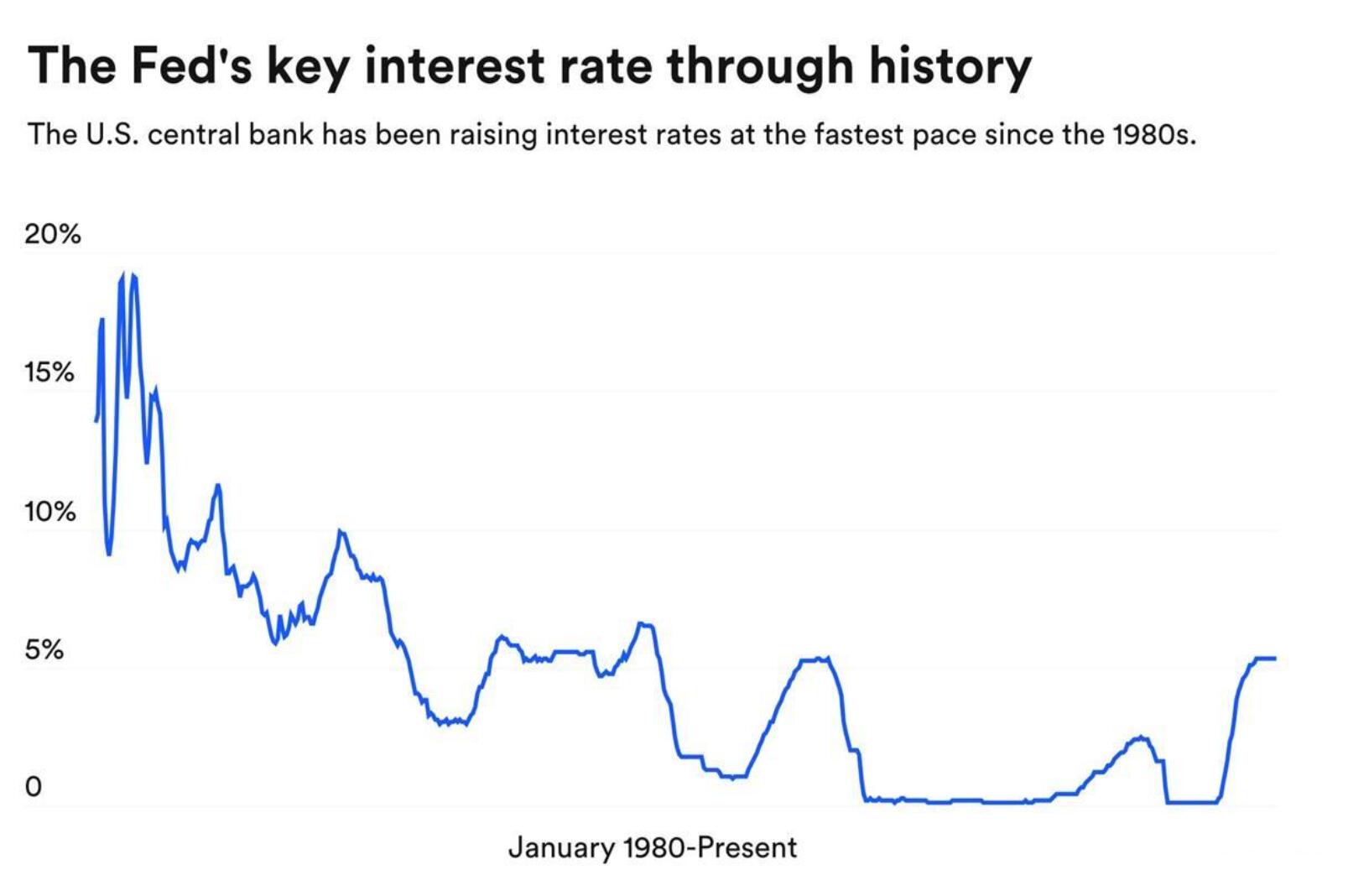

Under Volcker's leadership, the federal funds rate peaked at 20% in June 1981. He pointed out, "It is understandable that gold prices plummeted from their peak until 32 years later in 2011, after Volcker's significant measures, when they returned to the same level

He stated that the events surrounding the rise in gold prices in 2011 were different, but the rise in gold prices was also driven by specific geopolitical and economic shocks.

Zla wrote, "Although the inflation event in 1979 was triggered by the energy crisis in the Middle East, the surge in gold prices in 2011 can be attributed to a major factor - the bad behavior of global banks - as well as several secondary factors. After the US government decided to provide emergency assistance with taxpayer money to save most banks from bankruptcy, gold became the wisest choice. The US government is entering an unprecedented situation. Not many economists know for sure what the impact will be, so investors naturally turn to gold as a safe haven asset

By August 2011, the trading price of gold in the spot market was above $1900 per ounce, and then entered a downward trend again, with the price dropping by more than half from its peak to trough.

He pointed out that once the narrow and specific economic and financial factors driving the rise of gold prices are eliminated, the gold price will give up its gains.

He said, "The US government's policy of rescuing banks has raised short-term concerns, which has boosted gold prices. However, over time, this approach has proven successful, and as the prospect of a global financial collapse recedes, gold prices have begun to steadily decline

Zla said that this situation is different from the previous two times. He said, "The main difference between the significant increase in gold prices now and the previous two increases is obvious - there have been no major or catastrophic events that have caused gold prices to rise. Of course, inflation is real, but it is far from reaching the level of 1979, and there are not many people calling for the collapse of the entire financial system now

He concluded, "The decline in gold prices from their peak in 1979 and 2011 has been relatively rapid and intense, leaving little time for retail investors to react. However, due to the more leisurely rise in gold prices this time, this situation is unlikely to happen again. Although a short-term correction is always possible, with the Federal Reserve hinting at easing monetary policy, there is almost no sign that gold will not continue its momentum this time.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights