The surge in bankruptcies of American companies will drive the next rise in gold prices

Laurent Maurel, a precious metal investment researcher at Recherche Bay, said that as gold prices hit a historic high, the number of bankruptcies in the United States has increased. He mentioned that there are clear signs of a slowdown in the US economy in industries that are most sensitive to economic downturns.

Morrell pointed out that the US dollar has been soaring in the past two years, but as August approaches its end, it seems to be starting to weaken. The upward trend of the US dollar has clearly been broken, wiping out all the gains of 2024 in just a few trading days.

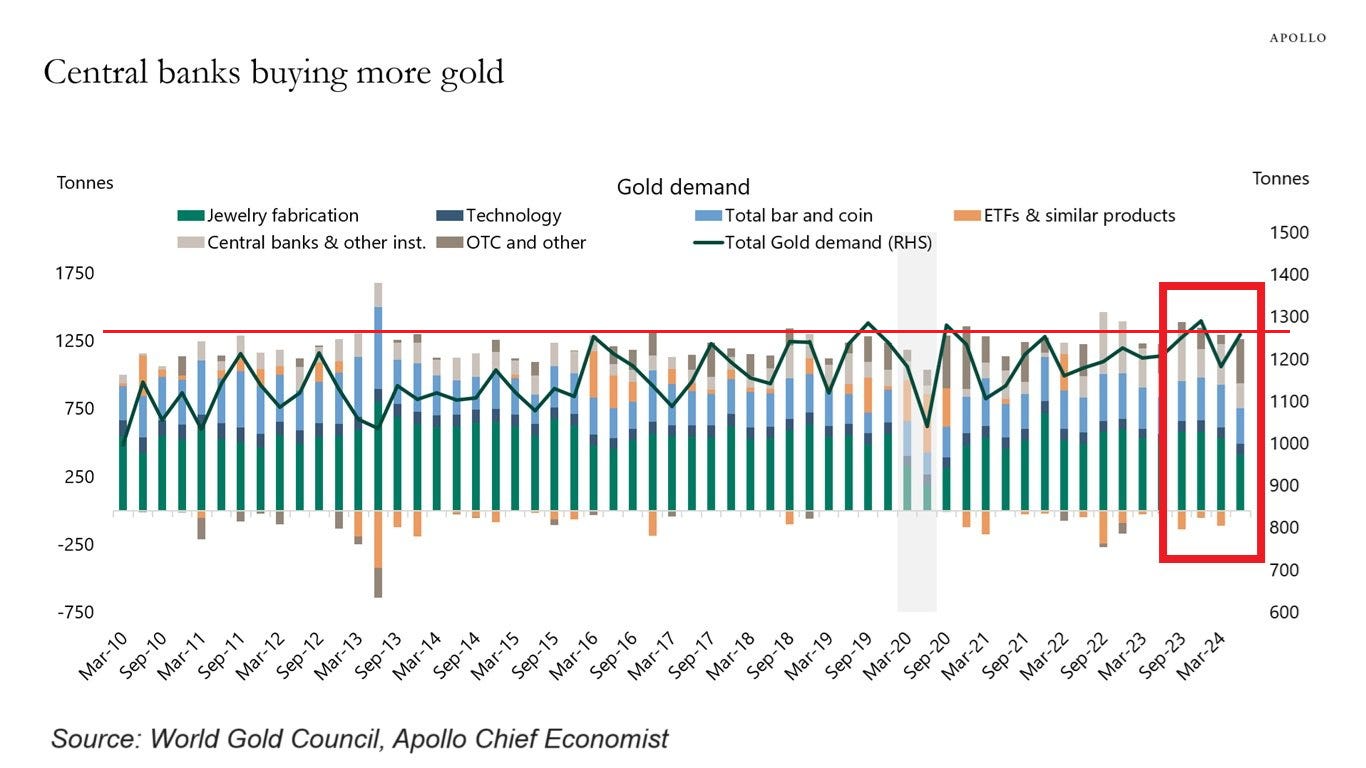

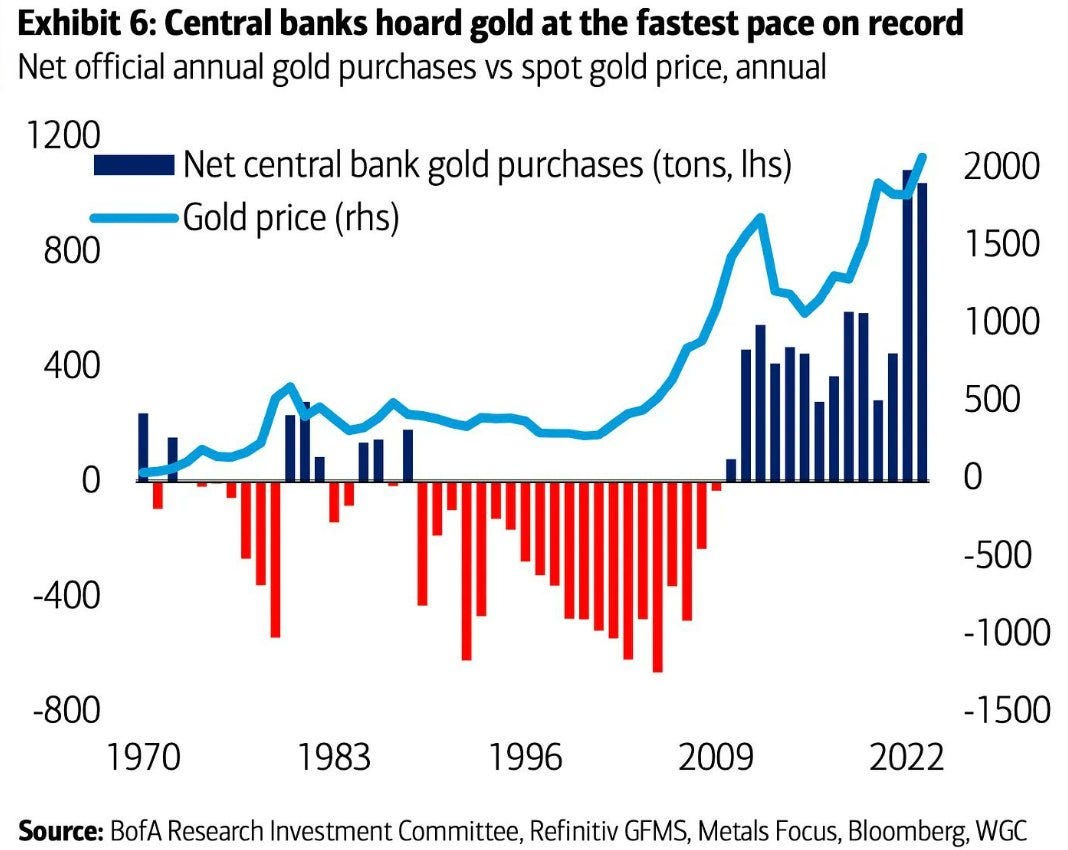

At present, the demand for gold reaching a historic high is mainly driven by the demand for physical metals from central banks and Asia (China and India). In July, gold demand rose sharply, approaching the highest level in 14 years.

In the past three years, the total demand for gold has fluctuated between 1200 and 1300 tons, mainly due to two types of buyers, namely Asian physical gold investors and central banks, who have never purchased as much gold as in the past two years.

The change in the past month is the return of demand from Western investors, as evidenced by the recovery of ETF liquidity and off exchange investment. The growth in demand for gold seems to be on the right track. But the second condition for gold to become an attractive asset again is to see the value of this classic 60/40 investment portfolio decline.

Bank of America's bond portfolio is currently facing unrealized losses of over $100 billion, which account for approximately half of the bank's pre tax tangible assets. This means that the present value of its bonds has significantly decreased compared to their original purchase value, and if these losses are realized, they could have a significant impact on the bank's financial condition.

Bank of America's bond portfolio is worth $466 billion, with the majority classified as held to maturity (HTM). This means that these securities should recover their nominal value over time, unless a systemic event forces the bank to liquidate these assets. However, the bank has multiple resources to avoid forced liquidation of the portfolio.

Firstly, the $301 billion available for sale securities (AFS) portion can serve as an important hedge against rising interest rates during economic downturns. In addition, the bank has approximately $1 trillion in liquid assets and a very satisfactory loan to deposit ratio of 55%.

A liquidity coverage ratio (LCR) of 113% at the holding level is sufficient to cope with systemic events without affecting the HTM investment portfolio. LCR is a financial indicator used by banks to assess their ability to respond to liquidity outflows within 30 days in the event of a crisis. It measures the ratio between the high-quality liquid assets (HQLA) held by banks and the expected net cash outflow.

An LCR of 100% or higher indicates that the bank has sufficient liquidity to meet its needs in times of financial pressure, and this is the case for Bank of America.

The market does not consider unrealized losses to be the main risk faced by the banking industry, which may be the reason why investors have not fled the bond market. In fact, high interest rates have attracted many new subscribers to debt related products. At present, 40% of the shares in these traditional investment portfolios are usually allocated to stocks, which has not been questioned. Analysts tend to assume a soft landing for the economy and do not anticipate any significant market correction. The US election year is expected to see interest rate cuts, putting immense pressure on the Federal Reserve and the Treasury to intervene in the event of a serious index correction, exacerbating this outlook.

However, in the industries most sensitive to economic recession, there are already clear signs of a slowdown in the US economy.

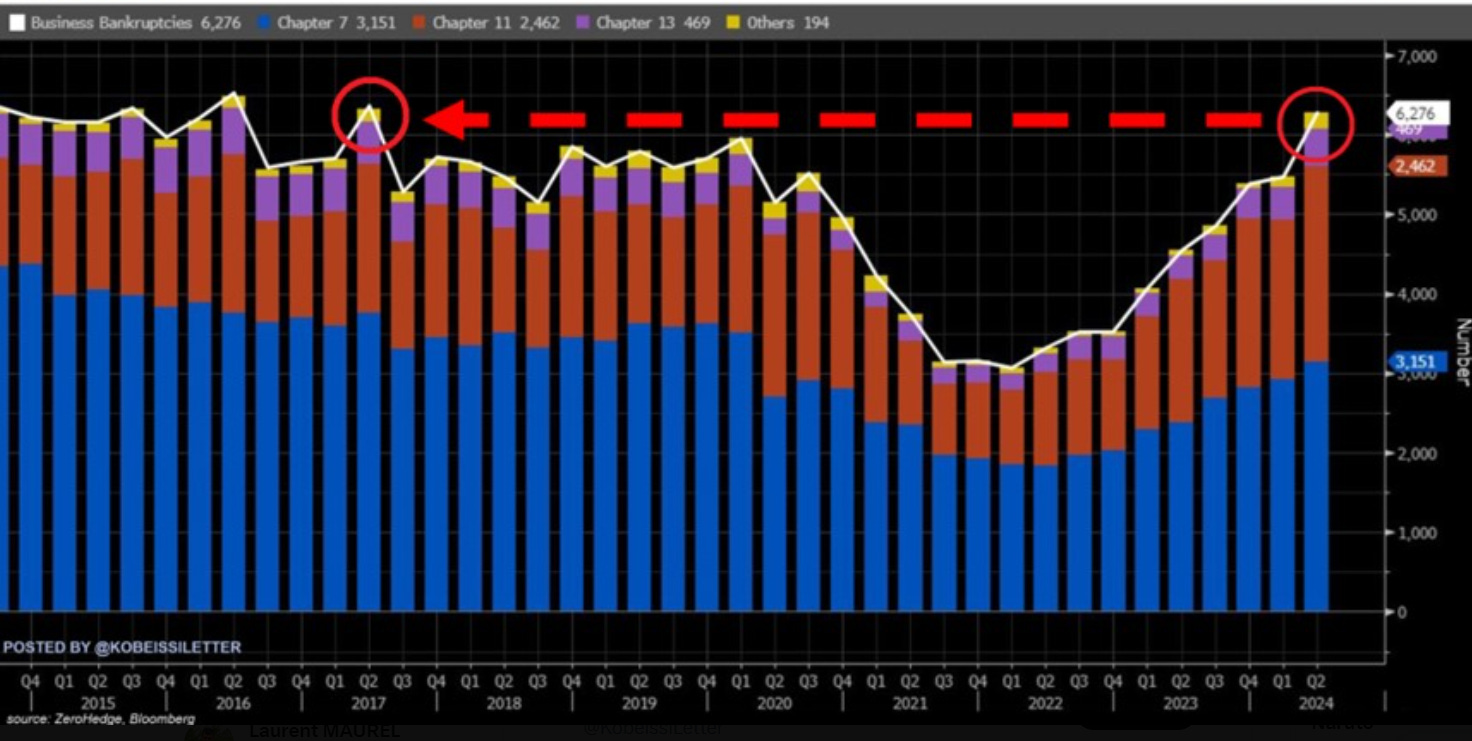

In the second quarter of 2024, the number of new bankruptcy cases in the United States reached 6276, the highest level since 2017. The number of corporate bankruptcies has doubled in two years. The number of applications for Chapter 7 (Liquidation) has risen to 3151, the highest level since the outbreak of the pandemic in 2020. Chapter 11 Bankruptcy allows the company to continue operating while developing a restructuring plan to repay some or all of its debts within a specific period of time. The number of bankruptcy cases reached 2462, exceeding all other quarters in the past decade. Chapter 13 and other bankruptcy cases have also increased. Chapter 13 allows debtors to develop repayment plans within three to five years and make regular payments to creditors based on available income. The increase in bankruptcy cases, especially due to loan defaults, indicates a worrying trend reminiscent of the Great Depression:

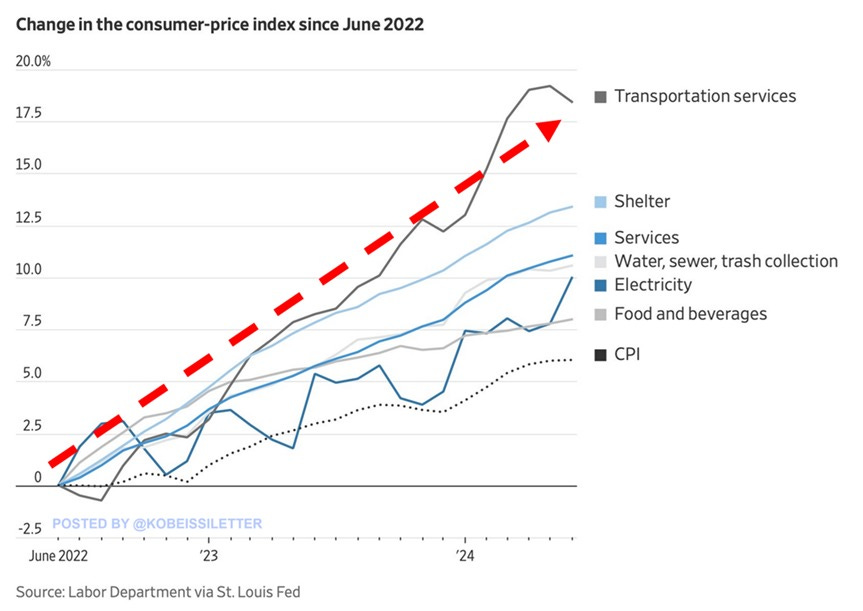

Small businesses seem to be particularly vulnerable to recent price increases. Since June 2022, the overall Consumer Price Index (CPI) inflation rate in the United States has increased by about 6%, but the inflation rate for many essential goods is much higher. Transportation service prices have increased by 18.5%, while housing and utility costs have risen by 13.5% and 11% respectively. Water, sanitation, garbage collection, and electricity prices have increased by about 10%, while food and beverage prices have risen by 8%. When these costs cannot be passed on to the selling price, profit margins will be squeezed, making it difficult to repay debts and threatening the survival of the enterprise. Default in debt repayment will immediately lead to default, which in turn will result in more bankruptcies:

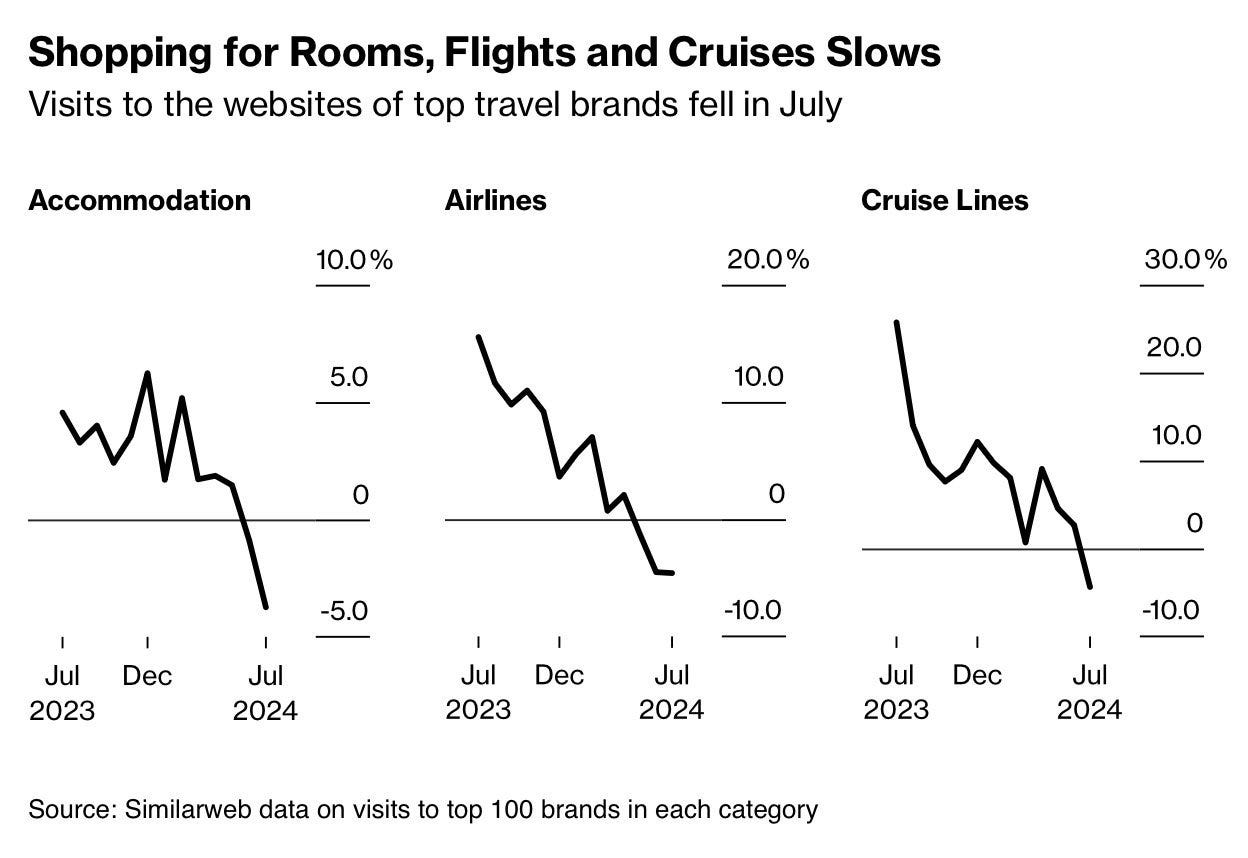

As the summer of 2024 draws to a close, the United States is facing a rising bankruptcy rate and a significant decrease in leisure activities. The late summer season is unfavorable for demand, as evidenced by the search metrics on travel agency websites

The continuous increase in the number of defaults has naturally pushed up the gold price.

Morrell finally mentioned that the confirmation of an economic recession triggered by the rising default rate in the United States indicates that gold will surpass the classic 60/40 investment portfolio in the future. This may be when gold began to significantly attract Western investors. Many analysts have been reluctant to invest in gold for the past two decades, and now they are paying attention to the rise in default rates. According to their logic, the more the default rate rises, the greater the possibility of gold appreciation, and even falling back from its peak.

For these observers, the increasing defaults in the US economy will drive the next rise in gold.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights