With the release of both CPI and PPI reports, the Federal Reserve is facing a nightmare of stagflation

On Thursday, after the latest stronger than expected US PPI report was released, financial markets were volatile, and investors were strongly concerned about interest rate cuts, hoping that the rise in risk appetite would bring further gains. Analysts at The Kobeissi Letter said, "The Fed's worst nightmare has begun

They wrote in a post on X: "We now have multiple continuously rising inflation indicators, and there are signs that the labor market is weakening. For the first time since September 2022, both CPI and PPI inflation have officially rebounded. Has the era of stagflation just begun

When elaborating on the thorny situation facing the Federal Reserve, analysts pointed out that "core PPI and CPI inflation have returned above 3.0% for the first time since April 2023

They added, "Although the Federal Reserve believes that inflation is moving towards the 2% target level, the fact is clearly not so. Inflation has clearly stabilized above the Fed's 2% target level, but they are still continuing to cut interest rates

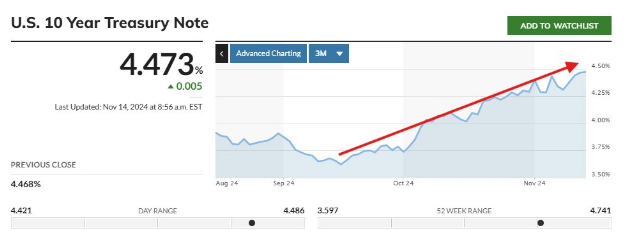

Analysts said, "This helps explain why the 10-year Treasury yield has risen sharply. Despite the Fed's 75 basis point interest rate cut (an unexpected 50 basis point cut in September), inflation is still rising. Many people believe that mortgage rates will rise above 8% in the next step

Analysts point out that it is not just the rise in yields that is sounding the alarm, as "in the past 12 months, the number of temporary assistance service positions in the United States has decreased by 145800, reaching the lowest level since October 2020. Temporary assistance service positions are considered a leading indicator of unemployment rate and have shrunk for 23 months, the longest duration since 2008

Figure: Yield of 10-year US Treasury bonds

Therefore, The Kobeissi Letter recommends shorting the S&P 500 index before this week, and analysts say this move will be successful.

They warned, "Despite a very strong rally after the US election, the market is nervous about inflation in 2025

Analysts have pointed out that in recent years, the Federal Reserve has been lagging behind in terms of inflation, emphasizing the speech by Federal Reserve Chairman Powell on May 4th. When asked about stagflation at the time, Powell stated that he "did not see stagflation or inflation".

At the press conference on November 7th, when asked about this issue, Powell put forward a different view, saying, "The whole plan is not stagflation, so we don't have to deal with it. This is our plan

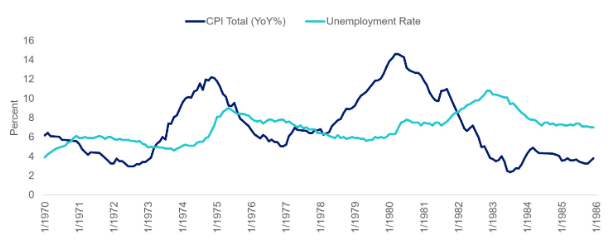

The Kobeissi Letter stated, "This will be a new version of their 2021 'inflation is temporary' forecast. At a high level, stagflation refers to an economy with rising unemployment and rising prices. This is a nightmare for the Federal Reserve because it puts them in a lose lose situation. If they raise interest rates, they will fall into recession; if they lower interest rates, inflation will further rise

Analysts emphasized the inflationary nature of interest rate cuts, pointing out that "since the Federal Reserve began cutting interest rates, the average interest rate for 30-year mortgages has risen by nearly 100 basis points. We now have over 7% of mortgages and overall rising interest rates. Despite the Fed's commitment to cut rates and slow them down, consumers are losing confidence as interest rates rise

Taking all the data together, The Kobeissi Letter warns that the US fiscal situation is "starting to look like stagflation from the 1970s".

They said, "Just as the Federal Reserve believes inflation is under control, there has been a rebound in inflation and unemployment rates. If we see another wave of inflation in 2025, we may be in a similar situation, but it may not be as bad as in the 1980s

Figure: year-on-year CPI (dark blue) and unemployment rate (light blue)

They added that as inflation rebounds, "we are starting to see significant volatility in the bond/commodity markets," and said, "This could spread to the stock market in 2025. We are engaging in volatility trading

They concluded, "Looking ahead, everyone's attention will be focused on the November employment report. The October employment report was the weakest since 2020, but it was cancelled due to the impact of hurricanes. The downward revision of employment data is the new normal

Joshua Kagan, CEO of Bonfire RWA, agrees with the views in The Kobeissi Letter, warning that "if inflation remains high and long-term interest rates remain high, we will face significant structural problems, with government and commercial real estate debt restructuring at much higher interest rates in the coming years

Kagan added, "The market seems to have not fully assessed this risk, but I also recall Keynes' famous quote, 'The time the market remains irrational may be longer than the time you maintain solvency.'

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights