European bank officials say they cannot cut interest rates too quickly as the 2% inflation target has not been achieved yet

Joachim Nagel, a member of the Governing Council of the European Central Bank, said that given that inflation has not yet stabilized at the 2% level, the ECB should be wary of cutting interest rates too quickly.

Nagel stated on Thursday that while the increase in consumer prices may be close to officials' mid-term goals achieved in the "late summer period," it may rebound again due to sustained strong growth in service costs and remain above target levels until 2025.

The German central bank governor said in a speech in Frankfurt, "We need to be cautious and must not lower policy rates too quickly. We have not reached that point yet. Although our target of 2%?% is within reach, we have not yet achieved it

Prior to this, consumer price increases in Germany and Spain in August were lower than expected, indicating that inflation may have also fallen below the expected 2.2% for the Eurozone 20 countries. The European Statistical Office will release these data on Friday.

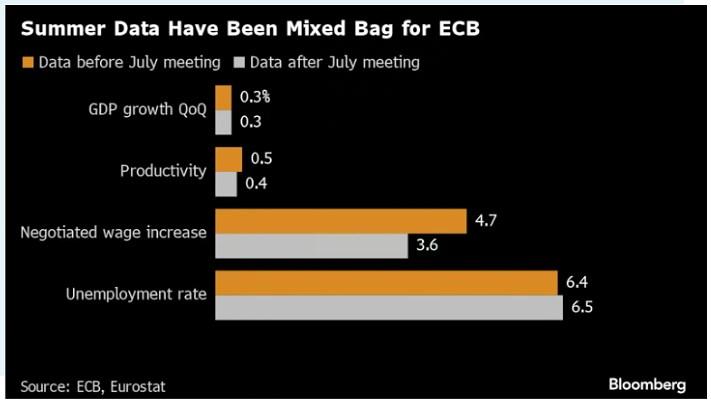

Nagel stated that policy makers will "continue to carefully monitor the upcoming data release," which also includes another wage growth indicator for the 20 countries. We are thoroughly evaluating whether these data confirm our expectations of timely recovery to our target level of 2%

Image: For the European Central Bank, summer data is mixed (yellow represents data before the July meeting, white represents data after the July meeting)

This is his first speech on monetary policy since the European Central Bank's summer break. With only two weeks left until the European Central Bank sets borrowing costs next time, several of his management committee colleagues have hinted that another interest rate cut may occur on September 12th.

Mario Centeno, the Governor of the Portuguese Central Bank, stated that the decision to be made should be "easy" given the deteriorating economic performance. The market betting on two to three more interest rate hikes this year seems to agree with this.

But Dutch central bank governor Klaas Knot said on Tuesday that he is waiting for more information before deciding whether to support a rate cut next month. Austrian Central Bank Governor Robert Holzmann stated that this step is not a "foregone conclusion".

Nagel noticed this divergence, but attempted to eliminate broader divergent views. He said, "The turning points of interest rate cycles are often influenced by intense debates

He said, "When making decisions, monetary policy makers always face a certain degree of uncertainty, which is why their differing opinions and their own judgments are considered characteristics rather than defects.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights